In the international market, the US Dollar Index edged up by nearly 0.1 points compared to the previous week, reaching 105.87.

USD prices remained elevated after key US inflation reports largely met expectations.

In the recently released US data, the core Personal Consumption Expenditure (PCE) price index, excluding food and energy, rose by 0.1%. Year-over-year, core PCE increased by 2.6%, down from April’s 2.8% and the weakest increase since March 2021.

The Fed began raising interest rates in March 2022, as inflation surged due to COVID-19-related factors. As of now, the Fed’s benchmark interest rate stands at 5.25%-5.5%, the highest level in about 23 years.

Recent economic data suggests that the US economy remains robust despite the Fed’s aggressive monetary tightening moves, leading to reduced expectations for the Federal Reserve to accelerate rate cuts.

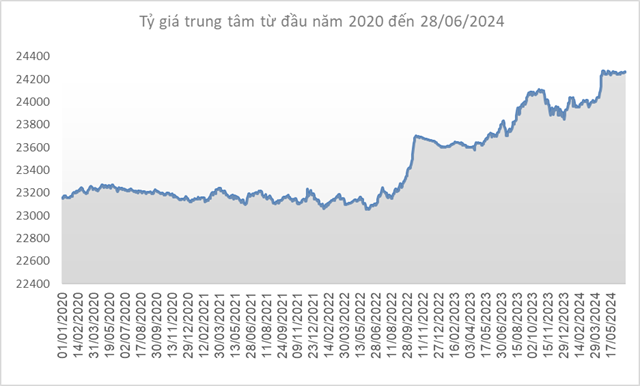

Source: SBV

|

Domestically, the Vietnamese Dong-USD central exchange rate saw a slight increase of 4 VND/USD compared to the June 21 session, reaching 24,260 VND/USD on June 28.

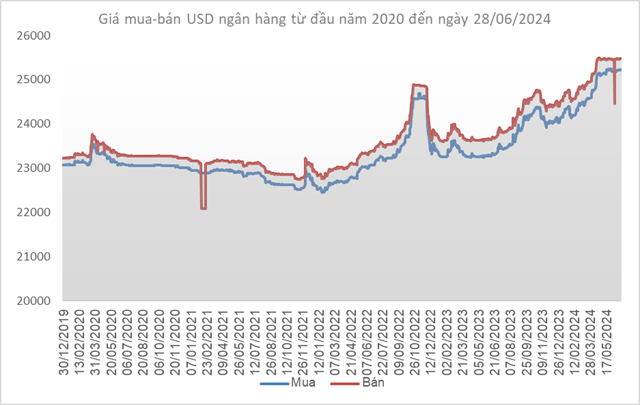

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at 23,400 VND/USD. Additionally, the selling price remained at 25,450 VND/USD since April 19. This is the intervention selling price at which the SBV offers USD to banks with negative foreign currency positions to bring their positions back to zero.

Source: VCB

|

Following a similar trend, Vietcombank’s posted exchange rates witnessed a slight increase of 5 VND/USD in both buying and selling rates, reaching 25,223-25,473 VND/USD.

Source: VietstockFinance

|

Khang Di

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.