The banking stock group soared in the afternoon session, led by BID and TCB, creating a very positive spillover effect. The breadth of the HoSE floor tilted strongly towards gainers, pushing the VN-Index above its 20-day moving average and marking its third consecutive gaining session.

The index rose slightly in the morning session, gaining just 1.5 points (+0.12%). However, by the close of the afternoon session, it had climbed 7.06 points (+0.56%). The breadth improved from 170 gainers and 176 losers in the morning to 242 gainers and 161 losers in the afternoon. The number of stocks that reversed course and ended in positive territory indicated a broad-based rally.

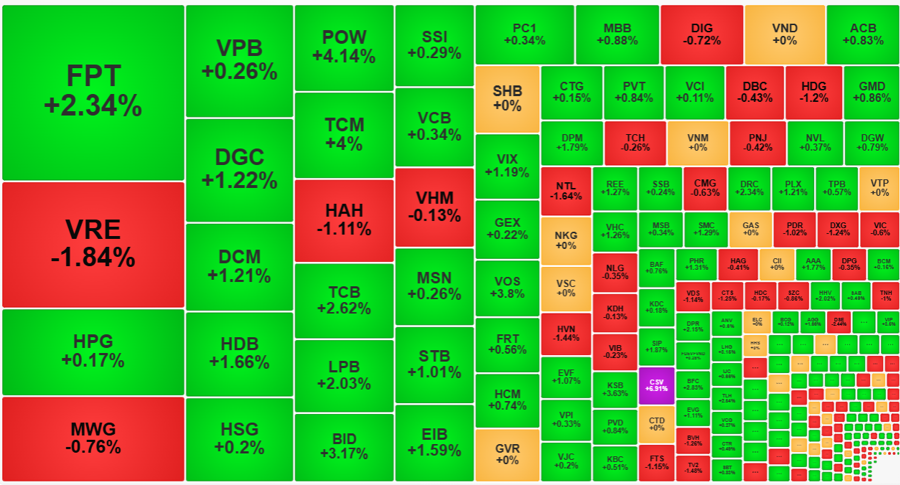

Blue-chips continued to lead the charge in the afternoon, with FPT, the strongest performer in the morning, losing some steam. After a brief rally in the afternoon, peaking around 2 pm with a 3.75% gain over the reference price (up 2.89% at the morning close), it faced selling pressure and ended the day up 2.34%.

Other stocks stepped up to take FPT’s place, with BID and TCB leading the afternoon rally. Both stocks were relatively weak at the end of the morning session, up only 0.33% and 0.87%, respectively. However, starting around 1:15 pm, they witnessed a surge in buying interest, with prices climbing rapidly. BID closed up 3.17% from the reference price, gaining an impressive 2.83% in the afternoon alone. TCB ended the day up 2.62%, equivalent to a 1.73% gain. BID overtook FPT as the top contributor to the VN-Index, with TCB coming in third. These three stocks alone accounted for 4.2 points of the index’s 7.06-point gain.

The majority of stocks in the VN30 basket strengthened in the afternoon session, with only a few exceptions. VIC slipped 0.12% from the morning session, closing down 0.6% from the reference price. HPG fell 0.35% but still managed to stay in positive territory, up 0.17%. GVR lost 0.14%, falling back to the reference price, while FPT also gave back some gains. The declines in these stocks were relatively modest, while 23 other stocks in the basket advanced. Even VHM, VRE, MWG, and VIB, despite closing below the reference price, showed signs of improvement from the morning session.

The afternoon session saw an improvement in trading volume for the VN30 group, with a total turnover of nearly VND3,747 billion, a 45% increase from the morning session. Profit-taking pressure increased in some declining stocks, such as FPT, which traded an additional VND499.6 billion, and HPG, which traded an additional VND379.5 billion. However, the majority of stocks in the basket saw improved prices and liquidity. For example, BID traded actively with a volume of VND167.2 billion, bringing its daily turnover to VND214.6 billion. TCB also attracted strong buying interest in the afternoon, trading VND178.8 billion worth of shares and ranking among the most liquid stocks in the basket. Nevertheless, the VN30 group’s overall trading volume increased by only about 3% compared to the previous day.

Small-cap stocks outperformed their larger counterparts in terms of liquidity. While the VNSmallcap index closed up only 0.37%, its trading volume surged 37% from the previous day to nearly VND1,816 billion. The Midcap index also saw a nearly 7% increase in liquidity, with its index climbing 0.56%. Although these indices trailed the VN30-Index, which gained 0.73%, the HoSE floor saw 77 stocks rise over 1%, with only 7 of them from the VN30 basket. DGC, DCM, TCM, LPB, EIB, VIX, and VOS all traded in the hundreds of billions of VND and posted solid gains. Smaller-liquidity stocks like DRC, KSB, CSV, DPR, BFC, HHV, LHG, and TLH even rallied over 2%. Stocks with a turnover of more than 1% on the HoSE floor today accounted for 36.7% of the floor’s total trading value.