There are growth opportunities ahead for the stock market, according to Prof. Dr. Dinh Trong Thinh, an economic expert. He evaluates that the current growth of the stock market is not commensurate with the level of growth in the production index of the economy. Therefore, from now until the end of the year, the stock market still has the opportunity and prospect to grow better than it is now. As the economy is on an upward trajectory, the stock market can grow and attract capital better.

Firstly, as production enterprises grow, their stocks naturally increase. Stock indices reflect the health of the economy, and when the economy improves, the stock market will follow suit.

Secondly, in addition to stocks, there are bonds in the stock market. It is difficult for enterprises to issue bonds at the moment, but when the economy improves and enterprises need capital, if they cannot access bank credit, they will issue bonds. Currently, to issue bonds, enterprises must meet many conditions, and investors also feel more secure.

Thus, the stock market has the opportunity to grow and develop.

Prof. Dr. Nguyen Huu Huan, a lecturer at the University of Economics in Ho Chi Minh City, opined that the stock market in the second half of the year will remain as it is now. The important issue is that interest rates are low, exchange rate pressure is high, and the pressure of net selling by foreign investors is still quite high, even though domestic investors are the main support of the market. Thanks to domestic investors, the stock market remains stable and will hover around 1,300 points.

Stock Market Benefits from Stable Economic Growth

Ms. Bui Thi Thao Ly, Director of Analysis at Shinhan Securities Vietnam (SSV), said that at the beginning of the year, the government set two economic growth scenarios at 6% and 6.5%. GDP growth in the first half was positive, and the government is promoting economic growth to achieve a higher target of 6.5% in 2024. SSV expects a more positive scenario for the macro economy in the second half of 2024. From there, SSV also builds a scenario for the stock market to benefit from stable economic growth.

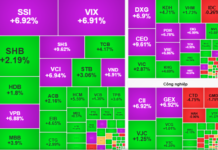

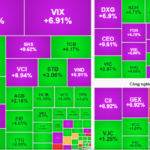

After a deep decline, the stock market has recovered, although there has been no strong breakthrough. The market sentiment remains cautious.

Source: Shinhan Securities Vietnam

|

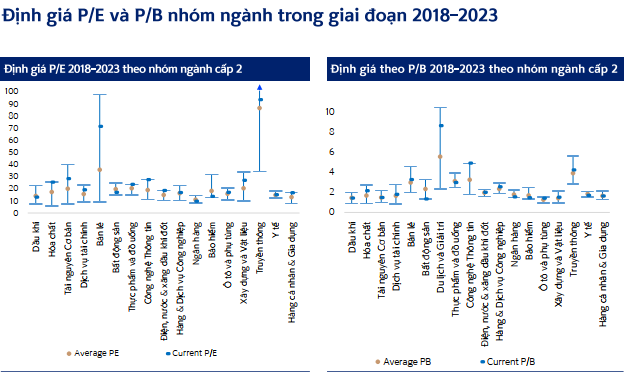

According to industry statistics, the real estate and banking sectors currently have P/E and P/B ratios that are lower than the 5-year average, while other sectors have equivalent or higher valuations, partly reflecting the current risks in these two sectors. If these two issues are resolved for the real estate and banking industries, it will not only be a driving force for the economy but also an important boost for the stock market.

Ms. Ly said that the biggest concern now is probably the net selling by foreign investors. Foreign investors have continuously sold for the last five quarters, and in the second quarter, the net selling value reached a record high of more than VND 30,000 billion. This can be explained by the negative interest rate differential, and there are signs of capital withdrawal from the Vietnamese market as well as other emerging markets, returning to the US market.

The positive point is that the market has been maintained thanks to the cash flow of individual investors – the cash flow has almost absorbed all the selling volume of foreign investors. The pressure to withdraw capital from foreign investors will decrease in the second half of 2024 and 2025 when the exchange rate cools down following the Fed’s interest rate cut roadmap. Furthermore, foreign capital will return soon if there are more significant steps in the process of upgrading Vietnam’s emerging market.

Enterprises on HOSE are expected to grow profits by about 15% this year

Ms. Ly forecasts that the banking sector will maintain its growth momentum, with pre-tax profits growing by about 15% in 2024. This will contribute significantly to the overall development of listed companies.

In addition, there is an expectation of a slight recovery for real estate businesses in the second half. It is predicted that companies listed on HOSE will grow profits by about 15% for the full year.

Secondly, a low-interest rate environment is a favorable condition for the growth of the stock market. Although interest rates rose slightly in June, compared to the end of 2022, interest rates have fallen quite sharply. SSV expects the low-interest rate environment to continue in the second half, which will be an important driving force to further increase the capital flow of individual investors. According to statistics, deposits at securities companies and margin loans in securities companies are still on a very positive upward trend. The positive point is that even though the debt has increased to a record high, the ratio of margin lending/equity is still low, at about 77%, and this figure is much lower than the peak in Q4/2021 and Q1/2022, which were about 113% and 115%, respectively.

“With the target P/E around the current level of 14x and the expected earnings growth of listed companies at 15%, we estimate that the reasonable threshold of VN-Index in 2024 will be around 1,390 points, equivalent to an increase of 23% compared to the end of 2023 and higher than 10% compared to the present (end of June 2023),” Ms. Ly added.

At the same time, SSV has greater expectations for the prospect of an emerging market upgrade. After nearly a decade of missed opportunities, the chances are becoming clearer as one or more of the following solutions are implemented: (1) Approve the draft circular amending and supplementing circulars related to foreign investors’ margin solutions and English information disclosure; (2) solve the problems of foreign ownership limits and room for foreign investors; (3) improve the level of freedom of the foreign exchange market; (4) CCP mechanism…

In the most optimistic scenario, Vietnam will be upgraded by FTSE and MSCI to emerging market status in 2025 and 2026, respectively, attracting an estimated $4-7 billion from emerging market-focused funds.

Statistics show that the stock market often explodes in the two years before being upgraded, and the average increase is about 23% in the period from the announcement of the upgrade to its taking effect.

If the issues of the economy and the stock market are synchronously resolved, a very positive prospect for the stock market in 2025 and 2026 will be opened up.

By Cat Lam

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

Will Vietnamese fruit and vegetable exports set a new record?

From the beginning of 2024, the export field of vegetables and fruits in Vietnam has received positive signals, with the estimated export turnover of over 500 million USD. With the current market trends, the vegetable and fruit industry is forecasted to set a new record and contribute 6-6.5 billion USD to the agricultural sector in 2024.