|

Vietnamese steel enterprises are facing numerous challenges – Image source: VGP/ Toàn Thắng |

Vietnamese Steel Industry Navigates Through Challenges

In mid-June 2024, Prime Minister Phạm Minh Chính chaired a conference on removing obstacles and promoting the production and consumption of cement, iron and steel, and construction materials.

The Vietnam Steel Association (VSA) predicted that the country’s finished steel production in 2024 could reach 30 million tons, a 7% increase compared to 2023. Domestic steel consumption this year is expected to increase by 6.4% compared to 2023, reaching 21.6 million tons. Inventories are estimated at 8.4 million tons.

Vietnamese steel also faces the pressure of import surplus. In 2023, the import volume of various finished steel products to Vietnam was about 13.33 million tons, with a value of over $10.4 billion, a 14.07% increase compared to 2022. China was the largest exporter to Vietnam, accounting for more than 62% of the total volume and over 54% of the total value.

According to VSA leaders, the biggest challenge is China’s continued increase in steel exports, putting Vietnamese steel producers at risk of losing the domestic market. Additionally, the rise of protectionism in production worldwide, as countries erect technical barriers and trade remedies to prevent steel imports and protect their domestic industries, poses significant obstacles to Vietnam’s steel exports.

The “supply exceeds demand” situation for many domestic steel products, coupled with the increase in steel imports, will intensify price competition in the domestic finished steel market. Moreover, global market instability and rising international freight rates pose potential risks for steel enterprises.

The Ministry of Industry and Trade (MOIT) attributes the difficulties faced by the Vietnamese steel industry to the decline in global demand and the slump in the domestic real estate sector, which has led to reduced steel input requirements for construction and export-oriented industries. Other factors include increased production costs due to higher raw material prices and high steel inventories in the market.

Steel is one of the most frequently investigated products for trade remedies worldwide. As of May 2024, out of a total of 252 cases of foreign trade remedy investigations against Vietnam, about 30% involved steel products. These investigations covered a diverse range of steel products, including galvanized steel, cold-rolled stainless steel, coated steel, steel pipes, steel nails, etc. The investigations mainly took place in Vietnam’s key steel export markets, such as the US, the EU, Australia, Malaysia, and Indonesia.

A notable example is the stainless steel segment. While Vietnam produces over 800,000 tons of stainless steel annually, the domestic market consumes only about 250,000 tons. Local enterprises sell approximately 115,000 tons (45%), while imports account for 135,000 tons (55%).

Stainless steel exports, averaging 250,000 tons per year, have recently faced challenges due to global economic difficulties and reduced foreign demand. Additionally, Vietnamese stainless steel exports are subject to high trade remedy taxes in some countries, including Thailand (310.74%), Malaysia (7.81%-23.845%), Turkey (19.64%-25%), and the US (16.24%). Currently, some stainless steel products are also under investigation in India and the European Union.

Consequently, Vietnamese stainless steel enterprises find themselves in a challenging position, facing competition from imported goods with price advantages in the domestic market while struggling to boost exports and expand overseas markets.

What Do Enterprises Aspire For?

Given the current challenges, the Vietnam Steel Association has proposed that the Government direct relevant agencies to continue developing and perfecting technical standards, quality management regulations, and technical barriers to prevent steel products that do not meet technical, safety, and environmental standards from entering the Vietnamese market.

The Ministry of Industry and Trade has been urged to promptly apply trade remedy measures (safeguard measures, anti-dumping, countervailing, and trade remedy measures) to prevent unfair competition practices and protect domestic production.

Mr. Phạm Công Thảo, Vice Chairman of VSA, suggested that the steel industry was the first to apply trade remedy measures due to the immense pressure from imports. Vietnam has implemented such measures for steel products like steel billets, construction steel, stainless steel, and galvanized steel. Enterprises have also raised the need to apply trade remedies to new products and maintain them for certain products like stainless steel.

“To protect domestic production, applying trade remedy measures is beneficial in specific cases. VSA encourages the use of trade remedies for steel products that meet the entire domestic demand,” Mr. Thảo recommended.

He emphasized that the WTO provides tools to curb unfair competition practices, such as dumping, and to prevent imported steel from harming the domestic steel industry. Vietnam’s steel industry is relatively young and has limited competitive capacity. Therefore, if imported steel is dumped in the market, it will damage the domestic steel industry and hinder its development.

Dr. Nguyễn Thị Thu Trang, Director of the WTO and Integration Center (VCCI), stated that trade remedy measures, particularly anti-dumping, are legal tools that the domestic steel industry can employ to safeguard its legitimate interests against unfair competition practices like dumping or selling subsidized products by foreign governments.

In the long run, Dr. Trang suggested that the government design a legal framework and establish an implementation mechanism for trade remedy tools that align with WTO rules. This would enable local steel enterprises to use these tools effectively and protect their rights and legitimate interests.

Experts believe that Vietnam, as a latecomer to the steel industry, is at a disadvantage compared to established steel-producing nations. Therefore, enterprises hope for a positive and timely response from the government, balancing interests to safeguard the steel industry, considered a fundamental industry for Vietnam, and promote a sustainable and healthy market for steel production and consumption.

By Nhật Quang

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

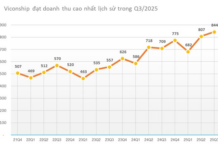

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.