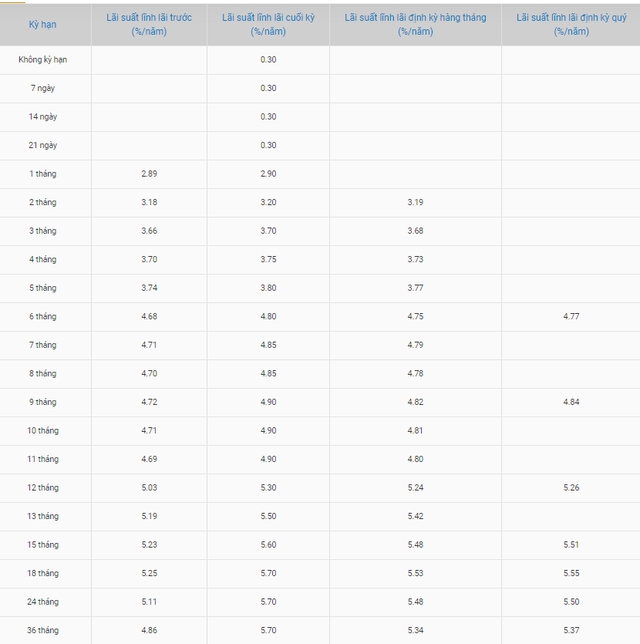

The latest BaoViet Bank savings interest rates came into effect on July 8th. According to the new online savings interest rate table published by BaoViet Bank, interest rates for 1-5 month terms have been adjusted, increasing by 0.1% per year.

Specifically, the interest rate for a 1-month term is now 3.1% per year, 2-month term is 3.5%, 3-month term is 3.9%, 4-month term is 3.95%, and the 5-month term stands at 4% per year.

For terms of 6-11 months, BaoViet Bank has increased rates by 0.2% per year. As a result, the 6-month term interest rate has increased to 5.1% per year, the 7-8 month terms have risen to 5.15%, and the 9-11 month terms sit at 5.2%.

In the case of 12-13 month terms, savings interest rates have increased by 0.1% per year. The 12-month term now offers a rate of 5.6% per year, while the 13-month term stands at 5.7%. Meanwhile, interest rates for longer terms of 18-36 months remain unchanged at 5.9% per year, which is also the highest interest rate offered by BaoViet Bank and currently leads the market.

The latest savings interest rate table at BaoViet Bank.

BaoViet Bank has not made any adjustments to the savings interest rates for corporate customers.

Should I deposit or not deposit for a term less than 3 months?

More and more customers are considering sending short-term savings of less than 3 months, so is this a suitable choice?