According to the Q1/2024 report from YouNet ECI on the revenue of e-commerce platforms, while the total transaction value recorded on the top four platforms decreased by 16% compared to Q4/2023, TikTok Shop was the only one to experience a “reverse” trend among Shopee, Lazada, and TIKI. With a remarkable 15.5% growth rate and VND 18,360 billion in revenue, TikTok Shop continues to showcase its strength in Shoppertainment and its vast network of over 2.8 million online sellers. Techcombank has quickly seized this opportunity by introducing a comprehensive suite of benefits and privileges for small and medium-sized businesses and online sellers across multiple platforms in the “digital business revolution.”

Experience Smart Digital Banking and Convenient Advertising Payment

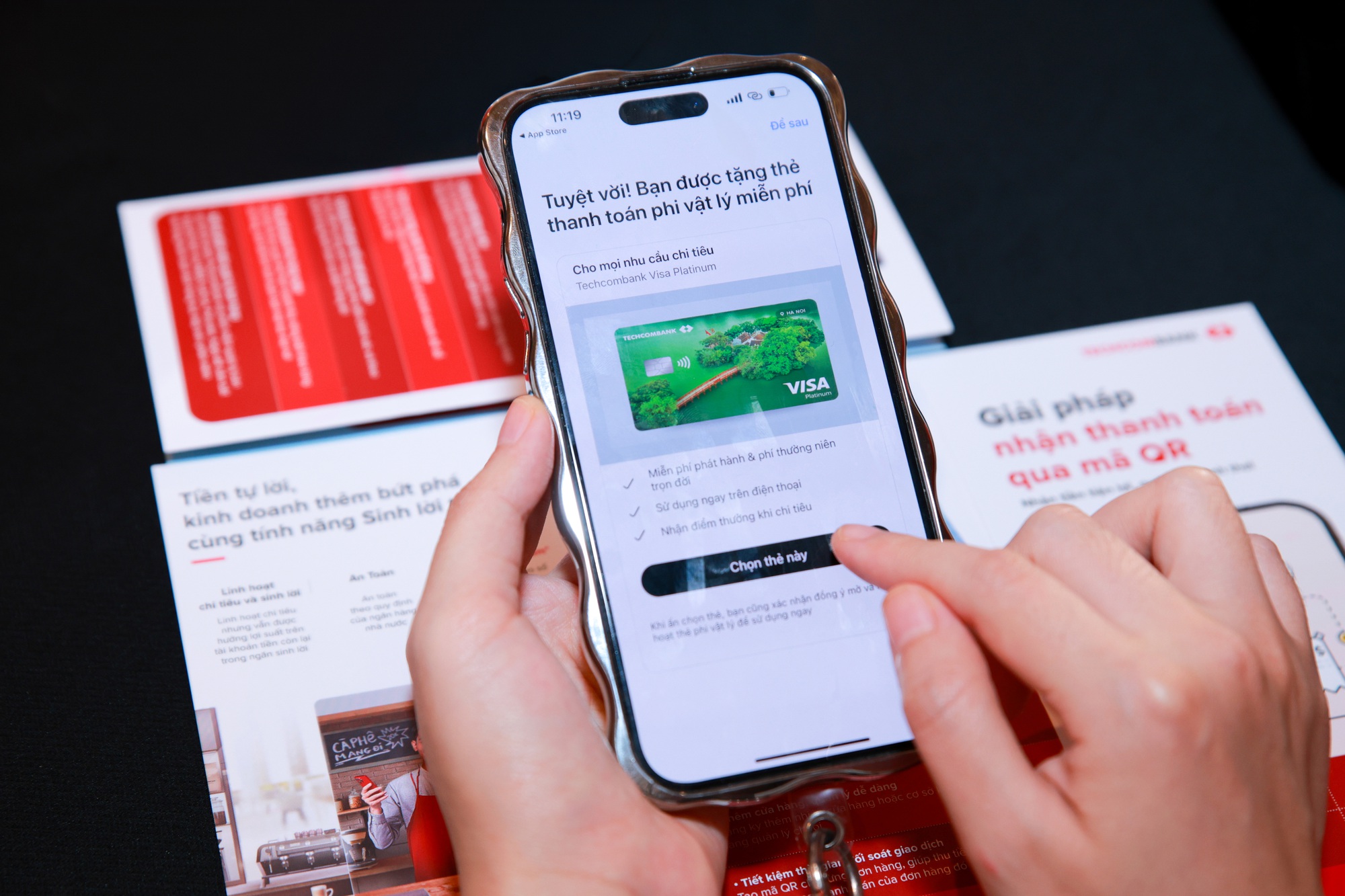

At the Vietnam SMB Summit 2024, hundreds of online sellers embarked on a journey to experience the full potential of Techcombank’s digital banking app, from a seamless and user-friendly account opening process to advanced e-banking features. Through electronic identification (eKYC) with a chip-enabled CCCD, sellers can instantly acquire and start enjoying the privileges offered by the “trio”: Payment Account, Virtual Payment Card, and QR Code for their online stores.

Mr. Ngo Anh Tuan (in black vest) – Senior Director of Payment Solutions and Unsecured Loan Development at Techcombank, sharing at the event

With a thoughtfully designed interface and smart feature linkages right on the home screen, sellers can easily access a wide range of services and utilities, from basic to advanced, on the Techcombank Mobile app. These include money transfers via account number, alias, phone number, or QR code scanning; account and card management; bill payments; financial overview and spending charts; and a smart financial assistant.

Sellers can start enjoying Techcombank’s optimal benefits in just a few minutes.

Ms. La Bich Phuong (Ho Chi Minh City, owner of a fashion shop on TikTok) shared her experience after using the app: “For someone in the online business like me, choosing a digital bank to partner with long-term is crucial for managing personal finances and sales revenue, as well as paying advertising fees. My first impression of Techcombank Mobile is its smoothness and detailed step-by-step guidance. The interface is well-organized, making it easy to explore and quickly grasp various features and services, from basic to advanced.”

