The following price types are included: import prices; raw material prices for production; transportation and storage prices; real estate prices; loan interest rates; stock prices; deposit interest rates; bond prices; labor prices; production prices; export prices; trade exchange rates; consumer prices; gold prices; USD prices, etc. The General Statistics Office has not yet announced some price types (such as real estate, bond, and labor prices), so this article only identifies the types of prices that the General Statistics Office has published.

TRANSPORTATION AND STORAGE PRICES INCREASE MORE THAN TWO-FOLD COMPARED TO THE PREVIOUS YEAR

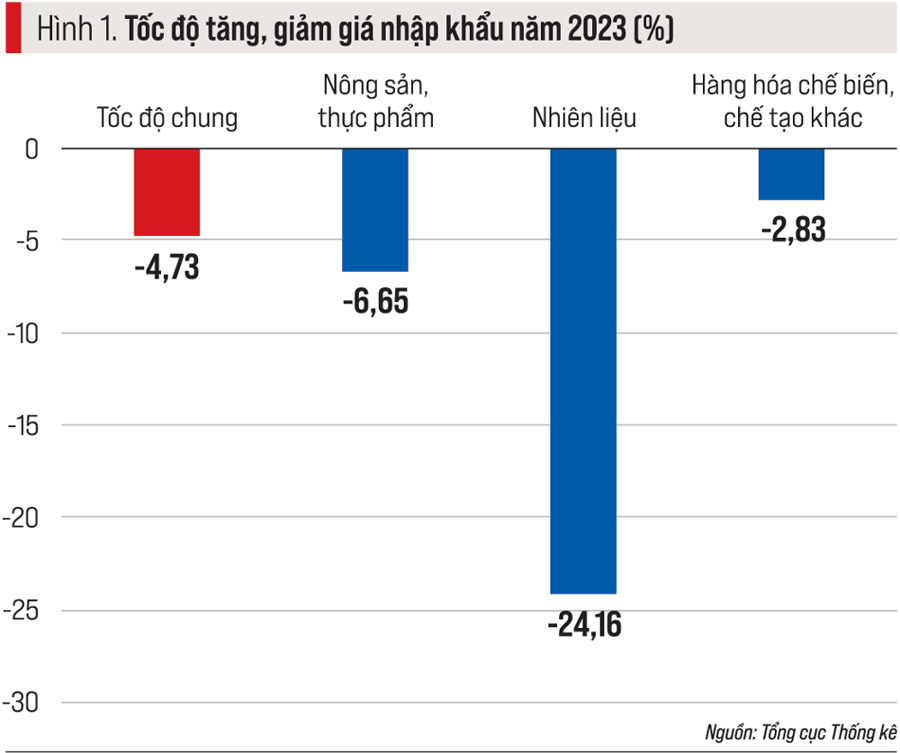

Import prices are the first type of input prices, affecting most other price types. The rate of increase and decrease in import prices in 2023 is as follows (Figure 1).

While last year saw a significant rise (8.66%) that raised concerns about “importing inflation,” import prices in 2023 have dropped considerably, with decreases across most commodity groups, and some experiencing even sharper falls.

This development has eased the pressure on other prices but has also led to an 8.9% drop in import turnover. The deeper decline in import turnover has contributed to a record-high trade surplus, reducing budget revenue from export and import activities. However, due to low domestic demand caused by reduced orders and risk aversion, this has negatively impacted production and exports in the following cycle…

Raw material prices for production are linked to production costs, production prices, pre-tax profit margins, and asset accumulation. The rate of increase and decrease in these prices in 2023 is illustrated in Figure 2.

After two consecutive years of significant increases (5.51% in 2021 and 6.79% in 2022), which burdened producers, raw material prices for production slightly decreased in 2023, particularly for those used in manufacturing industries. This development contributed to a moderate increase in production prices, positively affecting the containment of consumer prices…

Transportation and storage prices impact both input and output costs for production and influence the CPI. After a substantial increase (8.56%) in 2022, these prices rose even higher in 2023, more than doubling the previous year’s increase. Air transport services experienced a notable surge, while storage services and those related to transport support decreased (Figure 3) due to the early rise in industrial land prices, high construction material prices, and sand shortages…

Loan interest rates are a significant component of input costs, especially when bank loans account for a large proportion of the total operating capital of producers and businesses.

The interest rate for medium and long-term VND loans has been lower than in previous years (10.52% in 2019, 10.25% in 2020, 9.23% in 2021, and 9.92% in 2022). This indicates that Vietnam implemented a monetary policy easing earlier than many other countries. This is an essential factor for investors, producers, and businesses to consider when accessing capital for their operations. However, due to challenges in the output market, investment and business production face difficulties, while old debts with high-interest rates remain, or are even overdue. As a result, accessing bank capital remains challenging, with credit growth reaching 11.09%, lower than in previous years and below the target set for this year.

