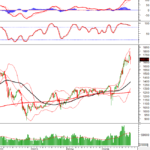

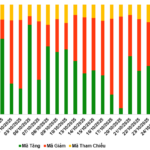

The market closed the first trading week of July with a dominant recovery trend. However, the liquidity decline indicated investors’ caution in opening new positions. At the week’s close, the VN-Index stood at 1,283 points, a gain of 37.72 points (+3.03%) from the previous week.

Following the upward momentum, the banking sector’s leading stocks witnessed positive trades, including BID (+9.36%), VCB (+3.29%), LPB (+14.18%), VPB (+2.68%), and SHB (+3.07%) …

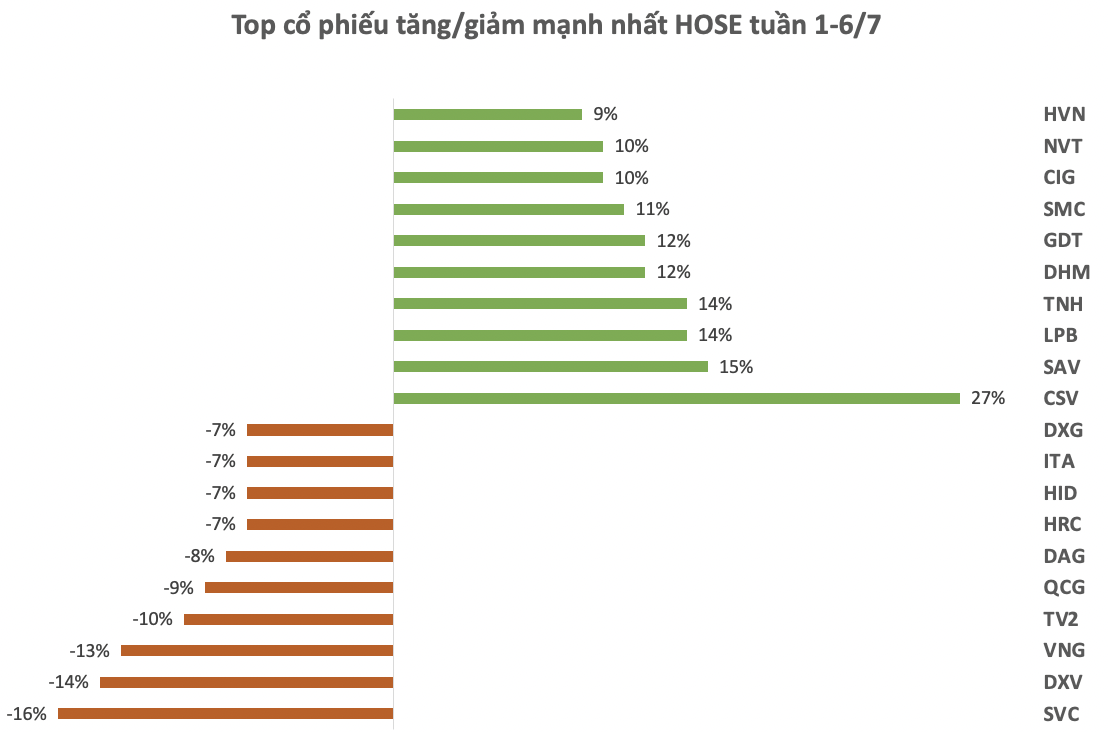

On the HOSE, CSV of Southern Basic Chemicals JSC topped the list of stocks with the strongest gains, recording three consecutive sessions of surging to the maximum allowed limit. CSV’s market price soared 27% week-over-week to reach a historical peak of VND33,650 per share. Trading activities on CSV were also vibrant, with millions of matched orders.

This positive performance came immediately after the “rolling deadline” for dividend payout. July 2 was the ex-dividend date for CSV shareholders to receive a 2023 cash dividend at a rate of 25% (1 share receives VND2,500), to be paid in two installments. In the first installment, shareholders will receive a 10% dividend, expected to be implemented by July 16. The remaining dividend will be paid at a rate of 15%, with a projected timeline of October 7.

Additionally, CSV plans to issue over 66 million shares at a ratio of 100:150 (shareholders owning 100 shares will receive 150 new shares). Following this issuance, CSV’s charter capital will increase from VND442 billion to VND1,105 billion.

HVN, the stock of Vietnam Airlines, also drew attention with a 9% weekly surge, coupled with impressive liquidity amid a lackluster broader market, witnessing millions of shares traded.

A notable development regarding HVN was the National Assembly’s approval for Vietnam Airlines to postpone debt repayment on a refinancing loan. Accordingly, the State Bank of Vietnam automatically extended the debt repayment deadline three times for Vietnam Airlines’ VND4,000 billion loan to address immediate challenges. Each extension period matches the initial refinancing duration, and the total maximum extension period for refinancing is five years.

Contrarily, SVC, DXV, VNG, TC2, and QCG faced profit-taking pressure, resulting in declines ranging from 9% to 16% this week.

