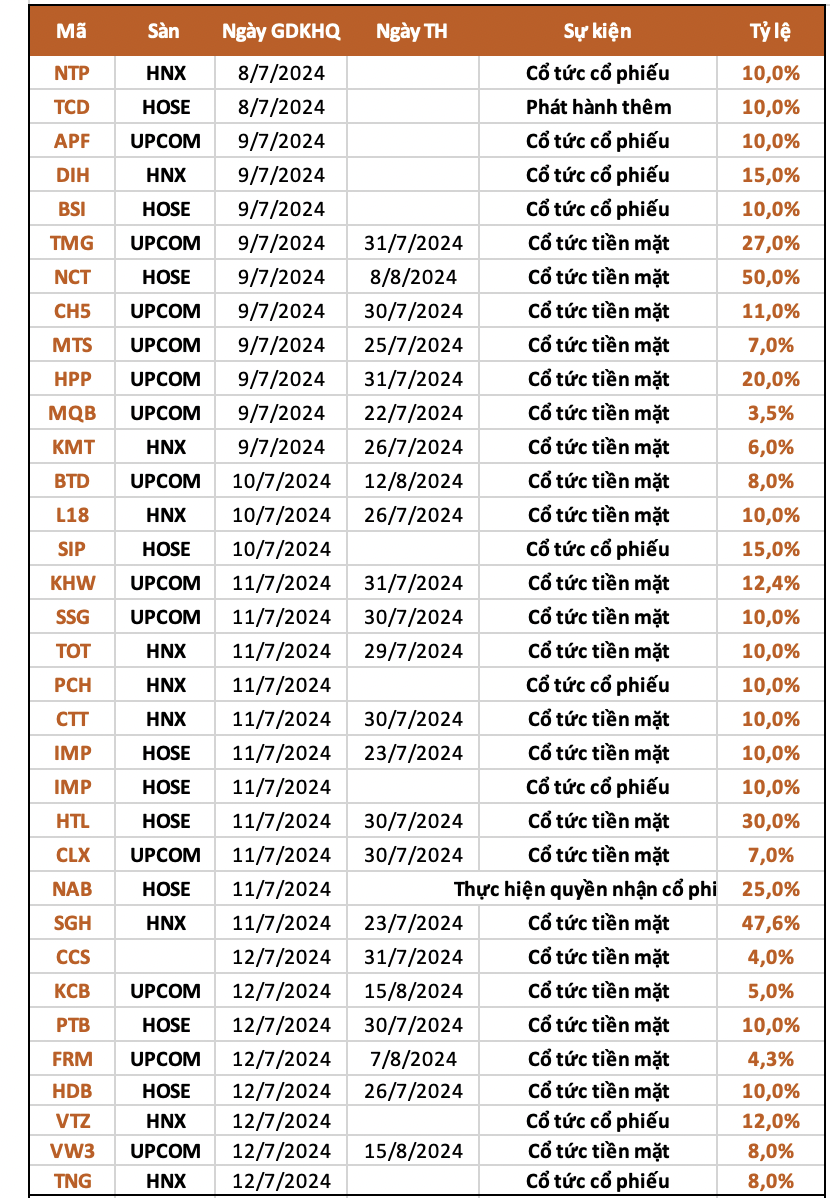

According to statistics, 33 companies announced dividend lock-in during the week of July 8–12. Of these, 21 companies paid cash dividends this week, with the highest rate at 50% and the lowest at 3.5%. In addition, this week, 9 companies paid stock dividends, 2 companies issued more, and 1 company paid a combination of dividends.

On July 10, Joint Stock Company for Noi Bai Cargo Services (NCT code) will close the right to receive the remaining 2023 dividend at a rate of 50% in cash (corresponding to VND 5,000 per share). The payment time is expected on August 8. With nearly 26.2 million shares circulating, NCT is expected to spend about VND 131 billion on this dividend payment.

Previously, in late December last year, NCT spent nearly VND 79 billion on an advance of the first dividend at a rate of 30%. Thus, including this dividend, NCT shareholders will receive a dividend for 2023 with a total rate of 80% equivalent to VND 8,000/share. The majority of dividends belong to Vietnam Airlines Corporation (HVN code).

As of March 31, 2024, Vietnam Airlines held a controlling stake of 55.13% in NCT and was expected to pocket about VND 72 billion in the upcoming dividend payment. In addition, this airline has 2 other major shareholders, America LLC fund with a rate of 10.7% and Joint Stock Company for Noi Bai Airport Services (Nasco – NAS code) with a rate of 6.98% capital.

On July 10, Hai Phong Paint Joint Stock Company (HPP code) will close the list of shareholders to pay cash dividends at a rate of 20%, corresponding to VND 2,000 per share for each share owned by shareholders.

With nearly 8 million circulating shares, HPP is expected to spend about VND 16 billion on dividend payments to shareholders. The expected payment time is July 31, 2024.

Previously, in December 2023, the company advanced the first 2024 dividend in cash to shareholders at a rate of 10%. Thus, with the completion of the new payment, the total dividend rate that HPP shareholders receive is 30%, as planned.

On July 12, Saigon Hotel Joint Stock Company (SGH code) will close the list of shareholders to receive the remaining dividend of previous years and 2023 in cash with a total rate of 47.6% (equivalent to VND 4,760 per share). This is also the highest cash dividend paid by the business so far. SGH is expected to pay dividends on July 23, 2024.

As of the end of 2023, after-tax profit undistributed profit reached more than VND 61 billion. With more than 12 million shares circulating, Saigon Hotel will have to spend nearly VND 60 billion on this record dividend payment, which means using almost all of the undistributed profit to distribute dividends.

On July 12, Truong Long Technical and Automobile Joint Stock Company (Hino Truong Long – HTL code) will close the list of shareholders to pay the second 2023 dividend at a rate of 30% in cash (VND 3,000 per share). With 12 million shares circulating, Hino Truong Long is expected to spend about VND 36 billion on this dividend payment. The payment time is expected on July 30.

Previously, in February this year, the company advanced the first 2023 dividend at a rate of 20% in cash. Thus, including this dividend, Hino Truong Long shareholders will receive a dividend for 2023 with a total rate of 50%. This is the highest dividend rate in the past 7 years since 2016 when the company distributed dividends at a rate of 60%. In recent years, the dividend rate has usually fluctuated in the range of 10-20%.

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank – HOSE: HDB) has just announced the 2023 cash dividend payment date of 10% on July 15, 2024, corresponding to the ex-dividend date of July 12, 2024. The expected cash dividend payment date is July 26, 2024. Shareholders on the list as of the record date will receive VND 1,000/share. With more than 2.9 billion shares circulating, HDBank is expected to spend more than VND 2,900 billion on cash dividend payments to shareholders.

Many businesses pay cash dividends immediately after Tet

After the Lunar New Year in 2024, many companies listed on the stock market will distribute dividends to investors. The banking sector stands out with its generous cash dividend payment.