The incident raises questions about VNDIRECT’s future prospects, especially as the loss of trust leads to a decline in its client base.

HOSE Q2 2024: VPS’s market share drops below 20%, FPTS falls out of the top 10

HNX Q2 2024: A slight dip in VPS Securities’ market share

Ho Chi Minh City Stock Exchange (HOSE) recently released the top ten brokerage market shares on its floor.

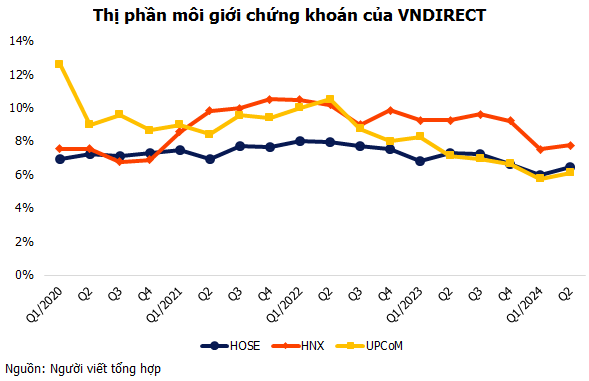

In Q2 2024, VNDIRECT’s market share on HOSE rose by 0.45 percentage points to 6.46%, retaining its fourth position behind VPS, SSI, and TCBS. On HNX and UPCoM, VNDIRECT maintained its third-place position with market shares of 7.77% and 6.12%, respectively, reflecting increases of 0.26 and 0.37 percentage points.

Historically, VNDIRECT has consistently ranked among the top three securities companies in terms of market share on HOSE, HNX, and UPCoM since 2021. However, it subsequently lost this position to TCBS on the HOSE floor and has yet to reclaim it.

In Q1 2024, VNDIRECT’s brokerage market share on HOSE dropped to 6.01%, its lowest level since 2016, before rebounding to 6.46% in Q2. Nonetheless, it remains far below its peak of 8.01% in Q1 2022.

At the 2024 Annual General Meeting of Shareholders held in late June, Mr. Nguyen Vu Long, CEO of VNDIRECT, acknowledged that the international hacker attack in late March had impacted the company’s operations. However, VNDIRECT has implemented appropriate and flexible solutions to address this issue.

The Board of Directors of VNDIRECT also conceded in their report to the 2024 Annual General Meeting that the company’s market share has been shrinking while VPS continues to widen the gap with its competitors, and SSI‘s market share has seen a slight increase.

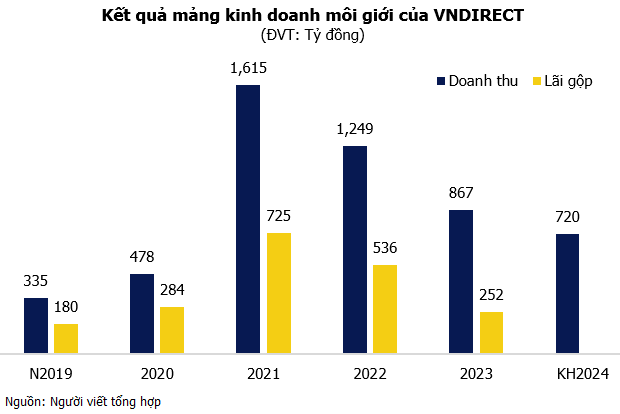

However, VPS and SSI have had to compromise on brokerage profits to maintain and expand their market shares. VNDIRECT, on the other hand, is willing to accept a potential reduction in market share without sacrificing profits. Consequently, while VNDIRECT’s trading volume may not match that of VPS and SSI, its brokerage service profit margin for 2023 stood at 29%, compared to 19% for VPS and 12% for SSI.

Nevertheless, looking at the five-year period from 2019 to 2023, VNDIRECT’s brokerage gross profit margin has been declining, dropping from 59% in 2020, accompanied by a noticeable decrease in revenue, and is expected to reach 720 billion VND in 2024.

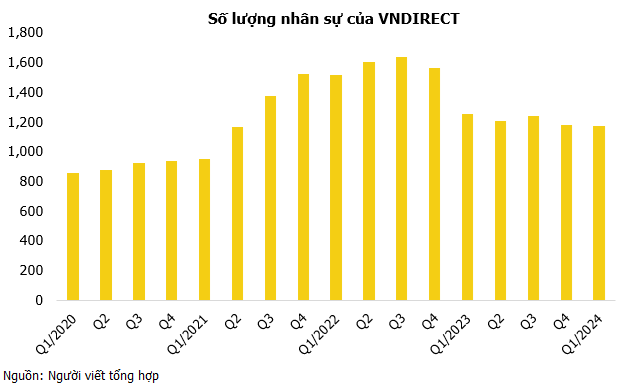

VNDIRECT also emphasized that they are not engaging in a fee competition but are instead focused on enhancing the quality of their services to attract and retain customers. Additionally, the company is committed to developing its brokerage team in terms of quality rather than quantity.

As of March 31, 2024, VNDIRECT had 1,169 employees, a decrease of 446 people in almost two years. Notably, this downward trend in staffing began in Q3 2022.

Specifically, in 2023, the reduction in personnel primarily affected employees with less than one year of service, while those with over three years of experience witnessed a slight increase.

The number of employees who left the company in 2023 was 4% higher than in 2022. Interestingly, the composition of departing employees shifted from trainees and inexperienced staff in 2022 to more experienced individuals, including managers, in 2023.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.