Experts attribute the rising ring gold prices, which are nearing bar gold prices, to anomalies that need to be addressed and controlled.

Experts point to anomalies

Economist and expert

“This is quite an unusual phenomenon because ring gold does not have the same liquidity as bar gold. Bar gold is a type of gold that people invest in for savings, and it has the same liquidity as money. This is because people can easily exchange their gold for cash whenever they need it. On the other hand, ring gold does not have this level of liquidity, and as a result, its price is usually much higher than that of bar gold.”

However, bar gold is currently very difficult to purchase, even though the State Bank has been selling gold through gold auctions and through four commercial banks: Agribank, BIDV, VietinBank, and Vietcombank, both directly and, more recently, online.

“The amount of gold being sold is very limited, so people are turning to buying ring gold instead. This shows that the demand for gold among the people is very high, even as gold prices continue to rise, both domestically and internationally,”

said Mr. Hieu.

According to Mr. Hieu, the gold market is like a balloon; if you push it in one place, it will bulge in another.

“If the State Bank does not meet the demands of buyers for bar gold, they will turn to buying ring gold for storage. This has led to the recent increase in ring gold prices, and it will continue to rise if left unregulated.”

If prices continue to rise, experts recommend that ring gold be regulated like bar gold. (Illustrative image: Minh Duc).

However, Mr. Hieu also warned that investing in gold at this time carries risks. The level of risk for investors depends on the intervention of the State Bank and two factors: price and supply.

Firstly, regarding the price of bar gold, Mr. Hieu said that the State Bank has successfully lowered the price from 92 million VND/tael to 77 million VND/tael. However, to maintain stability, there needs to be a sufficient supply as well.

“When there is an abundant supply, and we can keep the price at 77 million VND/tael, then we have succeeded in stabilizing the price. However, our supply is still limited, and this situation has pushed up the price of ring gold. If the price of ring gold continues to rise to a level that could impact the economy, it will once again trigger ‘goldization’ of the economy, which we successfully eradicated over a decade ago.”

“If the price of ring gold continues to rise and replaces bar gold, it will be a very concerning phenomenon that will draw the attention of the government and the State Bank, who will then regulate it like bar gold instead of allowing it to be sold freely as it is now. Therefore, those considering buying ring gold should exercise caution,”

Mr. Hieu advised.

Association says it’s normal

Meanwhile, Mr.

At the end of the trading week, global gold prices stood at $2,391 per ounce, a significant increase of $65 per ounce from the previous week’s close. Converted to Vietnamese dong at the bank exchange rate, excluding taxes and fees, the global gold price is approximately 73.4 million VND/tael, 3.58 million VND/tael lower than the selling price of SJC gold.

After a long period of consolidation, global gold prices have finally broken out of their slump this week as new signs point to a weakening job market. Once again, the precious metal is approaching the $2,400 per ounce mark.

“Another reason for the high price of ring gold is that it is not regulated by the state, while SJC bar gold is. This is why the price of ring gold is close to that of bar gold. It is quite normal for the price of ring gold to be close to that of bar gold. The most important thing is that the government aims to bring the price of SJC gold in line with international prices. Currently, the difference between domestic and international gold prices is about 4-5 million VND/tael, a significant reduction from the previous gap of nearly 20 million,”

said Mr. Bang.

Echoing Mr. Bang’s sentiments, economist

“In principle, gold is just 9999, whether it is in bar or ring form, and it should have the same value. The reason bar gold is more expensive is that we used to overly revere SJC bar gold, which is why its price soared. Now that gold is returning to the 9999 standard, it will revert to its true value, and when something is easier to buy and verify, consumers will naturally buy more,”

said Mr. Phong.

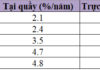

On the morning of July 7, SJC gold bars maintained their buying and selling prices at 74.98 million VND/tael and 76.98 million VND/tael, respectively. These prices have remained unchanged for over a month since the State Bank started selling gold to four state-owned commercial banks and SJC.

Meanwhile, SJC 9999 gold rings were bought at 74.6 million VND/tael and sold at 76.2 million VND/tael. On the other hand, Bao Tin Minh Chau Company bought gold rings at 75.38 million VND/tael and sold them at 76.68 million VND/tael, an increase of 800,000 VND. Doji bought gold rings at 75.65 million VND/tael and sold them at 76.95 million VND/tael, an increase of nearly 1 million VND compared to the previous week…

Currently, SJC 9999 gold rings are only 780,000 VND lower than gold bars of the same brand, a significant reduction from the previous gap of 1.4 million VND. For the first time ever, some gold bar companies are selling gold rings at the same price as SJC gold bars.

Compared to the beginning of the year, the price of gold rings has increased from 12.7 to nearly 14 million VND per tael, depending on the brand. From being more than 10 million VND lower than SJC gold bar prices, gold ring prices are now on par with or even higher than gold bar prices. With global gold prices on the rise, gold ring prices are expected to continue climbing in the coming period.

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.