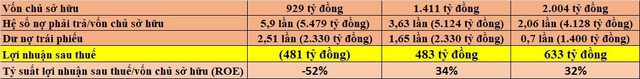

The Hanoi Stock Exchange (HNX) recently announced the financial performance of Hoan My Medical JSC for 2022 and 2023. In 2023, the company reported a net profit of VND 633 billion, a 31.1% increase from 2022’s net profit of VND 483 billion. This translates to a return on equity (ROE) of 32% for 2023, compared to 34% in 2022.

Over the past two years, this healthcare company has recorded a remarkable net profit of over VND 1,116 billion. A significant turnaround from the net loss of VND 481 billion reported in the financial year 2021, which coincided with the peak of the Covid-19 pandemic and nationwide lockdowns.

As of December 31, 2023, Hoan My Medical’s total assets stood at nearly VND 2,004 billion, a 42% increase from the beginning of the year. The debt-to-equity ratio improved from 3.63 to 2.06, with total liabilities of VND 4,128 billion. This includes VND 1,400 billion in bond debt, corresponding to the HMGH1825001 bond issue.

Hoan My Hospital’s business performance over the years.

During 2023, Hoan My Medical successfully redeemed the HMGH1823001 bond issue valued at VND 930 billion.

Established in July 2007, Hoan My Medical JSC operates in the healthcare sector with its head office located in Ho Chi Minh City. With a charter capital of VND 392.35 billion, the company is known for its ownership of the Hoan My Hospital chain, which includes 13 hospitals, 1 medical center, and 2 clinics across Vietnam.

The turnaround in Hoan My Medical’s financial performance is a testament to the resilience and growth of the healthcare industry in Vietnam, especially in the post-pandemic era.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.