The stock market is experiencing a boom, and small to medium-sized capitalization stocks are also making significant strides. A notable example is the case of Vitaco Petroleum Transport Joint Stock Company (VTO). This stock has just had its second consecutive session of reaching the ceiling, surging to a new all-time high of VND 14,400 per share. Since the beginning of the year, the share price has increased by over 60%, resulting in a market capitalization of VND 1,150 billion.

The upward momentum of the stock is partly supported by the information on cash dividends. In June, Vitaco disbursed nearly VND 64 billion in cash dividends for the year 2023, with a payout ratio of 8% in cash according to the list locked on June 3.

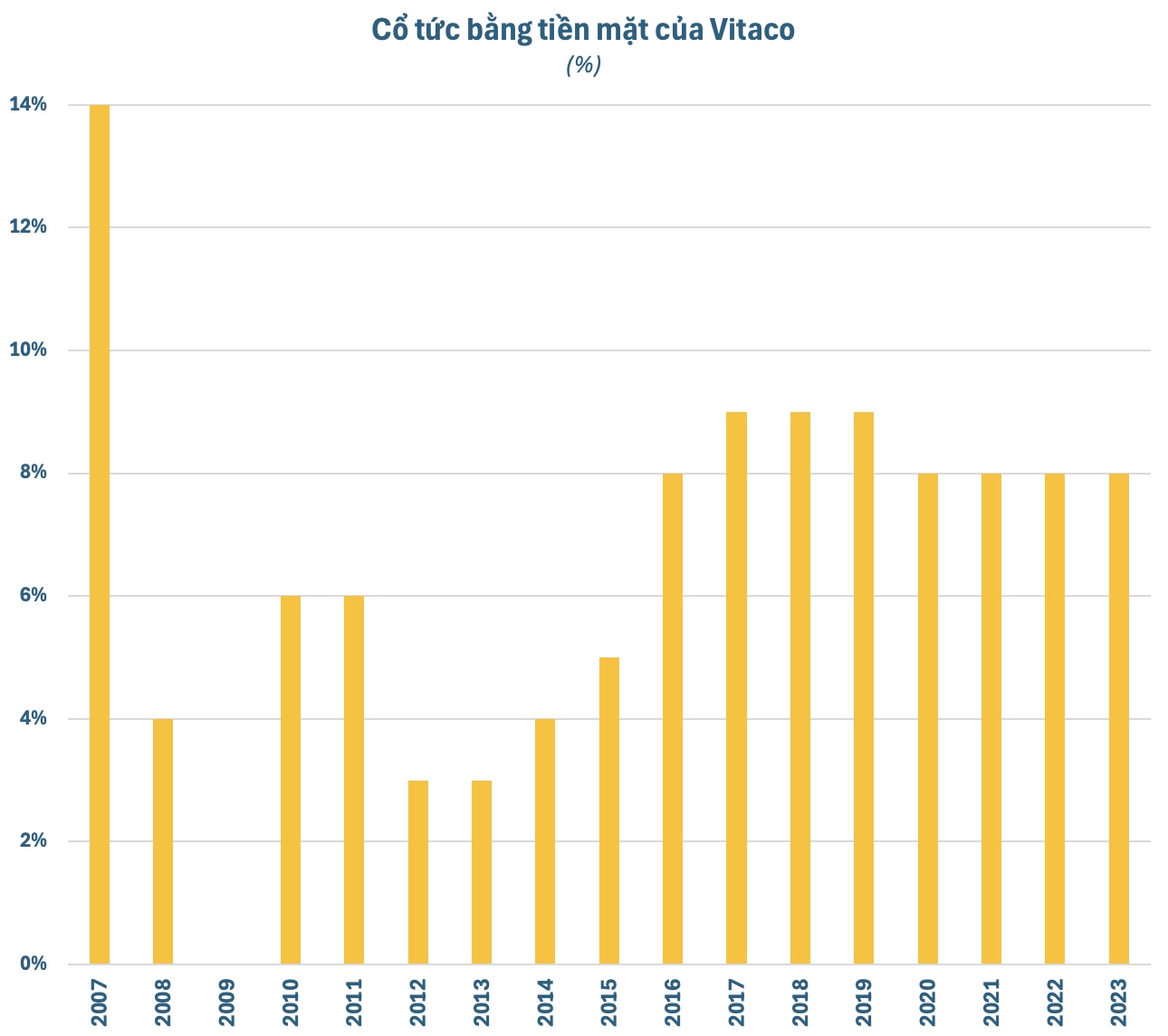

In reality, Vitaco has a tradition of consistently paying cash dividends to its shareholders annually. Since its listing in 2007, the company has only skipped paying cash dividends once in 2009. Instead, they offered a share sale with a ratio of 3:1 at a price of VND 10,000 per share. From 2016 onwards, the dividend payout ratio has often fluctuated around 8-9%.

Vitaco was initially a state-owned enterprise established under Decision No. 2585/QD/BTM dated October 27, 2005, of the Minister of Trade (now the Minister of Industry and Trade) by transforming from Vitaco Petroleum Transport Company Limited to Vitaco Petroleum Transport Joint Stock Company. The company officially commenced operations in early February 2006. Vitaco currently has a charter capital of nearly VND 800 billion, of which the Waterway Transport Petroleum Corporation – Petrolimex One Member Limited Company, as the parent company, holds 52% of the shares.

