The WTC Gateway complex is set to be a prominent commercial hub in the new Binh Duong city project, spanning an impressive 168,000 sqm. This mixed-use development will encompass a wide range of facilities, including a shopping mall, sports venues, and cultural and artistic spaces. Slated for inauguration in Q1 2024, it will serve as the central Metro station for the new city, attracting investment, business opportunities, technology, talented professionals, and experts from both domestic and international spheres.

WTC Gateway aims to entice a diverse range of retailers, F&B outlets, and entertainment providers, thereby enhancing the lifestyle offerings for residents while fostering a competitive business environment for local enterprises. With its comprehensive array of amenities and strategic location, the complex is expected to play a pivotal role in driving economic growth and attracting foreign investment to the region.

Currently, Vietnam’s largest luxury shopping mall, Royal City, boasts a total floor area of 230,000 sqm. Royal City was also the first shopping mall in Vietnam to adopt the international Mega Mall model, setting a precedent for modern retail destinations in the country.

Artist’s impression of the WTC Gateway project.

The WTC Gateway complex is being developed by Becamex IDC, a prominent company listed on the stock exchange under the ticker symbol BCM. Becamex IDC is renowned for its extensive involvement in the industrial sector of Binh Duong province and is also Vietnam’s leading infrastructure developer. The company is closely affiliated with the Binh Duong provincial government, with the provincial People’s Committee holding a 95.44% stake in the business.

With seven operational industrial parks spanning over 4,700 hectares, Becamex IDC is the largest industrial park investor in Binh Duong province, capturing more than 30% of the provincial market share. On a national level, the company ranks third, accounting for 3.6% of the country’s total market share.

Additionally, Becamex IDC has established a joint venture with a Singaporean company, resulting in the formation of the Vietnam-Singapore Industrial Park (VSIP). Becamex IDC holds a 49% stake in this venture. VSIP is a leading integrated industrial park and urban developer in Vietnam, with 12 projects spanning over 10,000 hectares across the country.

A VSIP industrial park, a successful collaboration between Vietnam and Singapore.

Over its nearly 50-year history, Becamex IDC has expanded its reach into various industries through its 23 subsidiary companies. These subsidiaries operate in fields such as industrial parks, construction, commerce, real estate, services, telecommunications, information technology, building materials, ports, education, and healthcare. Many of these subsidiaries are listed on the stock exchange, including Binh Duong Trading and Development Joint Stock Company (TDC), Becamex IJC (IJC), Becamex ACC (ACC), and Becamex BCE (BCE), to name a few.

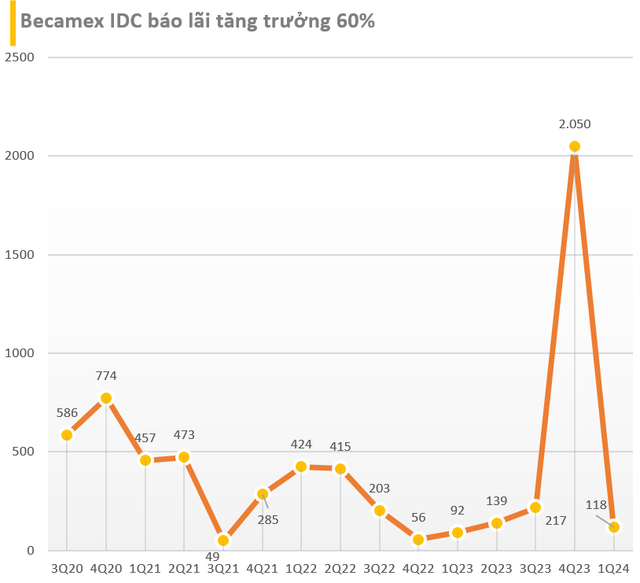

In 2023, Becamex IDC achieved a new record in profit margins. This positive trajectory continued into Q1 of 2024, with the company reporting robust financial results. Specifically, in the first quarter, Becamex IDC recorded a slight 3% year-on-year increase in revenue, totaling VND 812 billion. After expenses, the company reported an after-tax profit of VND 119 billion for Q1 2024, reflecting a significant 60% surge compared to the same period last year. Net profit stood at VND 118 billion.

As of the end of Q1 2024, the company’s total assets amounted to VND 54,069 billion, marking an increase of VND 645 billion from the beginning of the year. Inventory constituted a significant portion of the asset structure, accounting for 38%, or VND 20,348 billion. The company’s payables stood at over VND 34,543 billion, reflecting a rise of nearly VND 600 billion compared to the start of the year.

One notable development regarding Becamex IDC recently has been the strong recovery of its stock price after a decline in April. As of the market close on July 10, BCM shares traded at VND 65,300 per share, representing a remarkable 29% increase over the past three months. At this price, the company’s market capitalization stood at VND 67,585 billion.

The surge in BCM’s stock price comes on the heels of a decision by the Prime Minister to approve a reduction in state capital in Becamex IDC from 95.44% to 65% by the end of 2025. This paves the way for the state shareholder to offload its stake and diminish its ownership in the company.

Commenting on the recent desire to reduce state ownership in Becamex IDC, SSI Research opined that decreasing the ownership ratio through a capital increase, in which the state shareholder does not participate, would be a more feasible approach. This strategy would enable Becamex IDC to bolster its equity capital, reduce its debt-to-equity ratio, and attract new capital for investment into its subsidiaries and associated companies.

According to MBS Research, the outlook for Becamex IDC’s stock is positive due to the resurgence in the industrial real estate sector, fueled by robust FDI inflows from strategic partners like the US, Japan, and South Korea, as well as substantial investments in large-scale industrial park projects. MBS Research forecasts that Becamex IDC’s net profit for 2024 will reach VND 1,198 billion, halving from the previous year, but with a strong potential for recovery in 2025, estimating a 68% surge to VND 2,016 billion.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.