KienlongBank, a Vietnamese bank, has announced that it will finalize the list of current shareholders on July 22, who will then be able to nominate and vote during the upcoming extraordinary general meeting expected to take place in October 2024.

The purpose of this meeting is to present and approve the regulations governing the organization and operation of the Board of Directors and the Supervisory Board, as well as KienlongBank’s internal governance regulations and other related matters. Additionally, during this extraordinary session, KienlongBank will also make changes to the structure and number of members, electing additional independent members to the Board of Directors and the Supervisory Board for the 2023 – 2027 term.

Many commercial banks are holding extraordinary general meetings in June, July, and August to comply with the new regulations in the Law on Credit Institutions 2024.

Vietcombank, the country’s foreign trade bank, has also notified that it will finalize its shareholder list on July 19 in preparation for its extraordinary general meeting, scheduled for August 19. The agenda includes seeking approval for a plan to issue private placement shares to increase Vietcombank’s charter capital, amending and supplementing the bank’s organization and operation regulations, the Board of Directors’ regulations, and internal governance regulations. The extraordinary general meeting of Vietcombank is also expected to elect additional members to the Board of Directors for the 2023-2028 term.

Another bank, LPBank (LienVietPost Bank), will hold its extraordinary general meeting in September 2024 to elect additional members to its Board of Directors for the 2023-2028 term. The meeting will also address a proposal to adjust the plan for increasing the bank’s charter capital in 2024 and other matters within the competence of the general meeting of shareholders.

Previously, LPBank’s Board of Directors announced that it would consider submitting to the extraordinary general meeting for approval a proposal to adjust the plan for increasing the bank’s charter capital in 2024 by issuing shares to pay dividends from undistributed post-tax profits in 2023. The expected dividend payout ratio is 16.8%.

Additionally, PGBank also plans to hold an extraordinary general meeting in August this year, while MB and VIB have already held their extraordinary general meetings in June 2024 to address important issues.

According to the banks, the holding of these extraordinary general meetings is to promptly meet the requirements of the Law on Credit Institutions 2024, which came into force on July 1, 2024.

A KienlongBank representative stated that the changes in structure and personnel aim to strengthen the bank’s supervision and governance in line with the new Law on Credit Institutions. It will also further enhance the bank’s ability to meet governance practices and set the foundation for future development.

Speaking to the Báo Người Lao Động, representatives of several banks explained that with the new Law on Credit Institutions coming into effect on July 1, along with its updated regulations, banks need to modify and supplement their operating regulations, hence the need for these extraordinary general meetings. Certain provisions require updates according to the new law, and any changes must be approved by the shareholders, necessitating these meetings (either in person or online). Other agenda items for seeking shareholder approval may vary depending on the specific needs of each bank. This is a standard procedure for listed banks.”

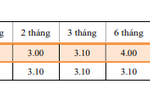

TPBank, KienlongBank Raise Savings Interest Rates, Effective April 26

TPBank, Vietnam Prosperity Joint Stock Commercial Bank, officially adjusts its savings interest rates starting today, April 26. A day earlier, KienlongBank had also revised its online savings interest rate schedule.