For this dividend round, VTZ will issue nearly 5.2 million new shares, which equates to a 100:12 ratio. In other words, shareholders owning 100 shares will receive 12 new shares as dividends for the year 2023. The issuance is expected to take place in Q3 2024.

If successful, Nhựa Việt Thành’s chartered capital is expected to increase to nearly VND 482 billion, equivalent to nearly 48.2 million shares.

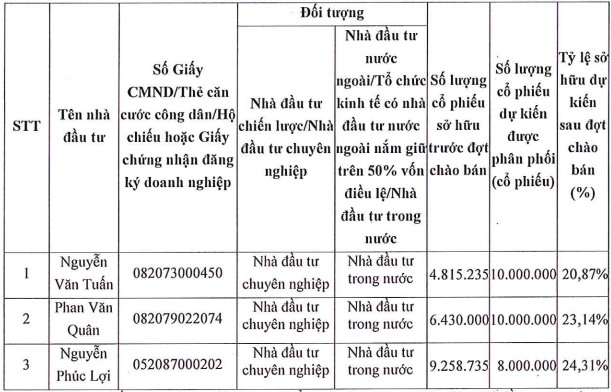

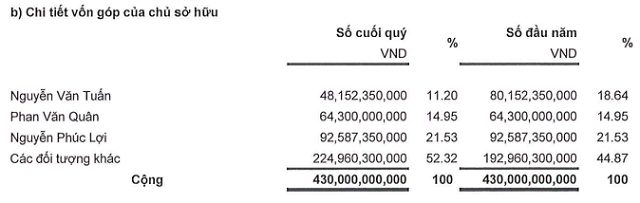

As of the end of Q1/2024, Mr. Nguyen Phuc Loi, the largest shareholder of Nhựa Việt Thành, owned 21.53%. Mr. Nguyen Van Tuan, Chairman of the Board of Directors, held 11.2%, and Mr. Phan Van Quan, Vice Chairman of the Board of Directors and General Director, held 14.95%.

In the upcoming 2023 dividend round, these shareholders are expected to receive over 1.1 million shares, nearly 578,000 shares, and nearly 772,000 VTZ shares, respectively.

Source: VTZ

|

This is the second year that Nhựa Việt Thành has paid dividends to its shareholders. In 2022, the company paid dividends for the first time at a rate of 15% in shares. In 2024, VTZ plans to distribute dividends at a rate of 10%.

Temporary suspension of the plan to offer 28 million shares

On July 1st, Nhựa Việt Thành announced the suspension of the review of the file for the issuance of 28 million VTZ private placement shares by the State Securities Commission due to the company’s request to withdraw the file for completion in accordance with regulations.

According to the plan, VTZ intended to issue 28 million shares to professional securities investors at a price of VND 10,000 per share, which is 12% lower than the closing price on July 3, 2024, of VND 11,400 per share. The offering was scheduled for Q3-Q4 2024.

The offered shares would be restricted from transfer for one year from the end of the offering period.

Notably, three investors participated in this issuance: Mr. Tuan (planned to purchase 10 million shares), Mr. Quan (10 million shares), and Mr. Loi (8 million shares).

|

Investors expected to participate in the share offering of VTZ

Source: VTZ

|

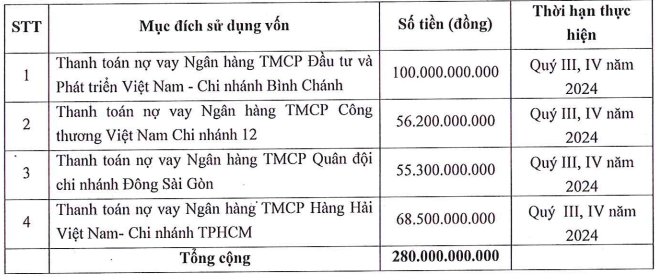

The proceeds from the share offering were expected to be VND 280 billion, and the company planned to use the entire amount to repay bank loans.

|

Capital usage plan from the share issuance of VTZ

Source: VTZ

|

The company stated that the purpose of the share issuance was to repay bank loans to reduce dependence on loan capital, mitigate financial risks by having long-term capital, strengthen financial potential, and facilitate business expansion.

However, there seems to be a contradiction here. While the company aims to issue shares to reduce reliance on loan interest, the Board of Directors of VTZ approved a credit limit of VND 550 billion at BIDV – Binh Chanh Branch on June 28th for the company’s production and business activities.

Earlier, on June 20th, VTZ approved a credit limit of VND 50 billion at Standard Chartered Bank Vietnam.

In May, VTZ also approved a credit limit of VND 100 billion at Woori Bank Vietnam – Bac Ninh Branch.

The interest rates and lending conditions at these three banks will follow the regulations of each respective bank.

Ambitious business plan

In terms of business operations, Nhựa Việt Thành has set an ambitious plan for 2024, targeting consolidated revenue of VND 3,500 billion, a 32% increase, and after-tax profit of VND 60 billion, a 2.6-fold increase compared to the performance in 2023.

| Financial statements of VTZ from 2021 – 2023 |

In the first quarter of the year, VTZ recorded consolidated revenue of over VND 902 billion and after-tax profit of nearly VND 16 billion, increases of 43% and 59%, respectively, compared to the same period last year. The company has achieved 26% of its revenue and profit targets for the year.

Large shareholders absent, Viet Tin Securities fails to hold extraordinary shareholders’ meeting

The extraordinary Annual General Meeting of Viet Tin Securities Joint Stock Company (VTSS) scheduled on February 5th, 2024, was unsuccessful due to insufficient attendance rate to meet the required quorum.