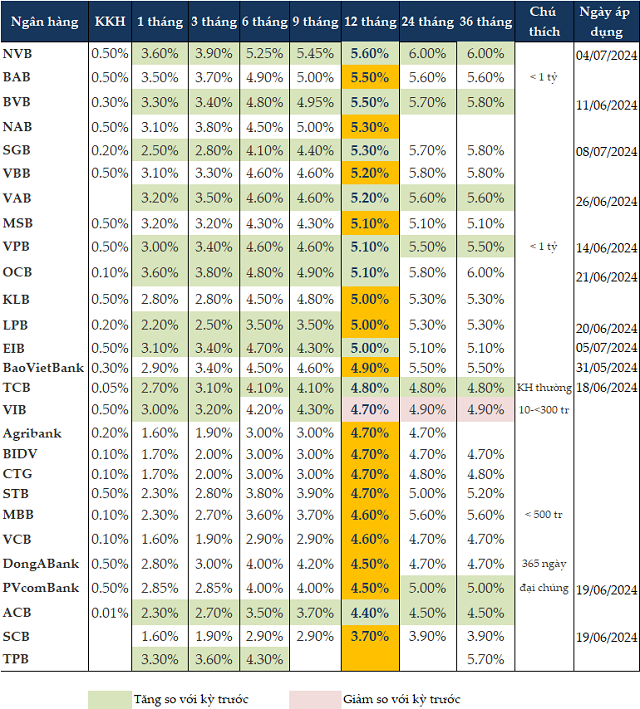

As of early July, a series of banks continued to raise deposit interest rates for all terms, including NVB, BVB, SGB, VPB, OCB, EIB, and TCB. From July 4, 2024, NVB increased interest rates on all term deposits by 0.2-0.5 percentage points. Specifically, the interest rate for the 1-month term increased by 0.3 percentage points to 3.6% per annum, the 3-month term increased by 0.3 percentage points to 3.9% per annum, the 6-month term increased by 0.5 percentage points to 5.25% per annum, and the 12-month term increased by 0.3 percentage points to 5.6% per annum.

VPB increased interest rates on all term deposits by 0.2-0.3 percentage points from June 14. The interest rate for the 1-month term deposit increased to 3% per annum, the 3-month term increased to 3.4% per annum, the 6-9 month term increased to 4.6% per annum, the 12-month term increased to 5.1% per annum, and over 12 months was 5.5% per annum.

Similarly, from June 21, 2024, OCB raised interest rates on term deposits of 12 months or less by 0.3-0.7 percentage points. The interest rate for the 1-month term deposit increased to 3.6% per annum, the 3-month term increased to 3.8% per annum, the 6-month term applied 4.8% per annum, and the 12-month term was 5.1% per annum.

While most private banks have raised deposit interest rates, state-owned banks, including Agribank, Vietcombank, VietinBank, and BIDV, have maintained their old interest rates. Interest rates for 1-month term deposits range from 1.6-1.7% per annum, 3-month term deposits from 1-9-2% per annum, 6-9 month term deposits are 3% per annum, and term deposits of 12 months or more range from 4.6-4.8% per annum.

As of July 8, 2024, interest rates on savings deposits for 1-3 months were maintained by banks in the range of 1.6-3.9% per annum, 6-9 month term deposits in the range of 2.9-5.45% per annum, and 12-month term deposits in the range of 3.7-5.6% per annum.

For the 12-month term, NVB offers the highest deposit interest rate at 5.6% per annum, followed by BAB and BVB at 5.5% per annum.

For the 6-month term, BVB still offers the highest interest rate at 5.25% per annum, followed by BAB at 4.9% per annum.

For the 3-month term, NVB currently offers the highest interest rate at 3.9% per annum, followed by OCB and NAB at 3.8% per annum.

|

Deposit interest rates at banks as of July 8, 2024

|

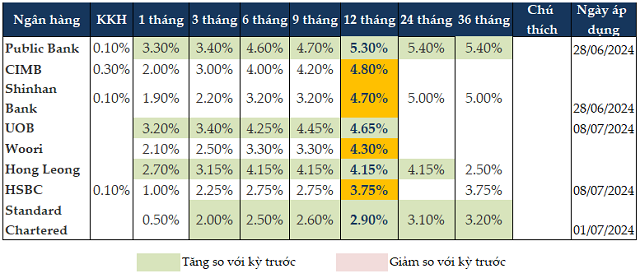

Foreign banks have also started to raise interest rates again. As of July 8, 2024, for the 12-month term, Public Bank offers the highest interest rate at 5.3% per annum. For the 6-month term, Public Bank still has the highest interest rate at 4.6% per annum after the increase.

|

Deposit interest rates at foreign banks as of July 8, 2024

|

As deposit interest rates increase, lending rates see a slight decrease. PGS.TS Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City (UEH), predicts that pressure on exchange rates and inflation will create pressure on interest rates, as evidenced by the fact that commercial banks have also started to raise deposit interest rates. This trend will continue until the end of the year.

Lending rates will also increase, but with a delay. Banks depend on the average inflow of capital to determine the outflow. Currently, cheap capital is still available as depositors for 3-month and 6-month terms still receive low-interest rates. Thus, banks still have room for cheap capital, but when this cheap capital passes and turns into expensive capital, banks will have to increase lending rates. However, as credit growth is low, lending rate increases will not be too high.

PGS.TS Dinh Trong Thinh, an economic expert, believes that the State Bank has recently requested commercial banks to minimize costs so that they can cut lending rates by 1-2%. This is something that banks are striving to achieve, but it is also a challenging task, as banks have already cut costs significantly over the past two years. Mr. Thinh predicts that lending rates in the latter half of the year will remain stable.

Ms. Bui Thi Thao Ly, Director of Analysis at Shinhan Securities Vietnam (SSV), forecasts that the State Bank will maintain a stable interest rate environment in the second half of the year, with the operating rate remaining at 3.5-4.5%. In an environment of slightly increasing deposit interest rates, Ms. Ly expects lending rates to drop slightly by 0.5% or stabilize as they are now to stimulate credit growth, as there is significant growth pressure in the latter half of the year.

However, if banks can reduce costs, streamline procedures, and apply digitization to lending activities, lending rates could be adjusted downward by 0.5-1% in the latter half of 2024. Compared to the end of 2023, the average lending rate in the market has decreased by about 1%.

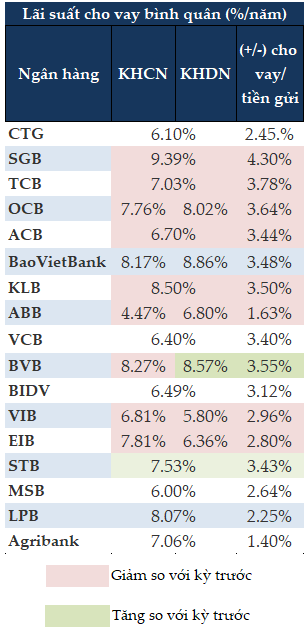

Following the trend of reducing lending rates, SGB has lowered its average lending rate to 9.39% per annum. The interest rate differential between lending and deposit rates averaged only 4.3% per annum. TCB also reduced its average lending rate to 7.03% per annum, with a differential of 3.78%.

At OCB, the average lending rate applied to individual customers (KHCN) is 7.76% per annum, and the rate applied to corporate customers (KHDN) is 7.8.02% per annum. The differential between lending and deposit rates is 3.64% per annum.

|

Average lending rates at banks

|

[Cát Lam]

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.