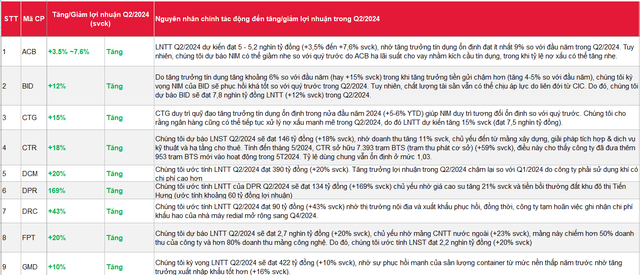

SSI Research has released its quarterly earnings estimates for 45 listed companies and banks for Q2 2024. It’s important to note that these are just predictions by analysts and may differ significantly from the actual results announced by the companies.

COMPANIES PROJECTED TO INCREASE PROFITS

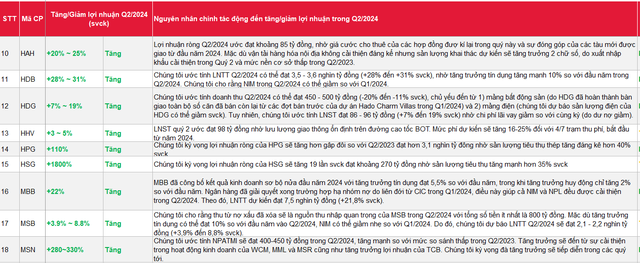

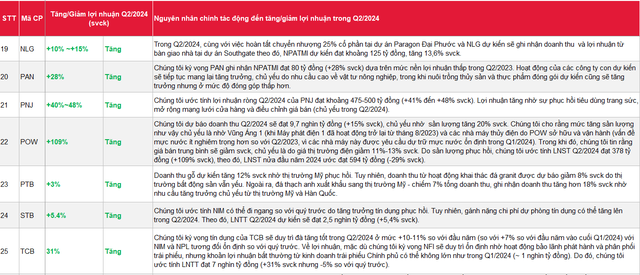

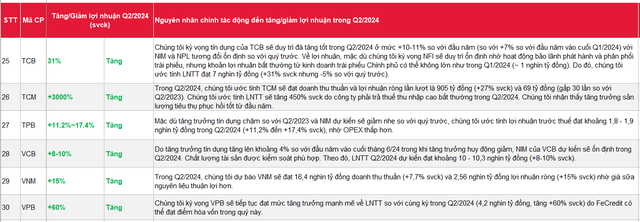

The following companies are expected to show growth in the second quarter: ACB, BID, CTG, CTR, DCM, DRC, FPT, GMD, HAH, HDB, HHV, HPG, HSG, MBB, MSB, MSN, NLG, PAN, PNJ, POW, PTB, STB, TCB, TCM, TPB, VCB, VNM, and VPB.

According to SSI Research, several large-cap banks in the market, including CTG, VCB, TCB, VPB, and BID, are expected to continue their profit growth trajectory in Q2 2023, with stable NIMs, and even improvements in some cases.

The research firm also forecasts significant growth for several prominent companies on the exchange, including DPR, HPG, MSN, HSG, and POW. Notably, Hoa Sen (HSG) is projected to see the most substantial increase, with profits estimated to be 19 times higher than the same period last year, attributed to a significant rise in sales volume.

FPT, Viettel Construction, and Vinamilk are also expected to maintain their growth momentum, as is Hà Đô (HDG), the only real estate company on the list, with an estimated 19% increase in profits to 500 billion VND.

COMPANIES PROJECTED TO REPORT LOWER PROFITS

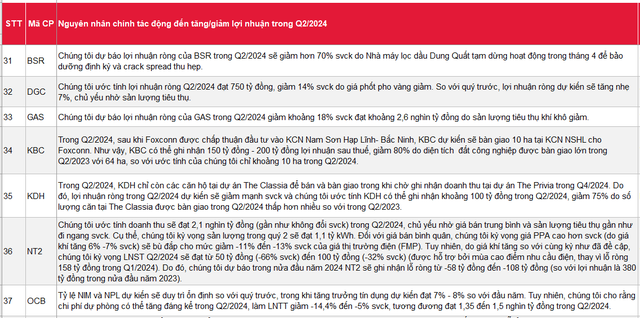

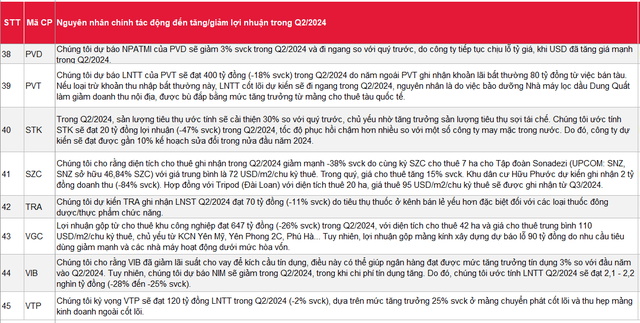

On the other hand, SSI Research predicts that 15 companies will report lower profits for the quarter, including BSR, DGC, GAS, KBC, KDH, NT2, OCB, PVD, PVT, SZC, TRA, VGC, VIB, and VTP.

BSR, GAS, PVD, and PVT are the four oil and gas companies projected to report lower profits for Q2 2024 by SSI Research. The research firm attributes this to a decrease in production and the maintenance shutdown of the Dung Quat Refinery.

Notable industrial real estate companies like KBC, SZC, and VGC are also expected to see a decline due to limited supply. Additionally, banks such as OCB and VIB are estimated to experience lower profits due to rising credit costs.

Surprisingly, two “hot” companies on the stock exchange, Đức Giang Chemical (DGC) and Viettel Post (VTP), are projected to report lower profits. SSI attributes this to an expected decrease in core business volumes for both companies during the second quarter of 2024.