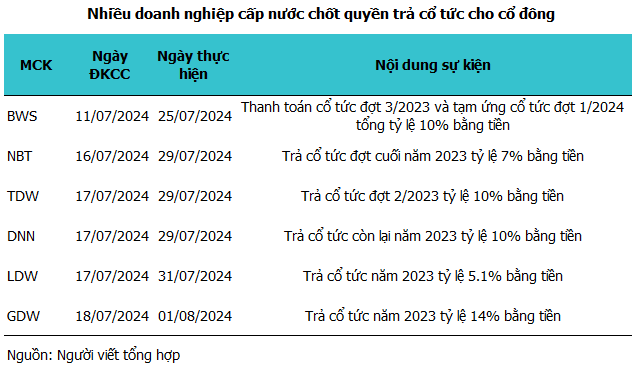

Gia Định Water Joint Stock Company (HNX: GDW) plans to pay 2023 dividends of VND 13.3 billion at a rate of 14% in cash on August 1st. The ex-dividend date is July 17th, 2024.

GDW has a tradition of paying cash dividends since 2010, with rates ranging from 7-12.5% per year. In late August 2023, the company distributed supplementary dividends (retained earnings from 2012-2020) at a rate of 8% in cash. For 2024, dividends are expected to range from 12-14%.

The majority of the dividends go to the Ho Chi Minh City Water Supply Corporation (Sawaco), the parent company that owns 51.21% of GDW‘s capital. Following that, Clean Water REE Company Ltd. holds 20.05%, and DongA Bank holds 10%.

Thu Duc Water Joint Stock Company (HOSE: TDW) will pay the second dividend for 2023 at a rate of 10% in cash, equivalent to a projected expenditure of VND 8.5 billion. The ex-dividend date is July 16th, and the payment date is July 29th, 2024.

More than a month earlier (June 21st), the company completed the payment of the first 2023 dividend at a rate of 14%. Sawaco, the parent company, benefited the most, owning 51% of the capital, followed by Clean Water REE, which holds nearly 44.2%.

According to the plan, the total cash dividend for 2023 is 34%, of which 20% is the remaining profit from 2021 and earlier years, and 14% is the undistributed profit for 2023. TDW shareholders are expected to receive at least one more cash dividend of 10% to complete the plan.

Since its listing on the HOSE in 2010, TDW has never failed to pay cash dividends, with a relatively stable rate. During the period of 2019-2021, the company maintained a dividend rate of 12%, which was then increased to 34% for the years 2022 and 2023. For 2024, the rate is expected to be 12%.

Also, on July 29th, Da Nang Water Supply Joint Stock Company (Dawaco, UPCoM: DNN) will pay approximately VND 58 billion in remaining 2023 dividends at a rate of 10% in cash. The ex-dividend date is July 16th, 2024.

Together with the 9% advance dividend, the total dividend rate for 2023 is 19%, completing the plan as mandated by the Annual General Meeting of Shareholders. Since its equitization in 2016, Dawaco has consistently paid dividends for eight consecutive years, with the highest rate of 22% for 2021 and 2022. For 2024, the rate is expected to be 12%.

As of March 31st, 2024, the Da Nang People’s Committee owns more than 60% of Dawaco’s capital, followed by Da Nang – Central Investment Joint Stock Company, which holds nearly 35%.

Ben Tre Water Supply and Drainage Joint Stock Company (Bewaco, UPCoM: NBT) also plans to spend more than VND 20.5 billion to pay the second dividend for 2023 at a rate of 7% on July 29th. The ex-dividend date is July 15th, 2024.

Previously, on January 29th, Bewaco paid the first 2023 dividend at a rate of 5% in cash, bringing the total dividend rate for 2023 to 12%. This is the highest dividend rate for the company since its listing on UPCoM in 2016. Most recently, in 2022, the dividend rate was 11%, and it was maintained at 9% during 2020-2021. For 2024, the rate is expected to be 11%.

The largest shareholder, owning 64% of Bewaco’s capital, is the People’s Committee of Ben Tre province, which is expected to receive the majority of the dividends.

On July 31st, Lam Dong Water Supply and Drainage Joint Stock Company (Lawaco, UPCoM: LDW) will spend over VND 40 billion to pay 2023 dividends at a rate of 5.1%, with the State Capital Investment Corporation (SCIC), which owns nearly 40% of the capital, benefiting the most. The ex-dividend date is July 16th, 2024.

This is the sixth consecutive year that Lawaco has maintained cash dividend payments since its listing on UPCoM in 2018, with the rate increasing annually (higher each year than the last). For 2024, the rate is expected to be at least 4.35%.

Shareholders of Ba Ria – Vung Tau Water Supply Joint Stock Company (UPCoM: BWS) will receive two consecutive dividend payments totaling a rate of 10%, including 1.8% for the third dividend of 2023 and 8.2% as an advance dividend for the first dividend of 2024. The ex-dividend date is July 10th.

With 90 million circulating shares, BWS needs to spend VND 90 billion to pay dividends. The payment date is July 25th, 2024. The largest beneficiary is the People’s Committee of Ba Ria – Vung Tau province, which owns 36.25% of the capital, followed by the Ba Ria – Vung Tau Provincial Party Committee, which holds over 10.5%.

Since 2015, BWS has consistently paid dividends in cash and/or shares to its shareholders. During the period of 2021-2022, the dividend rate remained at 15% in cash, increasing to 18% in 2023, and is expected to be at least 17% in 2024.