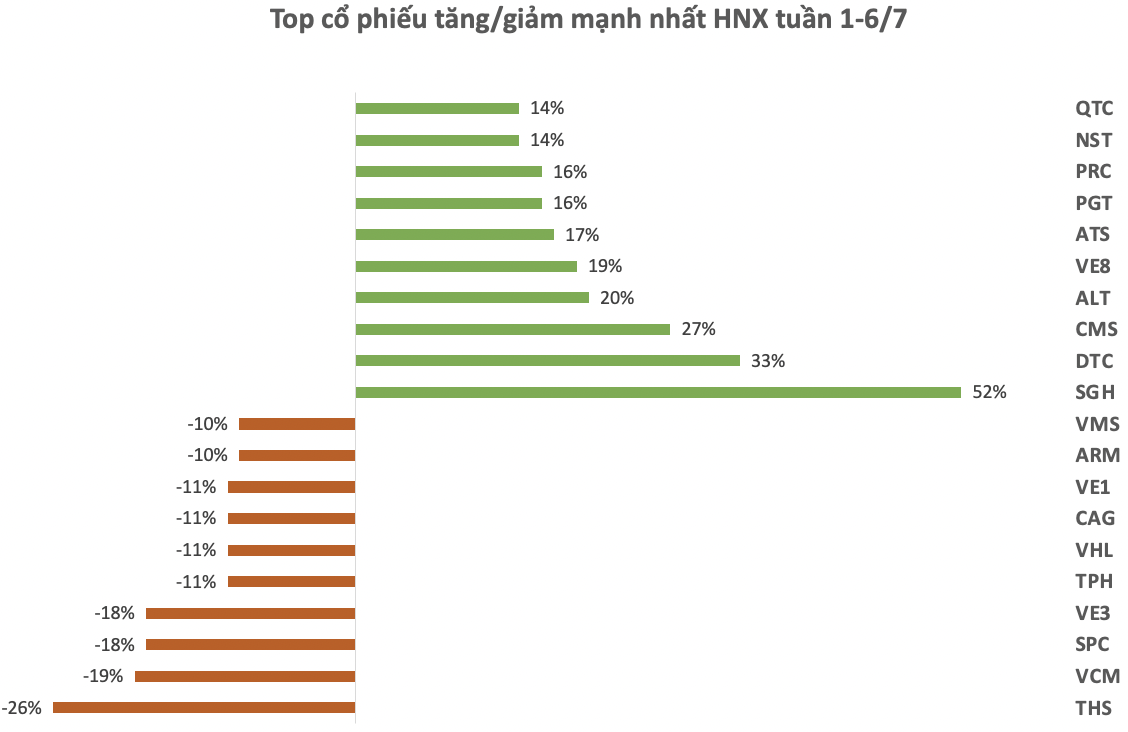

On the HNX, the gainers were mostly small-cap stocks with low liquidity, such as SGH, DTC, CMS, and ALT…

On the downside, THS encountered profit-taking pressure, declining by 26% during the week.

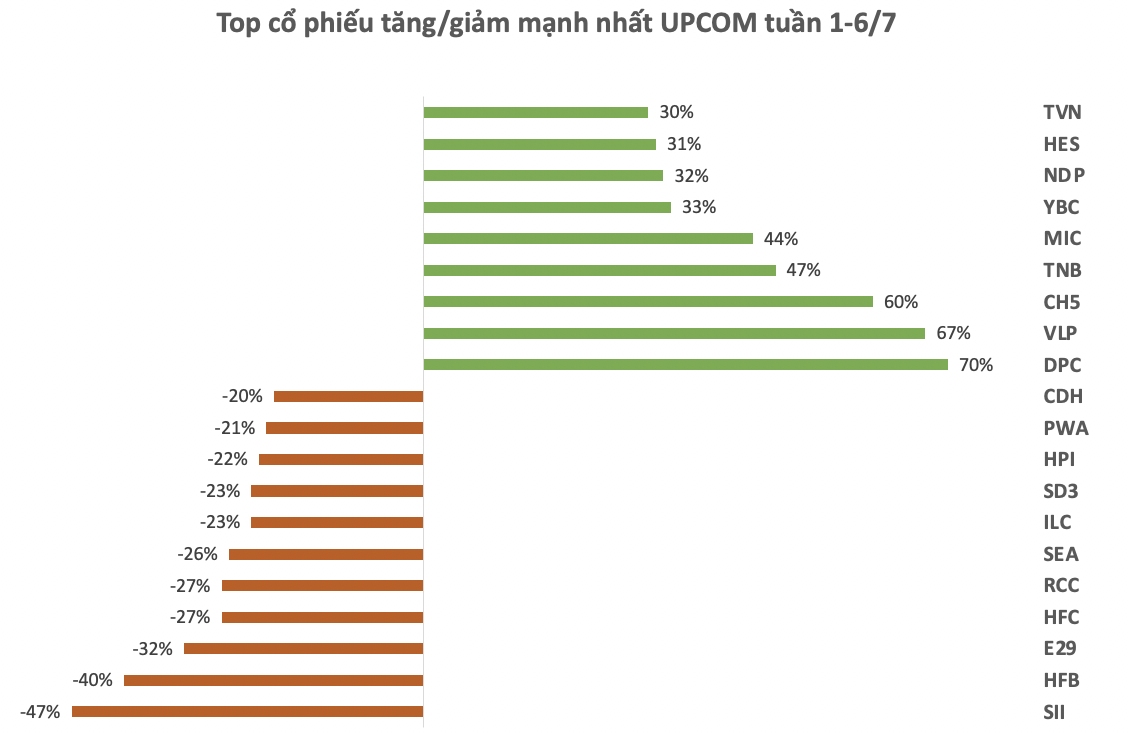

On UPCOM, DPC led the pack with a staggering 70% weekly gain. However, trading activities remained subdued, with only a few hundred shares traded per session.

In contrast, numerous stocks on UPCOM recorded weekly losses ranging from 20% to 47%.

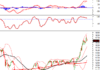

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.