CTCP Nông nghiệp Quốc tế Hoàng Anh Gia Lai (HAGL Agrico, HNG) has announced its consolidated financial statements for the fourth quarter of 2023 with a revenue of VND 74 billion.

According to the company, the low revenue is due to the production volume during the period only reaching 6,381 tons (compared to the target of 22,784 tons). The company continues to plan the areas of banana for harvesting but with low productivity in order to implement synchronized investments. Previously, HAGL Agrico did not invest in infrastructure and did not renovate the land before planting, resulting in a decrease in the quality of the plants after many years of exploitation.

For rubber trees, the fourth-quarter revenue reached only VND 109 billion, equivalent to a latex output of 3,656 tons (compared to the target of 5,075 tons). The main reason is the lack of 40% of rubber tappers in Laos who are involved in other activities. In addition, the cost of the garden’s capital mainly consists of depreciation costs (60%), leading to insufficient revenue to cover costs.

During the period, the company also recorded the cost of writing off inefficient assets with a total cost of VND 67 billion. As a result, HNG reported a consolidated net loss of VND 604 billion in the fourth quarter of 2023. Despite the loss, this is a significant improvement compared to the loss of VND 2,804 billion in the same period of 2022.

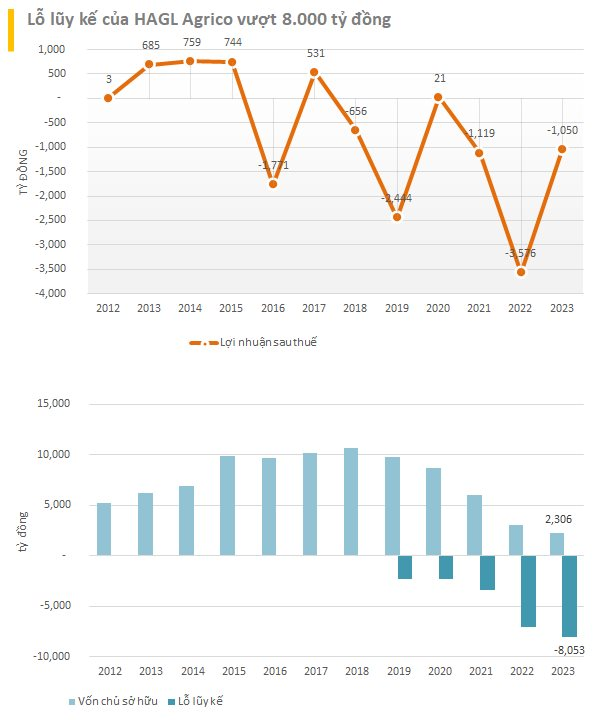

For the whole year of 2023, HNG recorded a revenue of VND 605.5 billion, a decrease of 18%. Deducting expenses, HNG incurred a net loss of over VND 1,050 billion.

Therefore, HNG has incurred losses for three consecutive years. In 2021 and 2022, the company incurred losses of VND 1,119 billion and VND 3,576.5 billion, respectively. The accumulated losses of HAGL Agrico have exceeded VND 8,000 billion, and the company’s equity capital at the end of 2023 continues to decrease to VND 2,300 billion.