Ms. Phuong also added, “With the virtual payment card offered during registration, I can activate and link my card spending directly on the TikTok advertising platform. Techcombank also introduced me to a cashback offer of up to VND 1 million on advertising spending through the card.”

Relaxed Management and Automatic Profit

Understanding the needs of online sellers to simplify their time, optimize processes, and manage revenue and advertising costs effectively, Techcombank has configured suitable utilities into the QR Code for shops, such as revenue statistics charts and transaction history accessible through the code. The bank has also introduced a revenue reward program for sellers and a Techcombank Rewards points program for buyers to strengthen their relationship.

Customers experiencing Techcombank’s products at the event booth

Additionally, sellers can instantly upgrade their payment accounts with Automatic Profit, allowing them to maximize safe profits daily by utilizing all idle funds, such as bill payments, inventory purchases, or even their sales revenue. Techcombank also offers two unsecured loan options, ShopCash and MyCash, to provide capital support for sellers with or without a business registration.

Sharing at the event, Mr. Ngo Anh Tuan, Senior Director of Payment Solutions and Unsecured Loan Development at Techcombank, stated, “With smart tools to help manage revenue and optimize profits, along with flexible credit support, we aim to give online sellers peace of mind to focus on product development, content creation, and effective customer attraction strategies.”

Mr. Tuan also emphasized that by leveraging technology and understanding the benefits of advertising platforms and digital banking, online sellers can unlock the key to breakthrough revenue growth.

Understanding the needs and challenges of online sellers in the digital business era, Techcombank is committed to promoting a comprehensive suite of benefits and privileges for small and medium-sized businesses and online sellers on platforms like TikTok and Facebook.

For more information and to open a new payment account with Techcombank for online sellers, click here.

PVcomBank receives two consecutive international awards from IFM

Last weekend, during the awards ceremony held in Thailand, the International Finance Magazine (IFM) honored PVcomBank as the “Best Digital Banking Platform for SME’s – VN 2023” and the “Most Innovative Corporate Bank Strategy – VN 2023”.