IPA Repurchases 700 Billion VND in Bonds but Debt Pressure Remains

Over the past few days, IPA has consecutively repurchased portions of two bond issues ahead of schedule, totaling 700 billion VND. Specifically, on June 27, 2024, IPA repurchased 300 billion VND of the IPAH2124002 bond issue, followed by 400 billion VND of the IPAH2124003 bond issue from June 27 to July 04, 2024. These repurchase plans were approved by the Board of Directors just a few days earlier, on June 24.

It is worth noting that both of these bonds are of the “three-no” type, meaning they are non-convertible, non-warrant-attached, and unsecured. Additionally, they do not represent subordinated debt of the company.

The fixed nominal interest rate for these bonds is 9.5%/year, with interest payments made periodically every 12 months. The bonds were initially issued in November and December 2021, with a three-year term and an issuance value of 1,000 billion VND each.

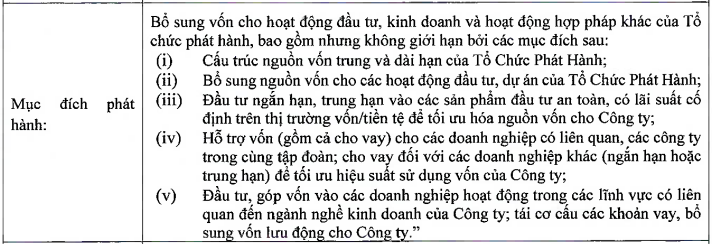

At the time of issuance, IPA announced that the proceeds would be used to supplement capital for investment, business, and other lawful activities, notably including debt restructuring.

Source: IPA

|

As a result of this repurchase, IPA still faces significant debt pressure, with 1,300 billion VND in principal payments due in November and December 2024.

Looking further ahead, another bond, IPAH2225001, will mature in February 2025. This bond has an issuance value of 1,000 billion VND, a 9.5%/year interest rate, and 12-month periodic interest payments. IPA has not repurchased any portion of this bond to date.

The above-mentioned bonds are all under the custody of VNDIRECT Securities Corporation (HOSE: VND) – a company in which IPA itself holds a 25.84% stake.

Raising a Large Sum Through Bond Issuance for Debt Restructuring

On the opposite end of the spectrum, on June 27, IPA completed the issuance of the IPAH2429002 bond, raising 735 billion VND with a five-year term maturing on June 27, 2029.

Prior to that, on June 05, IPA issued the IPAH2429001 bond, raising 317 billion VND with the same five-year term and maturity date. The proceeds from this issuance were used to repay loans to the Can Tho Investment and Development Joint Stock Company, signed on July 04, 2023, and November 17, 2023, totaling 317 billion VND.

Both of these bond issues are also of the “three-no” type, with a fixed interest rate of 9.5%/year and periodic interest payments every 12 months.

|

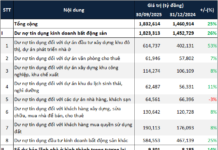

List of Circulating Bonds Issued by IPA

Source: HNX

|

As of the end of Q1/2024, IPA’s total short-term and long-term borrowings decreased by 9.4% compared to the beginning of the year, equivalent to a reduction of 411 billion VND, standing at 3,981.5 billion VND.

| Quarterly Changes in IPA’s Borrowings in Recent Years |

During Q1/2024, IPA made a significant investment in the Trung Nam Renewable Energy Joint Stock Company, a member of the Trung Nam Group.

By the end of the quarter, IPA’s total assets had slightly increased from the beginning of the year to over 8,900 billion VND, mainly due to long-term financial investments totaling 5,926 billion VND, accounting for 66% of total assets. Among these investments, IPA made a new investment in Trung Nam Renewable Energy worth 850 billion VND, equivalent to 9.36% of its charter capital.

Meanwhile, the company continued to maintain its investment of over 928 billion VND in CenLand Joint Stock Company (HOSE: CRE) but had to make a provision of 474 billion VND.

In Q1, IPA’s revenue increased by 34% year-on-year to 86 billion VND. The main contributors were service provision, commercial electricity sales, and goods sales, generating 39 billion VND, 30 billion VND, and 11 billion VND, respectively. Post-tax profit reached 105 billion VND, a significant improvement compared to the loss of 136 billion VND in the same period last year. Net profit stood at 101 billion VND.

For the full year 2024, IPA sets a target of 1,080 billion VND in total revenue and 425 billion VND in pre-tax profit.

Nearly 7.4 trillion VND of TPDN bought back in January 2024, over 279 trillion VND due for repayment throughout the year.

According to data compiled by the Vietnamese Bond Market Association (VBMA) from HNX and SSC, as of February 2, 2024, there were two private corporate bond issuances totaling VND 1.65 trillion and one public bond issuance totaling VND 2 trillion in January 2024.