In a recent development, REE’s largest shareholder has registered to publicly acquire 4 million shares, equivalent to 0.85% of REE’s charter capital. If the transaction is successful, the fund will increase its ownership from 34.85% to 35.7%, holding nearly 168.2 million shares.

Notably, the expected offering price is VND 80,000 per share, which is over 20% higher than REE’s market price during the morning session on July 8, 2024 (VND 66,600 per share). The transaction is estimated to be worth approximately VND 320 billion, while REE’s share price is currently trading near its highest peak this year.

| REE’s Share Price Movement since the Beginning of 2024 |

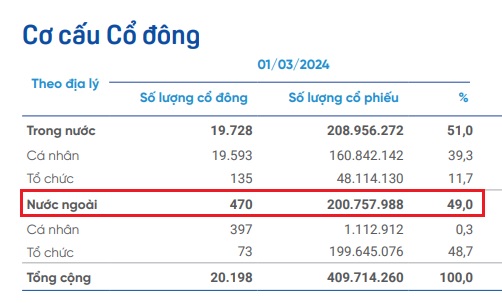

In reality, Platinum Victory fund has consistently registered to increase its ownership in REE over the years, but most of these attempts have not been realized due to “unfavorable market conditions.” However, the primary reason is likely because REE has reached its foreign ownership limit. According to the 2023 annual report, as of March 1, 2024, the number of shares held by foreign shareholders in REE was 49%, with two major shareholders being Platinum Victory, holding 34.8%, and Apollo Asia Fund Ltd., holding 5% (20.6 million shares).

Source: REE

|

This implies that if Platinum Victory wishes to acquire more shares, it has to obtain them from other foreign shareholders. Therefore, the fund has been consistently registering to buy REE shares to stay prepared for any opportunities. The new offering also indicates that the fund is willing to spend significantly more than the market price to increase its ownership in REE.

Platinum Victory Pte. Ltd., a part of the Jardine Cycle & Carriage (JC&C) conglomerate from Singapore, is also a major shareholder in Thaco (THA) and Vinamilk (VNM), listed on the Ho Chi Minh Stock Exchange (HOSE).

Previously, between May 10 and June 7, REE’s Chairwoman, Ms. Nguyen Thi Mai Thanh, also purchased nearly 2.55 million shares, valued at over VND 163 billion.

Recently, there has been a notable change in REE’s leadership structure. Specifically, according to a resolution dated June 26, 2024, the REE Board of Directors accepted the resignation of Mr. Huynh Thanh Hai, effective July 1, 2024. His replacement is Mr. Le Nguyen Minh Quang, a doctoral degree holder in construction, who previously held no position at REE.

In terms of business performance, REE recorded revenue of over VND 1,800 billion in the first quarter of 2024, a 22% decrease compared to the same period last year. The infrastructure electricity and water segment, which contributes significantly to REE’s revenue structure, declined by 34% to over VND 1,000 billion. Net profit also decreased significantly by 36%, reaching nearly VND 481 billion.

According to REE’s explanation, the decline in electricity revenue was mainly due to the decrease in profits of member companies and associated companies in the hydropower group, including Vinh Son Song Hinh Hydropower Joint Stock Company, Thac Ba Hydropower Joint Stock Company, and Thac Mo Hydropower Joint Stock Company, which led to a reduction in REE’s profit.

| REE’s Business Performance |

Chau An