The Navico Board of Directors plans to issue a 1:1 bonus share issue (holding 1 share will entitle you to receive 1 additional share), corresponding to the issuance of over 133.1 million new shares. The capital source for the issuance will come from accumulated undistributed post-tax profits up to the date of December 31, 2023, as per the audited 2023 consolidated financial statements.

The expected timeline for the execution of this plan is within 45 days from when the SSC announces the receipt of complete documents.

If successful, Navico’s chartered capital will double to 2,667 billion VND, and it will become the pangasius exporting enterprise with the largest chartered capital on the stock exchange – surpassing Vinh Hoan Joint Stock Company (HOSE: VHC) with a chartered capital of over 1,870 billion VND.

Estimated profit of 50-60 billion VND for the first half of 2024

In an update report, Rong Viet Securities (VDSC) cited figures from the Vietnam Association of Seafood Exporters and Producers (VASEP) showing that Vietnam’s pangasius exports in the first six months of 2024 reached USD 922 million, up 6% compared to the same period.

According to data from Agromonitor, ANV’s total pangasius export revenue for the first five months of the year reached USD 40 million (VND 1,000 billion at a USD/VND exchange rate of 25,000), a 17% decrease year-on-year, due to a 14% decrease in the selling price in USD and a 4% decrease in volume.

Although the export value of the pangasius industry has shown strong growth, ANV’s main export market in China faces challenges as purchasing power remains weak despite higher tilapia prices compared to pangasius.

However, VDSC believes that the worst period for ANV has passed, with export value gradually increasing month-over-month and a positive 1% growth in May thanks to a 16% increase in volume compared to the same period last year. ANV’s management also revealed that profit for the first half of 2024 is estimated at 50-60 billion VND.

In 2024, the company expects a total revenue of 5,000 billion VND, up 13% compared to 2023. Pre-tax profit is projected to be 360 billion VND, nearly six times higher than the previous year.

| ANV’s financial results for the last 5 years |

As of December 31, 2023, the remaining undistributed profit was nearly 1,519 billion VND. Navico will pay a 2023 dividend with a ratio of 5% in cash, corresponding to an expected expenditure of about 67 billion VND.

ANV has a tradition of paying dividends to shareholders since its listing on the HOSE in 2007, with the exception of 2015 when no dividends were paid. During the period of 2020-2022, the dividend ratio remained at 10% in cash; it was then reduced to 5% in 2023 and is expected to be in the range of 5-10% for 2024.

ANV leaders are racing to “cash in”

In the morning session of July 8, ANV’s market price was VND 33,650/share, up nearly 20% from its recent low at the end of April. Average trading volume for the past two months reached 1.55 million shares/day.

| ANV’s stock price since the beginning of April 2024 |

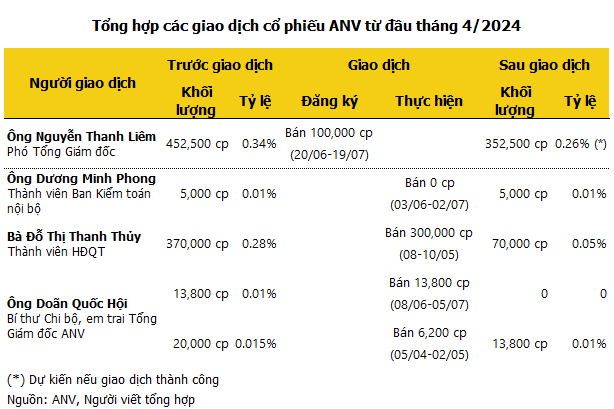

In this context, a series of Navico leaders have made moves to offload their holdings, pocketing billions of VND in the process. Most recently, Deputy General Director Nguyen Thanh Liem registered to sell 100,000 ANV shares from June 20 to July 19, aiming to reduce his ownership to 352,500 shares (a ratio of 0.26%).

From June 3 to July 2, Mr. Duong Minh Phong, a member of the Internal Audit Committee, reported an unsuccessful sale of 5,000 ANV shares, as he had already arranged the necessary finances.

Previously, Mr. Doan Quoc Hoi, Secretary of the Party Cell and younger brother of Navico’s CEO, needed a second attempt to complete the sale of 20,000 ANV shares as registered. After the transaction, Mr. Hoi no longer holds any shares in the company. Ms. Do Thi Thanh Thuy, a member of the Board of Directors, also sold 300,000 ANV shares over three days from May 8 to 10, reducing her ownership to 70,000 shares (a ratio of 0.05%).

The Manh

Vietnam Airlines sees promising results in its quest for financial balance

By the end of 2023, this business has incurred a total loss of over 5.8 trillion VND despite a 30% increase in revenue.

Unforeseen sharp reduction in flight tickets from Ho Chi Minh City

Unlike the previous days of 27th, 28th, and 29th of the lunar calendar, the airfare from Ho Chi Minh City to northern provinces on 9th February (or 30th of Tet) has significantly reduced. In fact, passengers can still purchase tickets for same-day travel as there are still plenty of flights available.