In March 2024, Mr. Nguyen Phu Cuong, Chairman of the Members’ Council of Vietnam Chemicals Group (Vinachem), revealed that despite facing numerous challenges in 2023, the Group still achieved a combined revenue of over VND 57 trillion, with profits approximating VND 3.5 trillion and tax contributions of VND 1.7 trillion.

Vinachem successfully secured employment for nearly 20,000 workers, offering an average income of VND 13.6 million per person per month.

The Chairman of Vinachem also shared that three underperforming entities on the list of 12 struggling projects under the Ministry of Industry and Trade, namely Ha Bac Nitrogenous Fertilizer Joint Stock Company, Ninh Binh Nitrogenous Fertilizer Joint Stock Company, and Lao Cai DAP Joint Stock Company (DAP No. 2 – Vinachem), had turned their fortunes around. These companies, which previously had negative owner’s equity and incurred losses for multiple years, have now reported profits for three consecutive years.

In 2022, the total profits of these three entities stood at VND 2.7 trillion, and in 2023, they achieved VND 1.3 trillion. Even in the first two months of 2024, these units continued to operate stably and profitably.

However, a closer look at the recently published audited financial statements for 2023 reveals that the consolidated pre-tax profit figure of VND 3.750 trillion for Vinachem was largely due to the waiver of interest debt by the Vietnam Development Bank for its three subsidiaries (the aforementioned struggling companies).

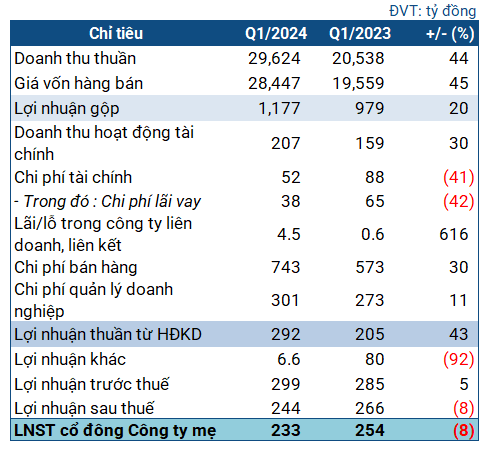

According to the report, Vinachem’s net revenue for 2023 amounted to VND 50,572 billion, a decrease of over 10% from the previous year. While revenue declined, cost of goods sold increased, resulting in a gross profit of VND 5,898 billion, a 54% drop compared to 2022. The gross profit margin also witnessed a significant decline from 22.89% to 11.66%.

Financial income plummeted by 47.3% to VND 949 billion.

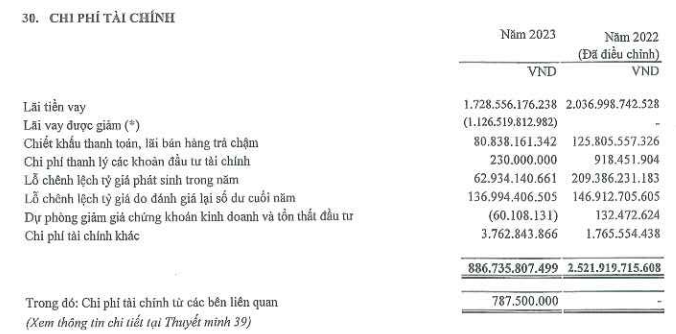

During 2023, the Vietnam Development Bank – Lao Cai Branch waived interest on overdue principal debt and interest on delayed interest payments for Lao Cai DAP Joint Stock Company (DAP No. 2 – Vinachem). They also reduced interest rates on loans and restructured repayment schedules, totaling VND 1,127 billion, which was recorded as a reduction in financial expenses.

Consequently, Vinachem’s financial expenses stood at VND 887 billion, as opposed to over VND 2,500 billion in the previous year.

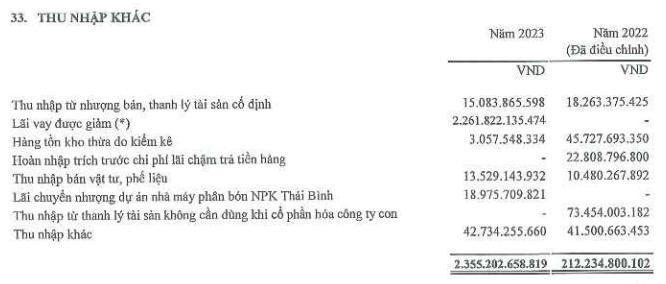

Simultaneously, the Vietnam Development Bank – North East Area Branch reduced loan interest totaling VND 2,262 billion for Ha Bac Nitrogenous Fertilizer and Chemicals Joint Stock Company (VND 1,802 billion) and Ninh Binh Nitrogenous Fertilizer One-Member Limited Liability Company (VND 460 billion). These savings were recorded as other income.

As a result, Vinachem’s other income for the year reached VND 2,174 billion, a staggering 368-fold increase compared to 2022 (nearly VND 6 billion).

Thus, the total interest debt waived and reduced by the Vietnam Development Bank for Vinachem’s three subsidiaries amounted to VND 3,388 billion. Excluding this interest waiver, Vinachem’s pre-tax profit would have been just under VND 550 billion.

According to the auditor’s opinion, these loans were associated with the three projects of Ninh Binh Fertilizer, Ha Bac Fertilizer, and Lao Cai DAP. After the interest waiver, reduction in loan interest rates, and restructuring of repayment schedules, the short-term assets of Ha Bac Nitrogenous Fertilizer and Chemicals Joint Stock Company were sufficient to cover its short-term debts, and the owner’s equity exceeded the accumulated losses as of December 31, 2023. In contrast, Lao Cai DAP Joint Stock Company (DAP No. 2 – Vinachem) and Ninh Binh Nitrogenous Fertilizer One-Member Limited Liability Company had short-term debts exceeding short-term assets and negative owner’s equity due to accumulated losses.

As of December 31, 2023, Vinachem’s total assets stood at VND 53,467 billion, a decrease of VND 3,286 billion from the beginning of the year. The company held over VND 10,300 billion in cash and bank deposits. Its liabilities amounted to VND 26,019 billion, a 17% reduction from the start of the year, including VND 12,881 billion in borrowings. Vinachem’s owner’s equity was VND 27,448 billion.