Novaland Group (stock code: NVL) has announced the completion of a restructuring agreement for a $299 million convertible bond offering with a 5.25% interest rate, maturing in 2026, convertible into common stock.

This international convertible bond offering by Novaland has received unanimous approval for restructuring and has been endorsed by the Singapore International Commercial Court (SICC) in late April this year.

As per the agreement, the payment due date is set for the bond’s maturity in June 2027, or an early buyback option may be exercised in the future. The outstanding principal amount (after interest capitalization) corresponding to the effective date of July 5th, as per the restructuring plan, will be $320,935,280.

The buyback value will be calculated at 115% of the principal amount (after conversion to shares) plus accrued interest and late interest. Late interest will be charged at a rate of 5.25% per annum.

The $300 million bond offering, raised in 2021, is listed on the Singapore Exchange (SGX).

Going forward, bondholders will have the option to convert their bonds into NVL shares at an initial conversion price of 40,000 VND per share (three times the closing price on July 5th), with a conversion ratio of 134,135 shares per bond.

Prior to this, after receiving approval from the SICC, Novaland had been working closely with relevant authorities to obtain the necessary approvals and confirmations for the completion of the previously agreed-upon procedures. The successful restructuring of this international bond offering demonstrates the bondholders’ confidence in Novaland’s recovery prospects.

This bond offering, raised in 2021, is listed on the Singapore Exchange (SGX) without collateral, and the original maturity date was in 2026. Each bond has a face value of $200,000, with an annual interest rate of 5.25% and a conversion right into shares at an initial price of 135,700 VND.

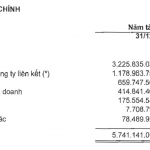

In late June, Novaland also received approval to extend the maturity of 8 out of 17 NVL2020 bond series, with a total issuance value of nearly VND 3,200 billion, extending the maturity to 60 months, i.e., maturing from June to August 2025.

At the 2024 Annual General Meeting, Mr. Bui Thanh Nhon, Chairman of the Board of Directors of Novaland Group, stated that the company has essentially completed the restructuring of its domestic and foreign debts and bonds, and its assets remain balanced with its liabilities.

“Moving forward, Novaland will continue to restructure its finances and resources, improve legal compliance, shift strategies, focus on its core business, streamline its organization, and embrace ESG action plans,” affirmed Mr. Nhon.

According to the Chairman, given the subdued economic environment, delayed legal reforms, and ongoing bank control over project cash flows, the Group lacks the resources to immediately fulfill its commitments to customers. This has caused significant damage and seriously affected the reputation and brand that Novaland has carefully cultivated for over 30 years.

“Currently, the Group’s revenue sources are limited. We must prioritize maintaining continuous operations and completing our projects, delivering products as committed. Out of a sense of responsibility and honor, Novaland pledges to do its utmost to promptly address any issues that arise. Our entire team has been working tirelessly to overcome countless challenges,” asserted Mr. Nhon.

For 2024, Novaland aims to achieve consolidated revenue of VND 32,587 billion and after-tax profits of VND 1,079 billion. The company plans to raise VND 16,000 billion in capital from financial institutions in 2024 to fund project development and business operations.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.

![[Infographic] A Mid-Year Review: Banking Sector Performance in 2025](https://xe.today/wp-content/uploads/2025/09/info-ngan-hang-quy-2-218x150.jpg)