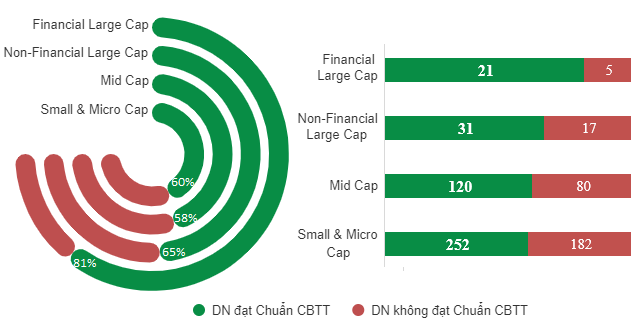

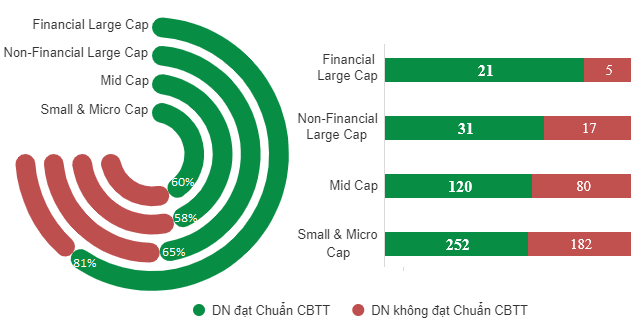

On July 1, 2024, the IR Awards 2024 program released the Comprehensive Survey Report on Information Disclosure Activities on the Securities Market in 2024. The results showed that the number of enterprises fully and timely fulfilling their information disclosure obligations on HOSE and HNX was 424/708 units, accounting for 60% of the total listed market for the 2024 survey period (the previous survey period reached 50%).

Source: IR Awards 2024 Program

Financial Large Cap Leads

Financial Large Cap (the group of enterprises with large market capitalization, including three sectors of banking, securities, and insurance) leads in the rate of Enterprises meeting the Information Disclosure Standard in 2024 when compared within 4 capitalization groups (Finacial Large Cap, Non-Financial Large Cap, Mid Cap, Small & Micro Cap). Specifically, up to 81% of Financial Large Cap met the 2024 Information Disclosure Standard, equivalent to 21/26 enterprises. With this rate, Financial Large Cap outperformed other groups, followed by Non-Financial Large Cap with 65%, Mid Cap with 60%, and Small & Micro Cap with 58%.

Non-Financial Large Cap is the group with the second-highest rate of meeting the 2024 Information Disclosure Standard with a rate of 65%, equivalent to 31/48 enterprises. Although both are Large Cap enterprises, there is a significant difference in compliance with legal provisions on information disclosure activities in the securities market between the Large Cap group in the financial sector (Financial Large Cap) and the Large Cap group in the non-financial sector (Non-Financial Large Cap), with a difference of up to 16 percentage points, in which the Financial Large Cap group took the lead.

Small & Micro Cap Impressively Grows

Previously, information disclosure activities were focused on large enterprises (Large Cap), but in this 2024 survey period, the group of small enterprises (Small & Micro Cap) has made a breakthrough with an impressive increase in the rate of meeting the Information Disclosure Standard from 46% to 58%. This shows that small enterprises are paying more and more attention and achieving good results in information disclosure activities. In 2024, Small & Micro Cap has achieved an outstanding performance in the 14-year journey of IR Awards.

In terms of the number of units, the Small & Micro Cap group had 252/434 Enterprises meeting the 2024 Information Disclosure Standard.

Mid Cap also recorded growth and reached a rate of 60% of Enterprises meeting the 2024 Information Disclosure Standard (increased from 54% to 60%). With this rate, Mid Cap was slightly higher than Small & Micro Cap by 2 percentage points.

Enterprises meeting the 2024 Information Disclosure Standard by Capitalization Group

Source: IR Awards 2024 Program

Financial Large Cap meeting the 2024 Information Disclosure Standard

|

|

Stock Code |

Company Name |

Exchange |

Sector |

|

1 |

|

Asia Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

2 |

Bank for Investment and Development of Vietnam Joint Stock Company |

HOSE |

Finance and Insurance |

|

|

3 |

VietinBank – Vietnam Joint Stock Commercial Bank |

HOSE |

Finance and Insurance |

|

|

4 |

|

Export Import Commercial Joint Stock Bank of Vietnam |

HOSE |

Finance and Insurance |

|

5 |

Ho Chi Minh City Securities Corporation |

HOSE |

Finance and Insurance |

|

|

6 |

Ho Chi Minh Development Joint Stock Commercial Bank |

HOSE |

Finance and Insurance |

|

|

7 |

|

LienVietPost Joint Stock Commercial Bank |

HOSE |

Finance and Insurance |

|

8 |

Military Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

9 |

Maritime Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

10 |

|

Orient Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

11 |

PVI Joint Stock Company |

HNX |

Finance and Insurance |

|

|

12 |

Saigon – Hanoi Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

13 |

|

Saigon – Hanoi Securities Joint Stock Company |

HNX |

Finance and Insurance |

|

14 |

Saigon – Saigon Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

15 |

Saigon Securities Incorporated |

HOSE |

Finance and Insurance |

|

|

16 |

|

Sài Gòn Thương Tín Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

17 |

Techcombank Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

18 |

TienPhong Commercial Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

19 |

|

Vietcombank – Vietnam Joint Stock Commercial Bank |

HOSE |

Finance and Insurance |

|

20 |

International Joint Stock Bank |

HOSE |

Finance and Insurance |

|

|

21 |

VIX Joint Stock Company |

HOSE |

Finance and Insurance |

Non-Financial Large Cap meeting the 2024 Information Disclosure Standard

|

No. |

Stock Code |

Company Name |

Exchange |

Sector |

|

1 |

|

Becamex Industrial Infrastructure Development Corporation |

HOSE |

Nearly 300 Industrial Accidents Occurred in Hanoi in 2023

In Hanoi City, there are still several units, enterprises, and construction works that do not pay much attention to occupational safety and hygiene, posing many potential risks of insecurity. Last year, the city also had nearly 300 occupational accidents…

Flexible Holidays to Meet Order Deadlines

During the upcoming Labour day and International Workers’ Day celebration, citizens will be granted a 5-day extended break lasting from April 27th to May 1st. To strike a balance between employees’ well-deserved rest and the fulfillment of production orders… the majority of enterprises must reorganize their manufacturing and business operations.

[IR AWARDS] May 2024 IR Calendar

Notable scheduled information releases in the stock market during May include the Fed’s FOMC meeting results, the effective HNX30 portfolio structure, the announcement of the MSCI portfolio structure, the expiration of the VN30F2405 futures contract, the release of PMI, and the announcement of the socio-economic situation in May.

![[IR AWARDS] May 2024 IR Calendar](https://xe.today/wp-content/uploads/2024/05/ir-awards-1-2-150x150.jpg)