Stock prices are reflected in the VN-Index. At the end of 2023, the VN-Index stood at 1,130 points, a mere 12% increase from the previous year’s close and far below the peak of 1,550 points reached at the beginning of 2022. While the number of accounts has increased significantly, the drop in the index has led to a reduction in the amount of capital entering the market, with foreign investors even withdrawing capital. The issue here is that, given the current trend, it will be challenging to increase the amount of capital in this market, making it difficult for stock prices to rise…

Deposit interest rates attract money from circulation into banks, helping to curb inflation, while also ensuring banks’ liquidity. At the beginning of 2023, bank deposit interest rates reached 7-8%, higher than the average of the previous three years (6.58% in 2020, 5.88% in 2021, and 6.68% in 2022). However, from the middle of 2023 onwards, these rates decreased rapidly. By the end of 2023, terms of less than six months had fallen below 3%, lower than the CPI, meaning that interest rates had shifted from “positive” to “negative”… and were no longer attractive to depositors…

SERVICE PRICES INCREASE THE MOST AMONG THE THREE INDUSTRY GROUPS

Production prices are the result of various input prices and directly affect producers, influencing output prices. The rate of increase and decrease in production prices in 2023 is shown in Figure 4.

Among the three industry groups, service prices rose the most (9.59%). This increase was mainly due to the sharp rise in transportation and storage prices, particularly in air transport. Agricultural, forestry, and fishery production prices increased moderately (3.14%), mainly due to higher rice and fruit prices. Industrial prices decreased by -0.88%. This was one of the critical factors contributing to a significant increase in the added value of the agricultural, forestry, and fishery industry group, with the added value of the service industry group growing faster than the overall national rate.

Export prices, which increased moderately in 2021 (2.86%) and significantly in 2022 (7%), showed the following trends in 2023 (Figure 5).

Export prices in 2023 fell for both major industry groups, with some commodities experiencing more significant declines (such as seafood -7.21%, crude oil -12.6%, gasoline -12.8%, animal feed and raw materials -9.68%, chemical products -10.73%, fertilizers -29.61%, iron and steel -16.69%, electrical wires and cables -1.09%). Export prices increased for certain items, including fruits and vegetables (1.68%), coffee (14.70%), rice (7.33%), bags, wallets, suitcases, hats, umbrellas, and fans (9.56%), textiles and garments (0.72%), footwear (6.16%), and computers, electronic products, and components (5.86%).

The trade exchange rate, if positive (i.e., the export price index is higher than the import price index), favors exports over imports. Conversely, if the trade exchange rate is negative (i.e., the export price index is lower than the import price index), it favors imports over exports.

In 2023, the trade exchange rate was positive, reversing the trend of the previous three years (2020: -0.74%, 2021: -2.49%, 2022: -1.36%). This meant that it was more favorable for exports than imports, resulting in a larger surplus ($355.5 billion compared to $327.5 billion) and a smaller decrease compared to the previous year (-5.0% compared to -8.9%). Consequently, the trade surplus in 2023 reached a record high of $28 billion.

Consumer prices directly affect the majority of market participants and impact the living standards of the population. They are the result of fluctuations in the various prices mentioned above and are linked to inflation control targets…

The average rate of increase and decrease in consumer prices in 2023 is shown in Figure 6.

Thus, 2023 marks the tenth consecutive year of successful inflation control in line with targets. Over time, the average CPI has shown a decreasing trend across periods. Out of the 11 commodity groups, only three experienced increases higher than the target, while five had rates higher than the overall average. In terms of supply and demand, domestic demand remained weak, as reflected in the low rates of increase in asset accumulation (4.09%) and final consumption (3.52%) compared to GDP growth (5.05%). This weakness is also evident in the high proportion of trade surpluses, with services contributing more to GDP growth than asset accumulation (26.64%), second only to the contribution of final consumption (41.04%).

From a monetary perspective, despite the early easing of monetary policy compared to many other countries, credit growth in 2023 reached only 11.09%, lower than in previous years and below the target of 14% set for the year. Fiscal policy was also relaxed early on, with measures such as reducing the VAT rate from 10% to 8% and cutting various taxes and fees. Still, inflation did not rise significantly.

MONEY FLOW CHANNELS

Gold prices serve as a “safe haven” during periods of high inflation and are influenced by the limited gold price management mechanism and the onset of a rising cycle.

USD prices rose slightly in 2019 (0.09%) and then fell in 2020 (-0.02%), 2021 (-0.97%), and 2023 (2.09%). In 2023, gold prices started to increase from the second half of the year (June: 1.79%, July: 0.53%, August: 0.57%, September: 1.53%, October: 1.2%), but the rise slowed in November (0.05%) and December (0.59%). As a result, the average increase for the year was only 1.86%, lower than the previous year.

As the monetary policies of the United States and many other countries shift from tightening to easing, USD prices are expected to decline (USD-Index falling from over 106 points to over 103.2 points, then to 101.9 points, and potentially below 100 points). This shift will likely lead to a decrease in USD prices in Vietnam.

Along with the fluctuations and relationships between prices, which act as “cost push” factors, there is the movement of money. This topic is not often discussed, but it is crucial in a market economy. Just as water flows from high to low in nature, money flows from low-interest rates to high-interest rates in the economic realm.

When gold prices enter a rising cycle, a significant amount of money will shift from virtual currencies, real estate, corporate bonds, stocks, and even savings to gold. After a few years of earning substantial returns from gold, and when other channels offer higher returns, money will flow back into these channels. Therefore, it is predicted that the real estate cycle will begin in 2025 (allowing time for construction and completion) or even earlier, as land can be purchased one to two years in advance. Virtual currencies, after reaching a “peak” of $68,000 and then plummeting to $18,000, are now aiming for the $40,000 mark and may continue to rise in the coming years…

This article was published in the special edition “Economy 2023-2024: Vietnam & The World” on March 6, 2024. To read the full edition, please visit: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.