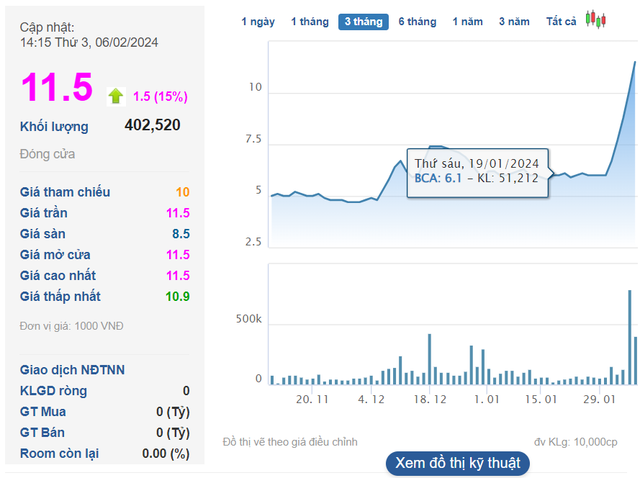

Ending the trading session on February 6, BCA shares of BCH JSC increased by the ceiling on the UPCoM floor (15%) reaching the price of 11,500 VND/share. The trading volume was at 402,520 units. This was the 5th consecutive session of limit-up for this stock. Consequently, the price of BCA has increased by nearly 92% in 5 sessions.

Previously, BCA had a breakthrough of 54% from December 6, 2023 to December 18, 2023. Then, the price cooled down to around 6,000 VND/share and stayed flat until the recent surge in 4 sessions.

BCA shares surged after the company’s leaders continuously had the “buying spree” but was unable to successfully implement it. First, Mr. Pham Ba Phu, Chairman of the Board of Directors, registered to buy 3 million shares, but only successfully traded 750,000 units from December 4, 2023 to January 3, 2024, increasing the ownership ratio to 9.09% of the capital.

Mr. Dang Ngoc Hung, Member of the Board of Directors and CEO, also registered to buy 1.2 million units from December 13, 2023 to January 5, 2024, but did not trade any shares. Both leaders explained that the reason was a change in their personal financial plan.

BCH JSC was established on March 10, 2004. The company has a charter capital of 190 billion VND and operates in various industries, with the main business being the production of steel billets, construction steel, scrap metal, coke, steel industry auxiliary products… However, at the end of 2023, the company had only 12 employees.

Currently, Mr. Pham Ba Phu, Chairman of BCH, is the largest shareholder of the company, holding 9.08% of the capital. The other three major shareholders of the company are Mr. Nguyen Duy Lan (8.87% of the capital), Ms. Le Thu Phuong – Chief Accountant (7.07% of the capital), and Mr. Dang Ngoc Hung – CEO (5.93% of the capital).

In the fourth quarter of 2023, the company recorded revenue of 1,358 billion VND, up 123% compared to the same period last year. However, the cost of goods sold increased more significantly at 125% to 1,356 billion VND, resulting in the company’s gross profit of only over 2 billion VND.

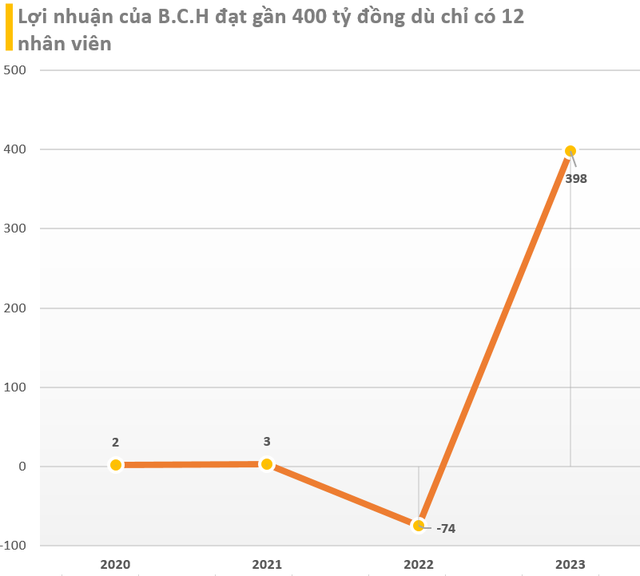

However, BCH reported a post-tax profit for the parent company of 397 billion VND, different from the loss of 74 billion VND in the same period last year. According to the explanation, this development came from receiving the transfer of shares to acquire the subsidiary company. Therefore, the fourth quarter of 2023 recorded other income from the profit from discounted transactions when consolidating the amount of 395 billion VND.

Accumulated for the whole year of 2023, the company recorded revenue of over 4,000 billion VND, post-tax profit of 398 billion VND, when the profit in the first 9 months was insignificant. This is also the record profit of this company.