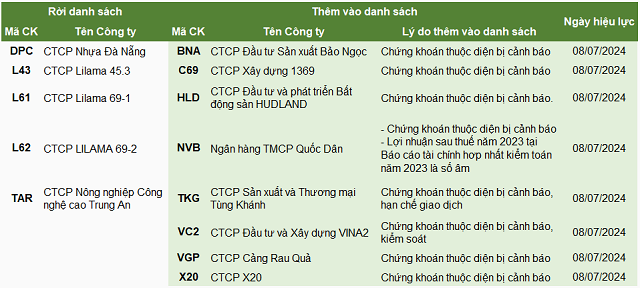

The number of stocks on the margin cut list has increased from 69 in the second quarter to 72 in the third quarter, with five stocks exiting the list and eight new additions. Stocks that have left the list include DPC of the Danang Plastic Joint Stock Company, TAR of Trung An High-Tech Agriculture Joint Stock Company, and the trio of Lilama-affiliated stocks: L43, L61, and L62. These stocks have been delisted from HNX and moved to UPCoM trading.

On the other hand, eight companies have had their stocks added to the list, including Investment and Production Bao Ngoc (BNA), Construction 1369 (C69), HUDLAND Real Estate Investment and Development (HLD), Fruit Port (VC2), Quoc Dan Commercial Joint Stock Bank (NVB), Production and Commerce Tung Khanh (TKG), Investment and Construction VINA2 (VC2), and X20. These additions are due to their stocks falling under the warning category, with TKG also facing trading restrictions, VC2 under surveillance, and NVB reporting negative post-tax profits in their audited consolidated financial statements for 2023.

|

Changes in the list of stocks under margin cut in Q3 compared to Q2/2024

Source: HNX, compiled by the author

|

Prior to the announcement of the 72-stock margin cut list by HNX, the Ho Chi Minh Stock Exchange (HOSE) had also released a similar list on July 2, consisting of 79 stocks, notably including HAG, HBC, HVN, FRT, and newly listed stocks such as HNA, MCM, and FUEKIVND.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.