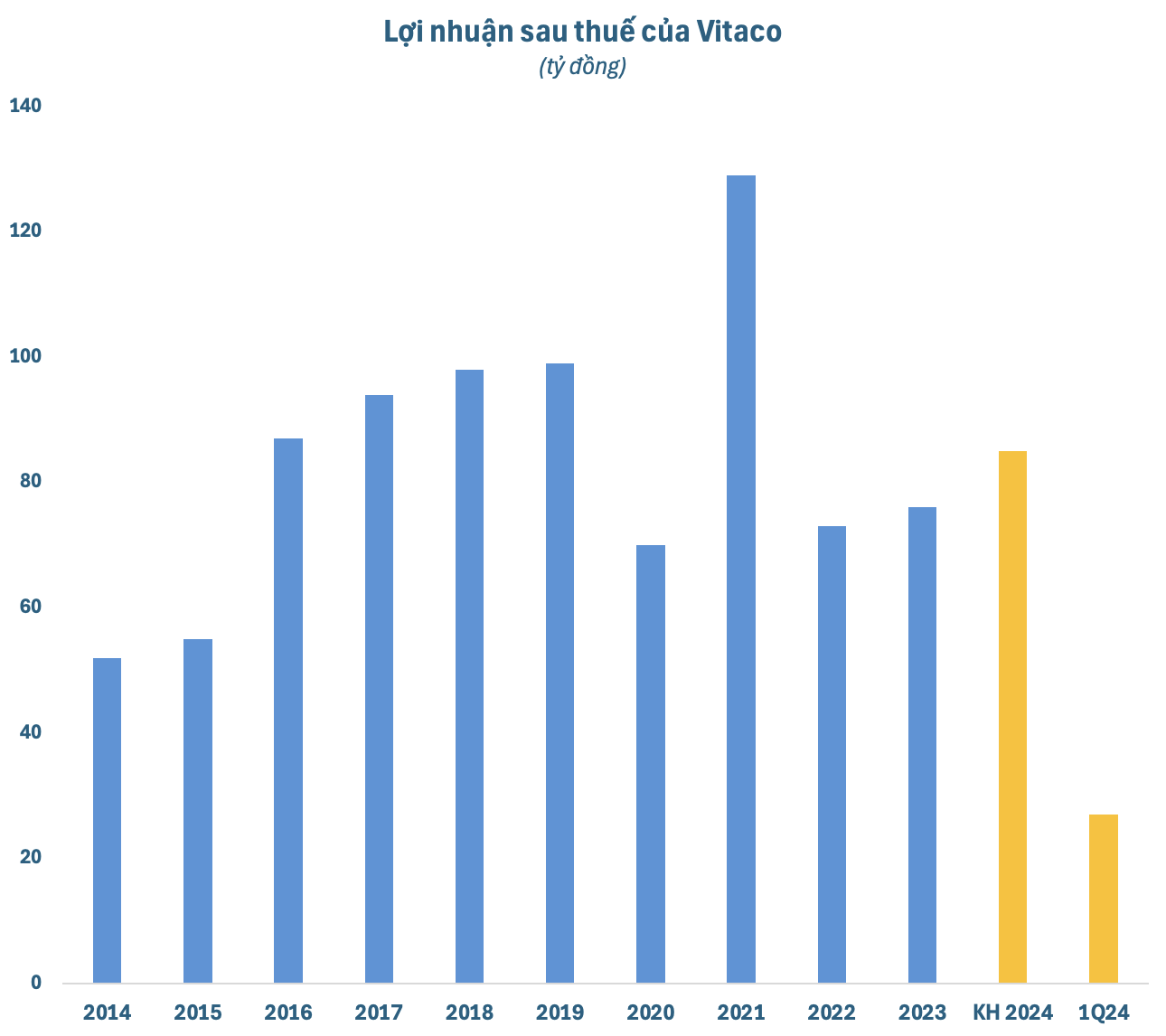

With its primary business being petroleum transportation, Vitaco’s financial performance has been quite erratic in recent years. After soaring to a record high of VND 129 billion in 2021, the company’s after-tax profit plummeted to below VND 90 billion in 2022-23, lower than the pre-pandemic period of 2016-2019.

In 2024, Vitaco set ambitious business targets, aiming for total revenue and income of nearly VND 1,000 billion. However, the projected after-tax profit is only around VND 85 billion, a modest increase of nearly 12% over the previous year but significantly lower than the record high previously achieved. The company strives for a minimum dividend payout ratio of 9%.

Vitaco’s management acknowledges that 2024 is a year full of complexities and uncertainties. Global economic, trade, and investment growth continue to slow down despite interest rate cuts by central banks. The petroleum market and oil price movements are also highly unpredictable in 2024 due to direct influences from economic, geopolitical factors, and OPEC+ export volumes.

Speaking at the 2024 Annual General Meeting of Shareholders, Mr. Nguyen Anh Dung, representing the Vietnam National Petroleum Group (Petrolimex) and the Waterway Transport Petroleum Corporation, as a major shareholder, expressed his desire for Vitaco to surpass its business plan and target a double-digit dividend payout ratio of at least 10% for 2024.

In the first quarter of the year, Vitaco recorded net revenue of VND 268 billion, a slight decrease of 3% compared to the same period in 2023. After deducting the cost of goods sold and expenses, the company’s net profit doubled to VND 27.5 billion compared to the first quarter of 2023. With these results, Vitaco has accomplished one-third of its full-year after-tax profit target.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.