Vietnam’s manufacturing sector witnessed a robust expansion in late Q2. New orders rose at one of the fastest rates on record, enabling firms to ramp up production and purchasing activity, and hire additional staff for the first time in three months.

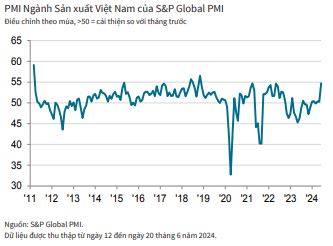

Input cost inflation also accelerated, hitting a two-year high as transportation costs and, notably, oil prices increased. To compensate, companies raised their selling prices at the sharpest rate since June 2022. The S&P Global Vietnam Manufacturing Purchasing Managers’ Index™ (PMI®) soared to 54.7 in June from 50.3 in May. The reading not only signaled a third consecutive month of improving business conditions but also pointed to a substantial strengthening of the sector.

In fact, the improvement in operating conditions was one of the strongest since November 2018, on par with those seen in April 2021 and May 2022.

The sharp upturn in business conditions largely reflected stronger increases in output and new orders midway through the year. Notably, new orders rose to just shy of the record seen in the first survey month of March 2011.

According to panelists, demand improved as some clients returned to place additional orders during the month. In some cases, competitive pricing helped companies secure new orders. Meanwhile, new export orders increased at the quickest rate since February 2022, although the pace of expansion was far slower than that of total new orders.

The surge in new orders matched the rise in production, with June recording the sharpest increase in output in over five and a half years.

The marked rise in new orders placed pressure on operating capacity, leading to a second increase in backlogs of work in three months. Although only marginal, the rate of growth was the strongest since last January.

In some cases, companies attributed the rise in outstanding business to staff shortages. Consequently, employment levels rose for the first time in three months, and at a solid pace. However, in some cases, new hires were only temporary. Firms also stepped up purchasing activity, and input buying increased for the third month running and at the quickest rate since June 2022. Nonetheless, pre-production inventories continued to deplete as inputs were used for production.

Similarly, stocks of finished goods decreased as warehouse items were shipped to fulfill sales orders. Moreover, post-production inventories fell at the sharpest rate in three years. Input cost inflation in June picked up for the third month running and hit a two-year high.

Numerous panelists reported higher transportation costs, alongside rising oil and imported material prices. To protect profit margins, manufacturers raised their selling prices accordingly, registering the greatest increase since June 2022. The rise in selling prices was recorded for the second month in a row. Greater material availability allowed suppliers to quicken delivery times in June, and vendor lead times shortened for the first time so far this year.

However, the improvement in vendor performance was only marginal as international sea freight continued to pose challenges. The outlook for favorable business conditions supported business confidence toward the year-ahead outlook for manufacturing output. Sentiment hit a three-month high, with around half of the surveyed companies expecting growth.

Commenting on the Vietnam Manufacturing PMI® survey, Andrew Harker, economics director at S&P Global Market Intelligence, said: “Vietnam’s manufacturing industry roared back to life mid-year, shrugging off relatively modest growth in recent months thanks to a sharp upturn in new orders. The marked rise in new work laid bare staff shortages at some companies and led to a rise in backlogs of work. In response, firms hired additional staff at a solid pace.

Alongside the strong growth came a heavier burden of cost inflation, particularly as transportation costs pushed input prices up to a two-year high. While rising inflation could dampen demand in the future, for now, companies will be enjoying the increase in new orders during June.”

Prime Minister discusses investment, production, and business with 19 corporations and conglomerates

On the morning of February 5th, Prime Minister Pham Minh Chinh chaired a working conference with the State Capital Management Committee in Enterprises and 19 groups and corporations to discuss the implementation of production and business activities in 2024, as well as promoting investment for economic and social development.

PMI January 2024: Increase in Production and New Order Volume

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI), a key indicator for the industry, has returned to above the 50-point threshold in the first month of the year, rising to 50.3 from December’s 48.9. The PMI result suggests an improvement in the health of the manufacturing sector for the first time in months, although the improvement is only modest.

Ensuring a Stable Fuel Supply for the Lunar New Year 2024

The Ministry of Industry and Trade has recently issued a letter to key petroleum producers, petroleum trading companies, and petroleum distribution businesses, requesting them to ensure a stable supply of petroleum for production, business, and consumption during the Lunar New Year holiday in 2024, which falls on the Year of the Wood Dragon.