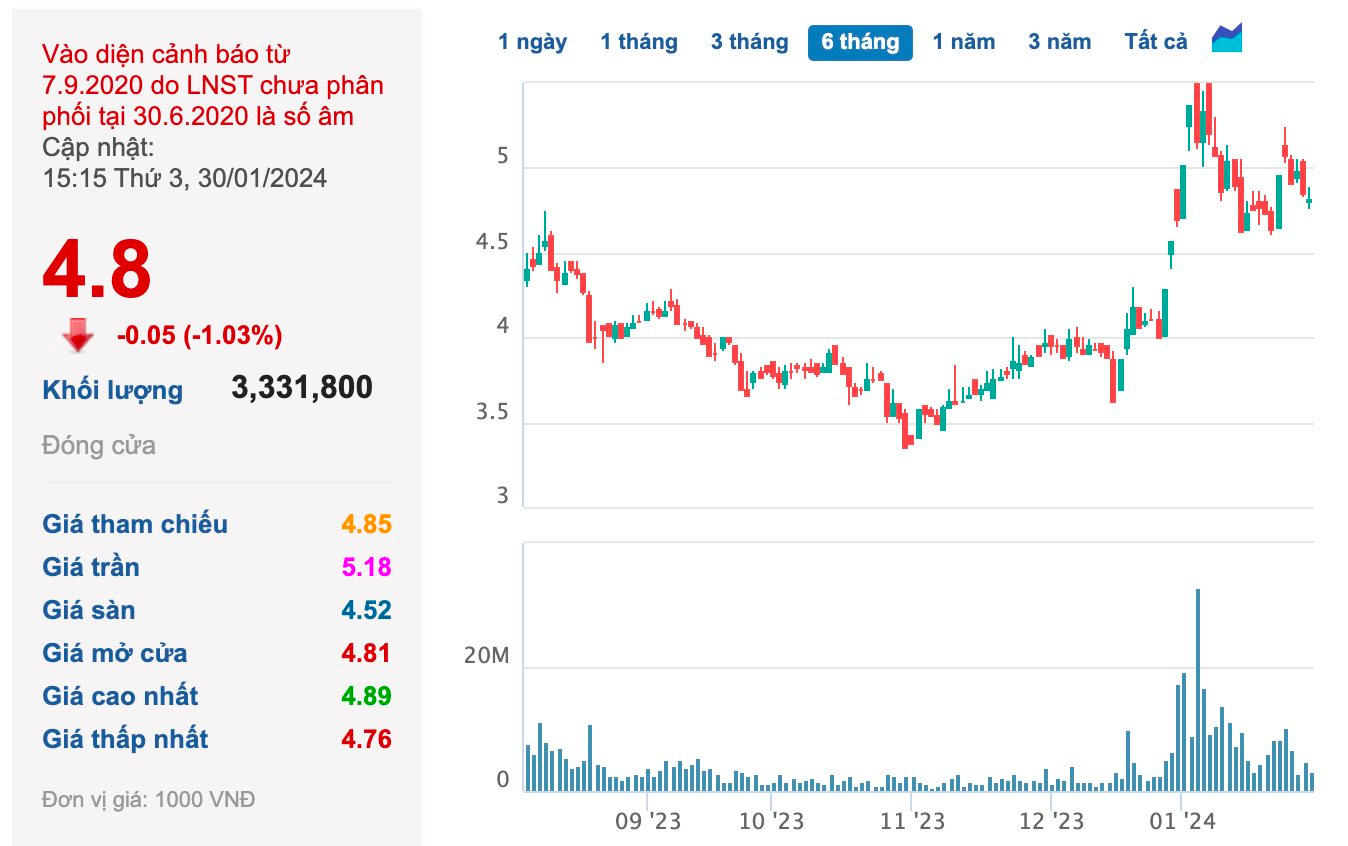

According to current regulations, a company is required to delist when it has incurred losses in production and business for three consecutive years or the total losses exceed the contributed charter capital or the equity capital is negative in the latest audited financial statements. HNG is currently in the first case.

Compared to the annual general meeting’s approved plan with a net revenue of VND 1,282 billion and a pre-tax loss of VND 2,316 billion, HNG did not achieve the revenue target, but the actual loss was much lower than the plan.

In the market, HNG shares have also recently experienced a sharp increase in trading volume. Currently, HNG is trading near VND 5,000 per share.

A shareholder had raised the question of whether Thaco is “draining the resources” of HAGL Agrico. Doan Nguyen Duc, Vice Chairman of HAGL Agrico, said: “HAGL Agrico does not have resources to drain, only bones left.”

Previously, HNG announced the establishment of a subsidiary with a charter capital of nearly VND 10,000 billion in Laos. This move by HNG came after Tran Ba Duong, Chairman of Truong Hai Auto Corporation (Thaco Group), had a meeting with Lao Prime Minister Sonexay Siphandone. During the meeting, Tran Ba Duong proposed recommendations to the Lao Government to implement the feasible investment project “Large-scale cultivation of fruit trees combined with cattle farming.”

Bau Duc also shared: “The company mainly uses land in Laos and Cambodia. The foundation set by Thaco for HNG is long-term, not like HAGL. Therefore, there is a considerable amount of money spent, and only long-term investors can see the issue, while short-term investors find it relatively difficult.”

The establishment of a unified legal entity for existing businesses in Laos may be a restructuring step to help improve HNG’s business in this country.

However, the financial picture of HNG still faces many challenges. By the end of 2023, the accumulated losses had increased to VND 8,054 billion, while the contributed equity capital was VND 11,085 billion. The total debt reported was over VND 8,200 billion, four times the equity capital (VND 2,306 billion).

With 12 consecutive quarters of losses, there is a possibility that HNG shares will be delisted from HoSE.