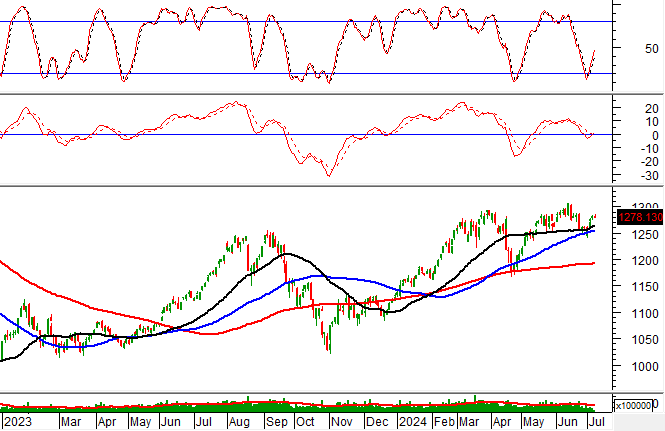

Technical Signals for VN-Index

During the trading session on the morning of July 5, 2024, the VN-Index declined, while trading volume slightly increased, indicating investors’ cautious sentiment.

Additionally, the VN-Index is finding support from the 50-day SMA and 100-day SMA, while the MACD indicator has turned positive, suggesting that the medium-term optimistic outlook remains intact.

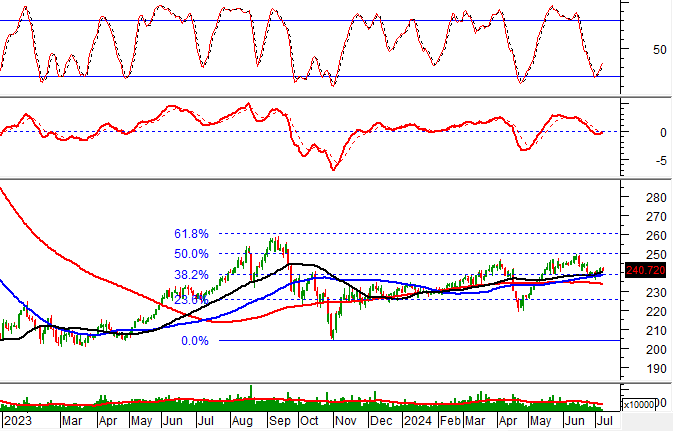

Technical Signals for HNX-Index

On July 5, 2024, the HNX-Index declined, while trading volume slightly increased during the morning session, indicating investors’ cautious sentiment.

Furthermore, the HNX-Index is testing the Fibonacci Projection 38.2% level (corresponding to the 238-242 point region) while the MACD indicator maintains its previous sell signal. If the index falls below this support level, the risk of a downward adjustment in the coming sessions will increase.

AAA – An Phat Green Plastic Joint Stock Company

On the morning of July 5, 2024, AAA witnessed a surge in its stock price, accompanied by a significant increase in trading volume, surpassing the 20-session average, reflecting investors’ optimistic sentiment.

Additionally, the stock price is testing the Fibonacci Projection 61.8% level (corresponding to the 11,500-11,900 range) while the MACD indicator has turned positive. If the buy signal is sustained and the stock price successfully conquers this resistance zone, a short-term bullish scenario is likely to unfold in the upcoming sessions.

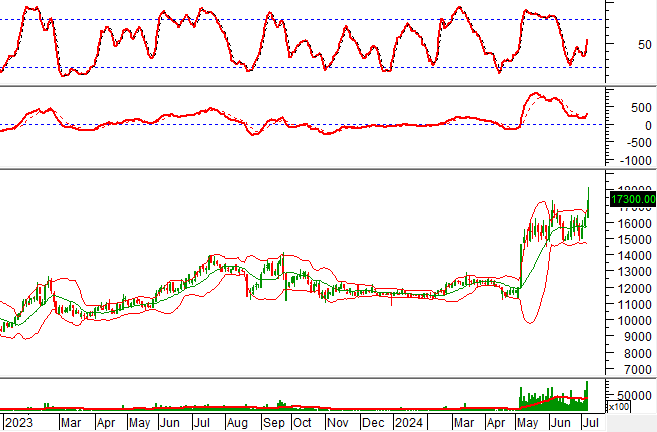

VGT – Vietnam Textile and Garment Group

On the morning of July 5, 2024, VGT witnessed a strong surge in its stock price, accompanied by trading volume consistently above the 20-session average, indicating active participation from investors.

Furthermore, the stock price rallied after breaking above the Middle Band of the Bollinger Bands, while the Stochastic Oscillator continues its upward trajectory, reinforcing the bullish short-term trend. The stock price is also finding support from the 50-day SMA, suggesting that the medium-term optimistic outlook remains intact.

Technical Analysis Department, Vietstock Consulting