The afternoon session saw a slight improvement in liquidity, but the buyers were highly enthusiastic, consistently pushing prices higher. As a result, the upward momentum extended, with the VN-Index closing at the day’s highest level, up 0.79% (+10.15 points). Compared to the previous peak on June 13, the gap is now less than 8 points, so a similar performance tomorrow could push the index to a new high.

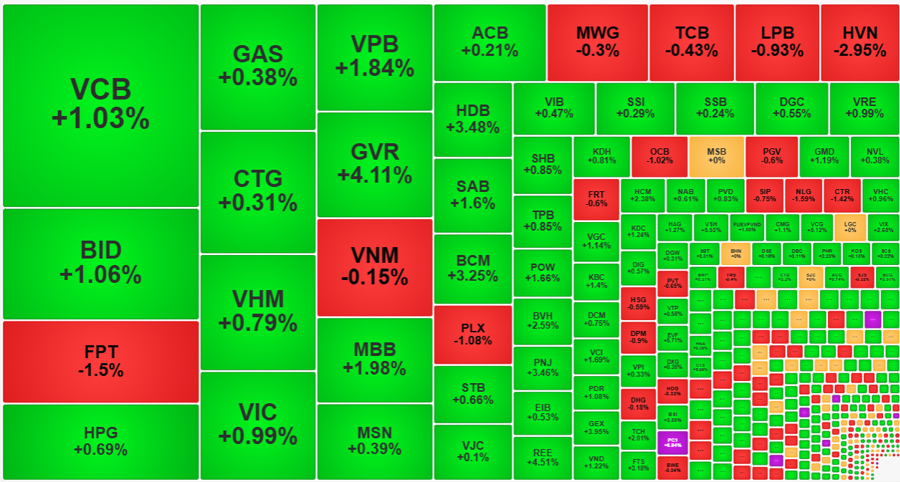

The strength in the afternoon came from the blue-chip stocks, with 17 tickers posting higher gains compared to their morning closing prices. While the breadth didn’t show a significant improvement, with 25 gainers and 5 losers (compared to 27 gainers and 7 losers in the morning), the overall price level was better, helping the VN30-Index close with a 0.45% gain compared to 0.1% at midday.

VIC was the most notable gainer in the afternoon session and even contributed to lifting the VN-Index. At midday, VIC was down 0.12%, and until 2:15 PM, it was still hovering around the reference price. Suddenly, in the last few minutes, VIC surged by 1.36% from the reference price before easing slightly at the close, ending up 0.99%. So, for the afternoon session alone, VIC gained nearly 1.12%. Aside from VIC, no other stock moved by more than 1%. VCB added 0.92%, VPB rose by 0.52%, MSN increased by 0.53%, and BVH gained 0.74%, being the most significant movers.

The overall breadth of the VN-Index also didn’t show much improvement. At midday, the index had 246 gainers and 168 losers, and at the close, there were 295 gainers and 155 losers. However, the price level was significantly better, with 125 stocks closing more than 1% higher (compared to 100 in the morning). The trading liquidity of this group accounted for more than 43% of the total matched value on the HoSE, while it was around 40% in the morning. Thus, the buying demand was strong, not only maintaining the price levels achieved in the morning session but also expanding and actively creating liquidity.

On the HoSE, 60 stocks had a liquidity of 100 billion VND or more – accounting for 77% of the total value. Of these, 46 stocks rose, with 27 gaining more than 1%. Only 13 of these stocks were in the red, and only 3 stocks fell by more than 1%: FPT fell by 1.5% with a liquidity of 1,327 billion VND; NLG decreased by 1.59% with 101.4 billion VND, and HVN dropped by 2.95% with 194 billion VND. Notable gainers included PC1, up 6.94% with a liquidity of 427.4 billion VND; EVF, up 5.71% with 156.8 billion VND; CTS, up 5.66% with 125.5 billion VND; REE, up 4.51% with 147.2 billion VND; and GEX, up 3.95% with 449.2 billion VND…

With some pillars joining the group of stocks that pushed the index the most, such as VCB up 1.03%, BID up 1.06%, VPB up 1.84%, and GVR up 4.11%, the VN-Index has the opportunity to break through to a new high. The upward momentum has now extended to the seventh consecutive session and suddenly accelerated just as the index entered the old peak zone. If there is a strong consensus among the leading large-cap stocks, the VN-Index surpassing the peak is within reach.

Although prices rose quite well, liquidity in the afternoon was not impressive, with the HoSE falling slightly by 1.2% compared to the morning session, reaching 10,038 billion VND. Including the HNX, the liquidity of the two exchanges decreased by 1.1%, reaching 10,815 billion VND. However, the threshold for matched orders above 10 trillion VND in the afternoon is still considered high because, in the past two weeks, only two sessions have exceeded this level, and today is the third.

Moreover, the lack of increase in liquidity is not necessarily due to weak money flow. It could also be attributed to reduced selling pressure as buyers were clearly more proactive. If investors wanted to unload their positions, there would be significant buying support, and liquidity would easily increase.

The mid- and small-cap stocks are benefiting significantly from the vibrant trading activities and the strong rebound. Eight stocks closed at the ceiling price, with relatively high liquidity, including CSV, PC1, VIP, BFC, VTO, and CSM. Stocks like SAV, VSH, VCG, IMP, MIG, BIC, CCL, and HVH all rose more than 4%.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.