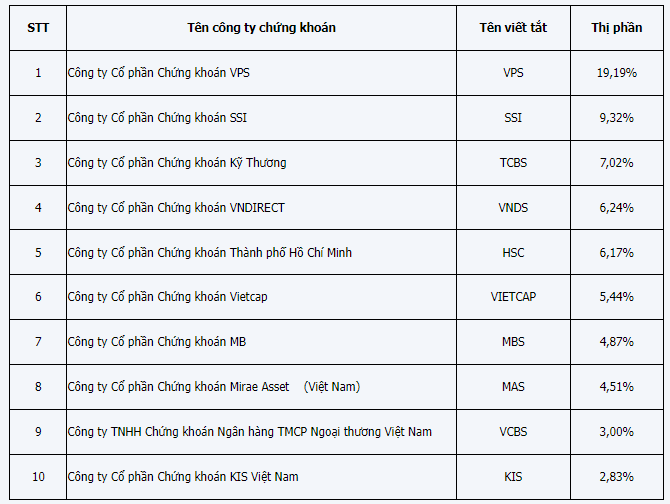

The Ho Chi Minh City Stock Exchange (HoSE) has just released the list of the top 10 securities companies with the largest market share in stock, fund certificate, and covered warrant brokerage transactions in Q2/2024, including: VPS, SSI, TCBS, VNDIRECT, HSC, Vietcap, MBS, Mirae Asset, VCBS, and KIS, with a total market share of 68.11%.

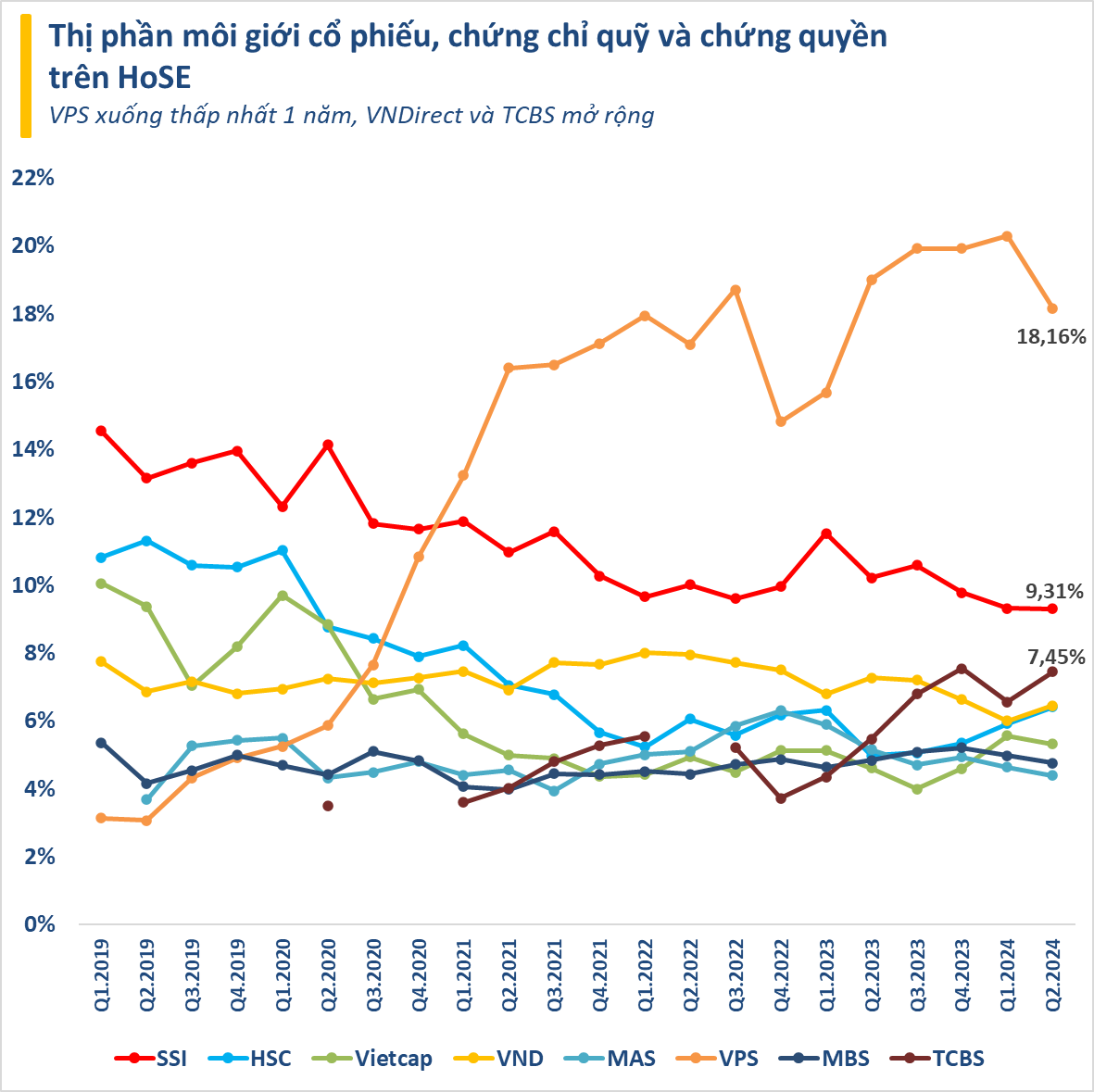

Compared to the first quarter, the top 10 market share in Q2 did not change much, except for the return of KIS, which replaced FPTS in the last position. However, the market share of each company fluctuated significantly. Notably, the leading company, VPS, unexpectedly narrowed its market share from 20.29% in Q1 to 18.16% in Q2, the lowest in a year, breaking its five-quarter streak of market share expansion.

Similarly, SSI, Vietcap, Mirae Asset, MBS, and VCBS also witnessed slight reductions in their market shares in the second quarter.

On the other hand, TCBS and VNDirect showed improvements, with their market shares increasing from 6.56% to 7.45% and from 6.01% to 6.46%, respectively. HSC also enhanced its position.

Overall, in the first half of 2024, the top 10 market shares of stock, fund certificate, and covered warrant brokerage on HoSE remained dominated by familiar names, with a total market share of 68.59%. VPS continued to lead the pack with a market share of over 19%. The group of securities companies with foreign capital included two representatives: Mirae Asset and KIS VN.

Top 10 Market Share of Stock, Fund Certificate, and Covered Warrant Brokerage on HoSE in the First Half of 2024

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.