Vietnam’s Stock Market is Trending Positively

In their latest strategic report, Yuanta Securities assesses that the stock market remains in a phase of strong positive volatility. The analysis team expects the VN-Index to surpass the 1,300-point resistance level in July.

Yuanta anticipates that an early Fed rate cut in September 2024 will support the upward trajectory of Vietnamese stocks in Q3 2024. Positive macroeconomic data, along with robust growth figures from listed companies in Q2 2024, are also bolstering the market’s performance in July 2024.

“Low valuations in large-cap stocks and the projected P/E ratio of the VN-Index at 12.x (equivalent to an earnings yield of 8.3%) indicate that the stock market remains more attractive than other investment channels, even as savings rates trend upwards,” states Yuanta.

Based on these insights, Yuanta highlights several notable stock sectors for July: Transportation, Technology, Chemicals, Banking, Securities, Electricity, Food Production, Oil & Gas Production, and Tourism.

GDP Growth Rate in Q3 2024 to Continue Outpacing Q2 2024

On the macroeconomic front, the analysis team notes that June’s economic figures showcase more favorable signals than April and May. Data on production, consumption, and import-export activities reflect robust growth, and fundamental macroeconomic factors such as interbank interest rates, exchange rates, and gold prices have cooled down.

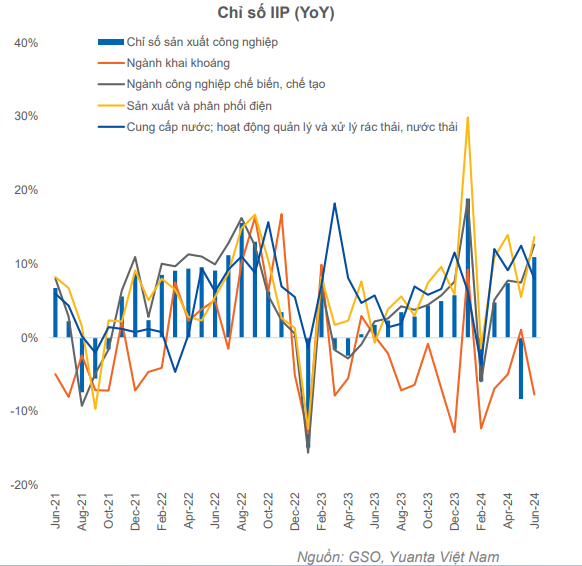

According to Yuanta, the industrial production index continued its upward trend, both month-on-month and year-on-year. Notably, new orders and export orders surged despite rising selling prices and input cost pressures. This can be attributed to the rebound in goods demand from major exporting countries, as their economies are on a solid recovery path.

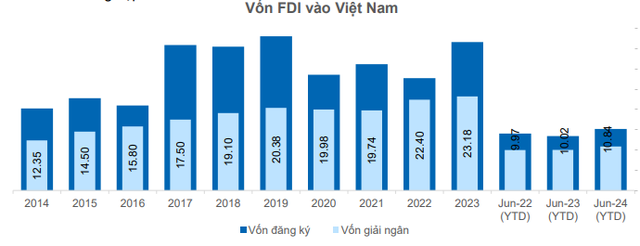

Additionally, investment remains a crucial driver of growth. While FDI registered and disbursed in June witnessed a robust rebound, public investment continues to be strongly promoted. Moreover, new business registrations and registered capital both increased compared to May and the previous year.

With the domestic and global economic recovery gaining momentum, Yuanta forecasts that the GDP growth rate in Q3 will surpass that of Q2, followed by a slight dip in Q4 due to the high base in Q4 2023. The economic growth for the entire year is estimated at around 6.2%, aligning with the adjustment made at the end of Q1.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.