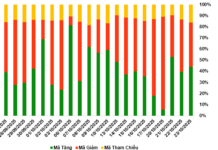

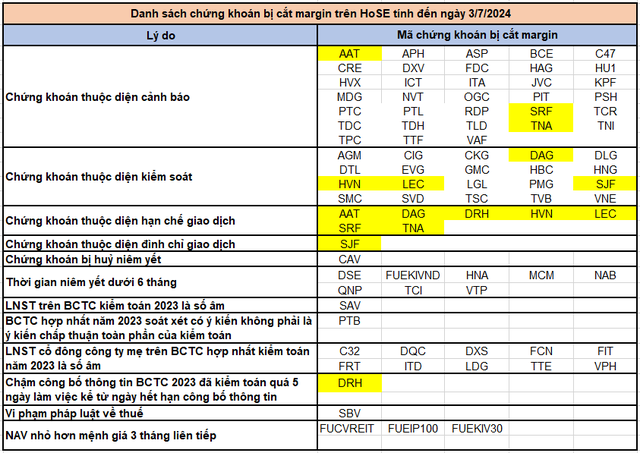

The Ho Chi Minh City Stock Exchange (HOSE) has released an updated list of 79 stocks that are ineligible for margin trading in Q3 2024. The list includes familiar names such as AAT, AGM, APH, ASP, and BCE, among others, which are either under warning or control.

Stocks like HBC (Hoa Binh Construction) and HVN (Vietnam Airlines), which are currently restricted or controlled by HOSE, are also ineligible for margin trading. Meanwhile, stocks such as HAG (Hoang Anh Gia Lai), ITA (Tan Tao), NVT (Ninh Van Bay), and VAF (Van Dien Fusion Phosphate) remain on the margin cut list for Q3 due to warnings issued by HOSE.

Additionally, stocks like DQC, DXS, FCN, and FRT are still on the margin cut list due to significant declines in their 2023 business results. This is attributed to negative profit after tax for the parent company’s shareholders in the reviewed consolidated financial statements for 2023.

The list of 79 stocks ineligible for margin trading in Q3 also includes a series of fund certificates with a net asset value (NAV) smaller than the par value based on the monthly net asset value change reports for three consecutive months (FUCVREIT, FUEIP100, FUEKIV30), as well as newly listed fund certificates such as FUEKIVND.

As per regulations, investors will not be able to use the credit limit (financial leverage-margin) provided by securities companies to purchase these 79 stocks that have been deemed ineligible for margin trading.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.