HIPT Corporation (stock code: HIG) has released its audited financial statements for the 2023-2024 fiscal year. As of March 31, 2024, HIPT’s total assets reached 851 billion VND, an increase of 111 billion VND from the beginning of the year.

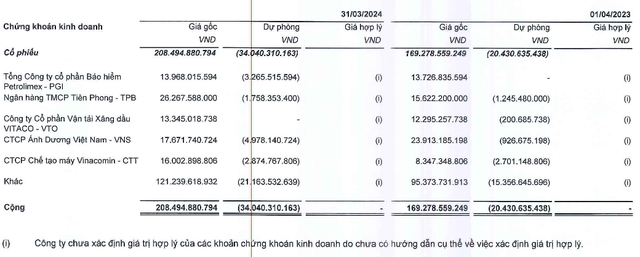

Notably, the company has invested 208 billion VND in securities and has had to set aside 34 billion VND in provisions for this investment. HIPT’s short-term financial investments amounted to 181 billion VND, representing 21% of its total assets.

According to the financial statement notes, the company holds a diverse portfolio across various sectors, including TPB (TPBank), PGI (Petrolimex Insurance), VTO (Vitaco), and VNS (Vinasun) stocks, among others. While the original investment amount was 208 billion VND, the company has not disclosed the fair value of its holdings but has had to set aside over 34 billion VND in provisions.

This is a rather unusual move for HIPT, as it is known as a technology group. Established in 1994, the company specializes in providing information security, technology infrastructure, software development, and technology equipment.

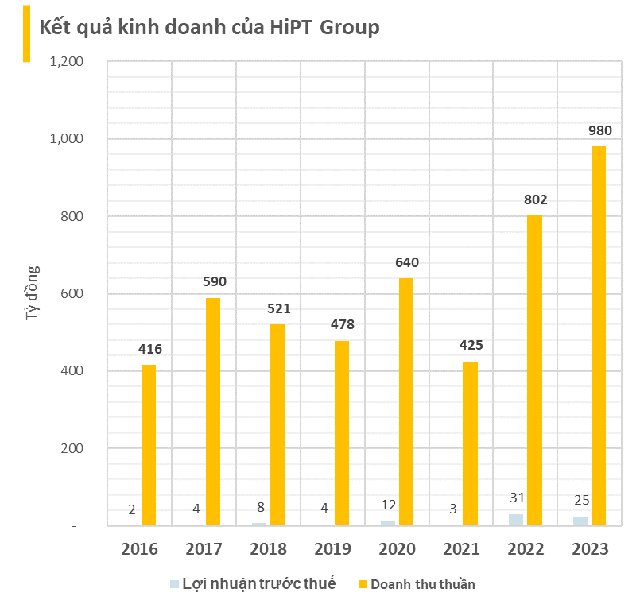

In terms of business performance, HIPT achieved a record-high revenue of 980 billion VND in the past fiscal year, a 22% increase compared to the previous year. However, the cost of goods sold increased more than revenue, resulting in a 7.6% decrease in gross profit.

The company’s financial income for the year was 21 billion VND, 2.3 times higher than the previous year. This was mainly due to a 3.5 billion VND gain from the sale of securities and 15.3 billion VND in dividends received during the year. After deducting expenses, HIPT’s after-tax profit for the year was 24.4 billion VND, a 21% decrease from the previous year.

As of March 31, 2024, HIPT’s total assets stood at 851 billion VND. Short-term receivables accounted for the largest proportion (32%) of total assets, amounting to 272 billion VND. The company also had 45 billion VND in cash and bank deposits at the end of the previous year. HIPT’s financial borrowings were 145 billion VND, while shareholders’ equity was 433 billion VND.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.