DXG-listed Dat Xanh Group has responded to allegations made by a man named Nguyen Xuan Trieu, refuting his claims as false and misleading.

In early July 2024, the group received a complaint from Mr. Trieu, who claimed to represent 15 investors and owned 448 bonds issued by Dat Xanh Services JSC (DXS). Mr. Trieu accused Do Van Manh, the General Director of Dat Xanh Services, and Luong Tri Thin, the Chairman of the company’s Board of Directors, of embezzling VND 44.8 billion through the bond issuance.

Dat Xanh Group has categorically denied these allegations, stating that Dat Xanh Services has not issued any bonds since 2021. As a public company, any bond or security offerings would have to be disclosed and comply with regulations. The group also clarified that Mr. Manh is not the General Director, and Mr. Thin is not the Chairman of Dat Xanh Services, and that these facts have been made public.

Additionally, the group mentioned that Dat Xanh Southern Services JSC, which issued the bonds in question, is no longer a subsidiary of either Dat Xanh Services or Dat Xanh Group, as they have divested their holdings to a 49% stake. To distance themselves from any negative associations, Dat Xanh Group has also revoked the rights to use their “Dat Xanh” brand and logo for this company.

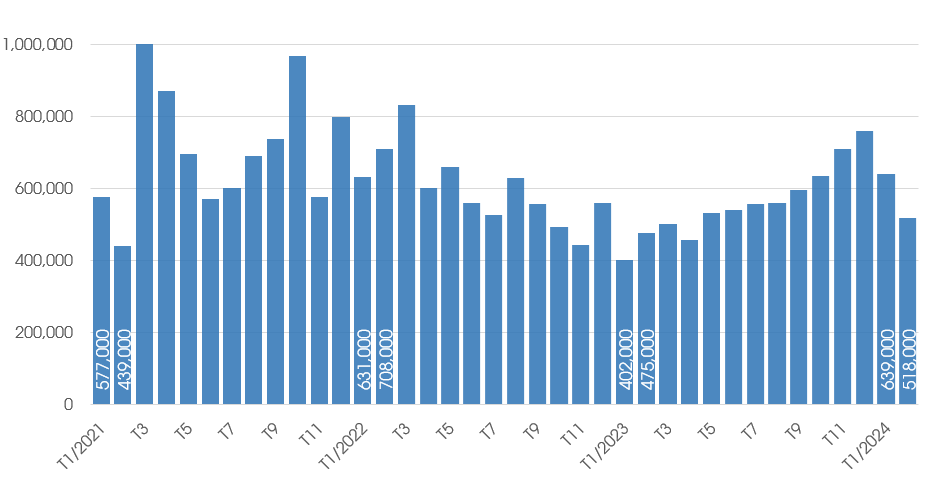

Promising Revival of the Corporate Bond Market

The corporate bond market in 2024 is expected to be more vibrant due to low interest rates, expanded supply, and improved investor confidence.