Cen Academy, a subsidiary of Cen Land, recently held a launch event for its Japan program and signed a strategic partnership agreement at the Daewoo Hotel. This marks CenLand Academy’s entry into Japan in the field of manpower supply.

Cen Academy, a subsidiary of Century Real Estate Joint Stock Company (Cen Land, stock code CRE) with a 56% ownership stake, operates in the field of education and training and was established in 2021 with a charter capital of 3 billion VND.

Shark Pham Thanh Hung, Vice Chairman of CenLand and Chairman of Cen Academy, shared: “After more than a year of expanding our business into the field of training and overseas employment, especially in European markets such as Germany and the UK, Cen Academy has now expanded into the Asian market, specifically Japan.”

In Japan, CenLand has also established Cen Japan, which operates under an outsourcing model (personnel management…) and focuses on industries with labor shortages such as logistics, hospitality, repair, mechanics, and nursing.

This move can be seen as a bold step by Cen and CenLand in the fields of human resources and study abroad, especially as their core business of real estate is facing significant challenges.

At the recent annual general meeting, the management revealed that this year’s profit from the study abroad segment could reach only around 10% due to its recent inception (starting from June 2023). However, CenLand remains optimistic about this segment, aiming for a doubling of profits to reach approximately 20% in the coming years.

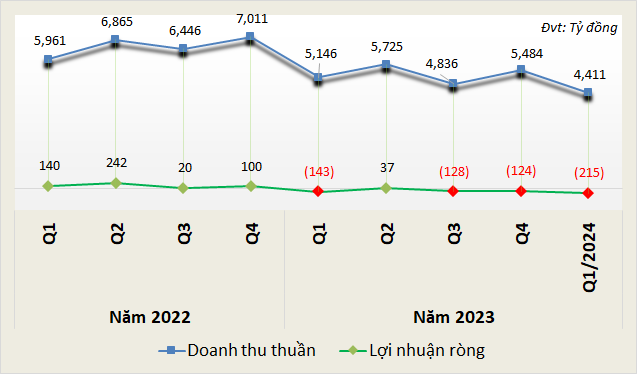

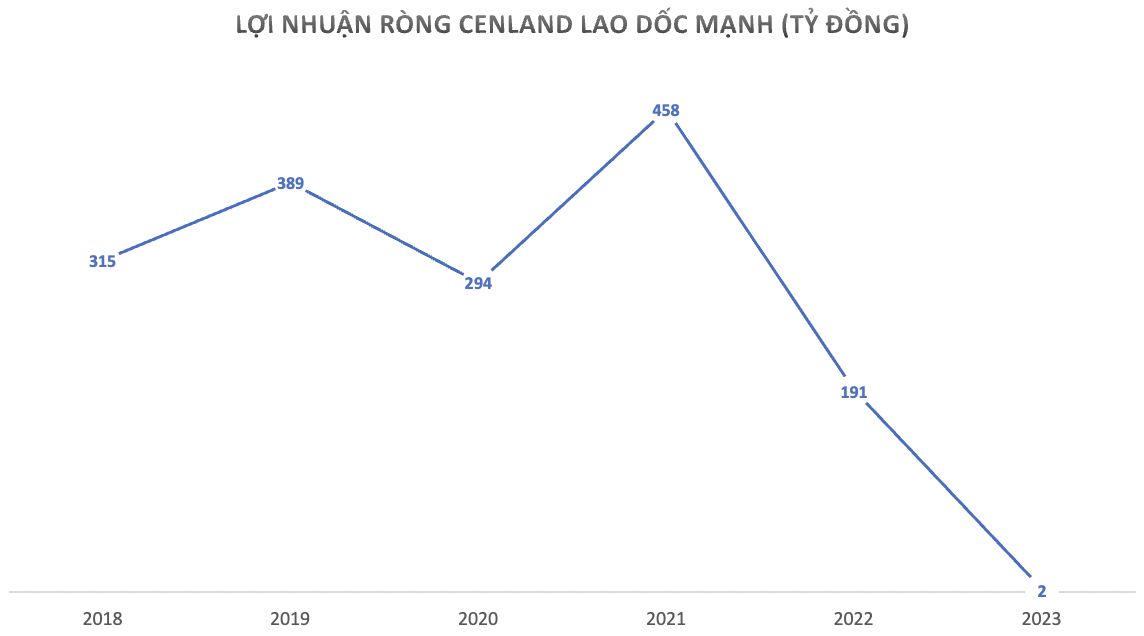

As for CenLand, challenges in the real estate market have led to a significant decline. In 2023, CenLand’s profit stood at a meager 2 billion VND, a far cry from its peak of nearly 500 billion VND in previous years.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.