Steel production at Southern Steel Company. (Photo: Xuan Quang/Vietnam+)

|

Vietnam’s domestic steel production is forecast to continue growing by 7-8% this year. This is a positive sign, but the rapid increase in imported goods from foreign countries is causing supply to far exceed demand.

Many opinions suggest that if there are no reasonable protective measures and timely support for the domestic steel industry, the local market will belong to foreign manufacturers.

Risk of Losing the Market

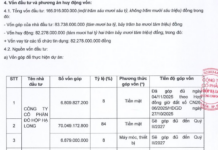

According to a report by the Vietnam Steel Association (VSA), the total production capacity of domestic steel enterprises has reached approximately 23 million tons of crude steel (billet and slab).

The production capacity of finished steel products, including construction steel, hot-rolled coils, cold-rolled coils, coated steel, and steel pipes, has reached about 38.6 million tons per year.

With the current recovery, steel production is expected to reach 30 million tons this year, a 7% increase compared to 2023. However, this recovery is uncertain, and steel companies still face many challenges.

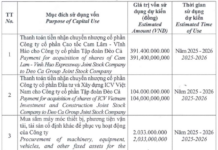

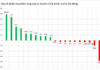

Mr. Nghiem Xuan Da, Chairman of VSA, said that steel production is currently in a situation of oversupply, and the increasing imports are making the competition in the domestic steel market more fierce. For example, according to the latest data from the customs agency, in April 2024, imports of hot-rolled steel (HRC) into Vietnam continued to rise, reaching 890,000 tons, 1.5 times the domestic production volume. Of this, 71% of hot-rolled steel imports came from China.

Cumulative imports of hot-rolled steel in the first four months of 2024 totaled 3.93 million tons, a 32% increase compared to the same period in 2023 and 159% of the total production volume of domestic HRC manufacturers.

Of this, imports from China accounted for 73% with 2.9 million tons, more than double the volume in the same period in 2023. This is the first time that Vietnam’s imports of HRC in one year have exceeded domestic production.

With such a large volume of imports, the Vietnam Steel Association said that the production of the two domestic hot-rolled steel manufacturers, Formosa and Hoa Phat, has declined, reaching only 73% of their designed capacity compared to 86% in 2021 due to unfair competition with imported products that are sold below production costs. In terms of price, import prices have fallen sharply from 613 USD at the beginning of 2023 to 541 USD at the end of 2023.

The increase in imports and low selling prices have caused the domestic market share of the two domestic HRC manufacturers to drop significantly from 45% in 2021 to 30% in 2023. It is expected that the continued surge in imports this year will affect the efforts to achieve self-sufficiency in high-quality steel production.

According to Mr. Phan Dang Tuat, Chairman of the Vietnam Supporting Industry Association, in the past, Vietnam could not produce hot-rolled steel because the investment required was too large, and the technology demanded was very high. But now, with investments from Formosa Ha Tinh and Hoa Phat, we are able to produce this product.

“When we couldn’t produce hot-rolled steel, it was natural to import it. But now that we can produce it and our product is highly competitive, this type of product is still pouring into the country in large quantities, especially recently, there are signs that it is being sold below production costs. This will affect domestic production and cause us to lose the market,” said Mr. Phan Dang Tuat.

Need for Protective Mechanisms

Although Vietnam’s steel production currently ranks 13th in the world and first in ASEAN, the steel industry still faces long-term bottlenecks.

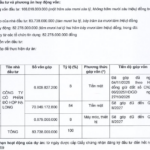

Vietnam continues to import rolled steel, accounting for over 50% of the total import turnover, mainly hot-rolled steel. In addition, Vietnam also imports shaped steel, some coated metal products, and color-coated steel, accounting for about 20-25% of domestic consumption.

Finished steel being transported to the warehouse for export to the market. (Photo: Tuan Anh/VNA)

|

Given this reality, the Vietnam Steel Association has proposed that relevant agencies continue to build and perfect the system of standards and technical regulations, quality management, and technical barriers to prevent steel products that do not meet technical standards for safety and environmental protection from entering the Vietnamese market.

The Ministry of Industry and Trade should promptly apply trade remedies to prevent unfair competition and protect domestic production.

The Ministry of Industry and Trade should also expedite the development and submission of the Strategy for the Development of the Vietnam Steel Industry until 2030, with a vision towards 2050, along with specific policies for the steel industry to grow green and sustainably.

In the meantime, until there is a steel industry development strategy, there should be measures to manage investments in large-scale steel projects to control the balance of supply and demand, prevent the waste of resources and land, protect the environment, reduce greenhouse gas emissions, and promote green production and consumption.

Recently, the Ministry of Finance also agreed with the Vietnam Steel Association’s opinion on the necessity of applying appropriate trade remedies to protect domestic manufacturing enterprises.

Accordingly, import and export taxes should be adjusted to increase gradually, with lower rates for raw materials and higher rates for more refined products, contributing to the creation of legal barriers to protect domestic manufacturing enterprises.

Dr. Nguyen Thi Thu Trang, Director of the WTO and Integration Center (VCCI), suggested establishing technical barriers in line with international standards to prevent low-quality imported goods. On the other hand, it is necessary to develop procedures and processes for inspecting the quality of steel imported into Vietnam. Accordingly, imported steel must have a certificate of conformity with Vietnamese quality standards.

Currently, the Ministry of Industry and Trade is developing and is expected to soon submit to the Prime Minister for approval the Strategy for the Development of the Vietnam Steel Industry until 2030, with a vision towards 2050.

The Ministry is also finalizing a draft to report to the Government to submit to the National Assembly for the issuance of the Law on the Development of Key Industries.

The long-term goal is to develop the steel industry into a national foundation industry, meeting domestic demand and increasing exports.

Regarding the issue of steel imports flooding the market, the Ministry of Industry and Trade has issued Decision No. 1535/QD-BCT on the investigation and application of anti-dumping measures for some coated steel products originating from China and the Republic of Korea.

Also, on June 14, 2024, the Ministry of Industry and Trade announced that it had received a full and valid request to investigate and apply anti-dumping measures for hot-rolled steel (HRC) products originating from India and China.

Duc Dung