SIP plans to issue nearly 27.3 million new shares as dividends for 2023, implying a ratio of 100:15. This means that for every 100 shares owned, shareholders will receive 15 new shares. If successful, the company’s charter capital will increase from over 1,818 billion VND to nearly 2,091 billion VND, equivalent to over 209 million shares.

The source of funding for this dividend issuance will come from the company’s undistributed post-tax profits (nearly 1,382 billion VND) as of December 31, 2023, as per the audited 2023 financial statements of SIP.

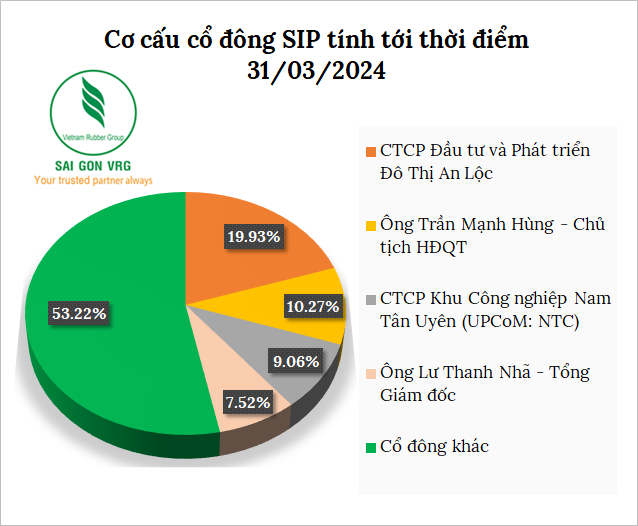

As of March 31, 2024, the largest shareholder of SIP is An Loc Urban Investment and Development Joint Stock Company, holding 19.93% of the capital. This is followed by Mr. Tran Manh Hung, Chairman of the Board of Directors, with a 10.27% stake, NTC Joint Stock Company with 9.06%, and Mr. Lu Thanh Nha, CEO of SIP, with a 7.52% ownership.

In this 2023 dividend payment, these shareholders will receive more than 5.4 million shares, nearly 2.8 million shares, nearly 2.5 million shares, and over 2 million SIP shares, respectively.

Source: VietstockFinance

|

At the recently concluded 2024 Annual General Meeting of Shareholders, SIP approved a dividend payout ratio of 31% for 2023, including a cash dividend of 16% (already paid out, amounting to nearly 291 billion VND) and a stock dividend of 15% as mentioned above. For 2024, SIP plans to distribute dividends at a minimum rate of 10%.

From 2019 to the present, SIP has consistently paid dividends to its shareholders, with ratios ranging from 19% to 90%, in the form of cash or shares. Notably, the total dividend ratio for 2022 was the highest at 90%.

ESOP Share Issuance at 0 VND

On July 1, 2024, the Board of Directors of SIP approved the issuance of more than 1.4 million shares (equivalent to 0.8% of outstanding shares) under the Employee Stock Ownership Plan (ESOP) at a price of 0 VND. This issuance is expected to be completed in the second or third quarter of 2024.

SIP stated that the purpose of this ESOP program is to reward employees with shares, thereby aligning their interests with the long-term success of the company.

Business Performance and Prospects

In terms of business performance, SIP has set a target for 2024 with consolidated revenue of nearly 5,388 billion VND and profit after tax of nearly 793 billion VND, representing decreases of 30% and 21%, respectively, compared to the actual results of 2023. The company plans to lease out 47 hectares of industrial land and 4.3 hectares of factory area in 2024, with the majority located in Phuoc Dong Industrial Park.

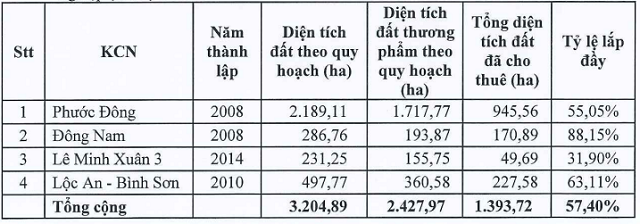

As of the end of 2023, SIP‘s four industrial parks had over 1,000 hectares of unsold land and had leased out nearly 1,400 hectares of industrial land, achieving a land occupancy rate of 57.4%. Phuoc Dong Industrial Park has the largest land bank, with over 770 hectares remaining.

|

Industrial Parks and Land Bank of SIP as of December 31, 2023

Source: SIP

|

| Financial Performance of SIP from 2019 to 2023 |

For the first quarter of 2024, SIP recorded revenue of over 1,826 billion VND, up 31% year-on-year, and profit after tax of nearly 258 billion VND, an increase of 44%. Compared to the full-year plan, SIP has achieved 34% and 33% of the revenue and profit targets, respectively.

As of the market close on July 3, 2024, the company’s share price stood at 92,500 VND per share, reflecting a 46% increase since the beginning of the year. The average trading volume was nearly 356,000 shares per session.

| Share Price Movement of SIP since the Beginning of 2023 |