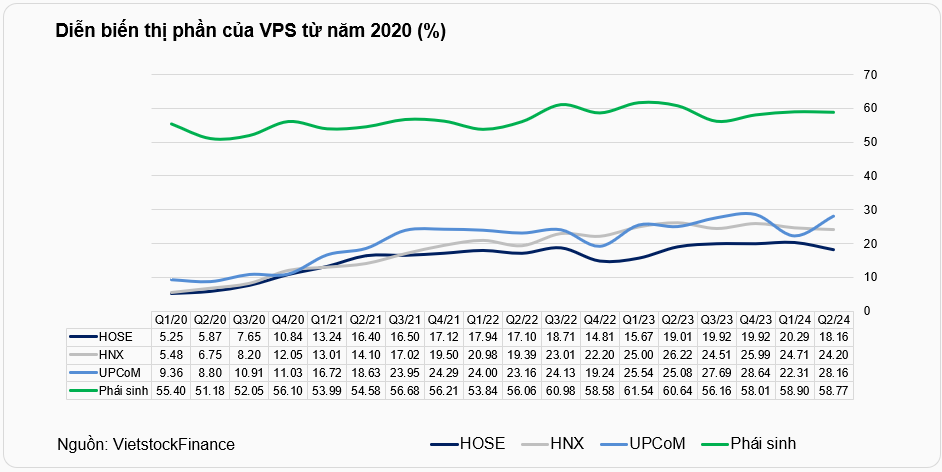

According to newly released data from the HOSE and HNX, VPS remains the leading securities company in terms of market share for stock and fund certificate brokerage on the HOSE, as well as stock brokerage on the HNX, UPCoM, and derivatives markets. However, the market share on HOSE and HNX, along with derivatives, declined compared to the first quarter of 2024, with only UPCoM showing growth.

Specifically, VPS’s market share on UPCoM increased by 5.85 percentage points in the second quarter of 2024, reaching 28.16%, regaining almost all that was lost in the previous quarter.

In contrast, VPS’s stock brokerage market share on the HNX decreased by 0.51 percentage points to 24.2%. A similar decline was observed in derivatives, which fell by 0.13 percentage points to 58.77%.

The market share of VPS on the HNX and in derivatives has been on a downward trend since peaking several quarters ago. The peak for HNX was in the second quarter of 2023 (with a market share of 26.22%), while for derivatives, it was in the first quarter of 2023 (61.54% market share).

On the HOSE, VPS’s market share for stock and fund certificate brokerage stood at 18.16% in the second quarter of 2024, a decrease of 2.13 percentage points compared to the previous quarter. For the first half of the year, VPS’s brokerage market share on the HOSE was 19.19%.

This is the first time VPS has experienced a decline in market share on the HOSE after a consecutive growth streak since the first quarter of 2023. Looking at the broader picture, this is only the third time VPS has lost market share on the HOSE since officially dominating the market in the first quarter of 2021.

|

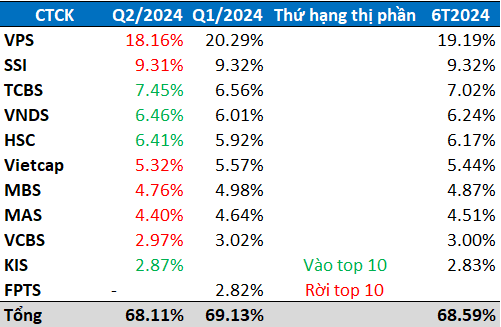

It’s not just VPS; most of the top 10 securities companies, including SSI Securities Company, Vietcap Securities (VCI), MB Securities (MBS), Mirae Asset Securities (MAS), and Vietcombank Securities (VCBS), have also seen a decrease in their brokerage market share on the HOSE in the second quarter of 2024.

On the other hand, Techcom Securities (TCBS), VNDIRECT Securities (VNDS), and Ho Chi Minh City Securities (HSC) were among the few securities companies that managed to increase their market share.

Following this overall declining trend, the combined market share of the top 10 securities companies on the HOSE also decreased from 68.59% to 68.11%, a drop of more than 1 percentage point.

HOSE’s market capitalization slightly decreased in June

|

Top 10 brokerage market share on HOSE in the first half of 2024

Source: HOSE, compiled by the author

|

Another notable point is that the liquidity of the VN-Index in the second quarter of 2024 was over 1,355 billion VND, an increase from the first quarter’s figure of nearly 1,263 billion VND. Similarly, liquidity on the HNX also improved, surpassing 115 billion VND compared to 105 billion VND in the previous quarter. Therefore, the decline in market share during the second quarter may not significantly affect the brokerage business performance of VPS and other securities companies.

In the first quarter of 2024, VPS, as the leader in stock brokerage market share on both the HOSE (20.29%) and HNX (24.7%), generated revenue of 961 billion VND, more than double that of the same period last year. This activity also accounted for the largest proportion of operating revenue, contributing 61%.

Finally, VPS reported a consolidated pre-tax profit of 631 billion VND and a net profit of 505 billion VND, both of which were more than four times higher than the previous year.

For the full year 2024, VPS aims to achieve a consolidated pre-tax profit of 1,500 billion VND, representing an 80% increase from the previous year. If this goal is met, it will be the company’s highest profit in its history.

With the conclusion of the first quarter, the company has already achieved 42% of its target for 2024.

VPS Securities aims for record profits in 2024 and plans to increase capital to nearly 5,900 billion