The US Consumer Price Index (CPI) for June unexpectedly fell for the first time in over four years, paving the way for the Federal Reserve to begin lowering interest rates sooner.

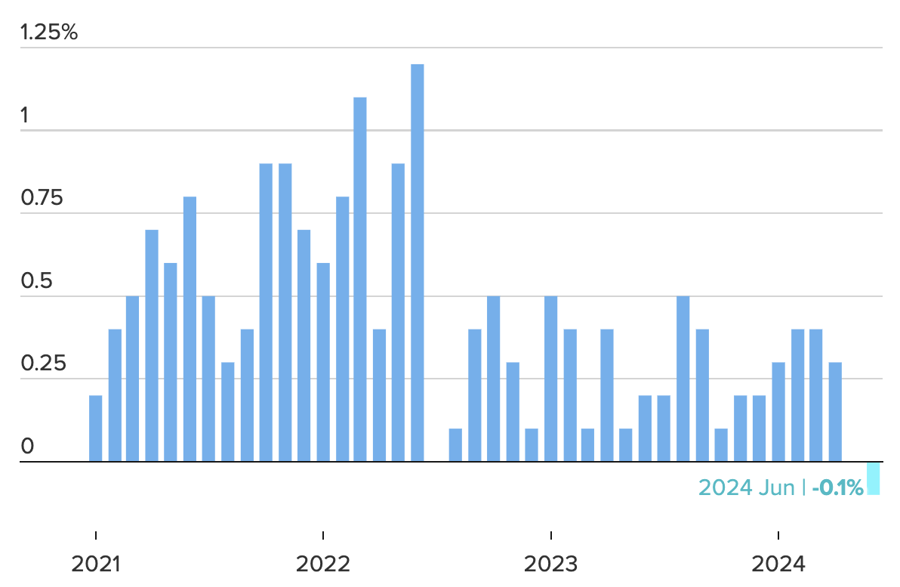

According to statistical data released by the US Department of Labor on July 11, the CPI—a measure of the prices of goods and services in the economy—fell by 0.1% in June compared to May. This is the first month-on-month decline in the US CPI since May 2020.

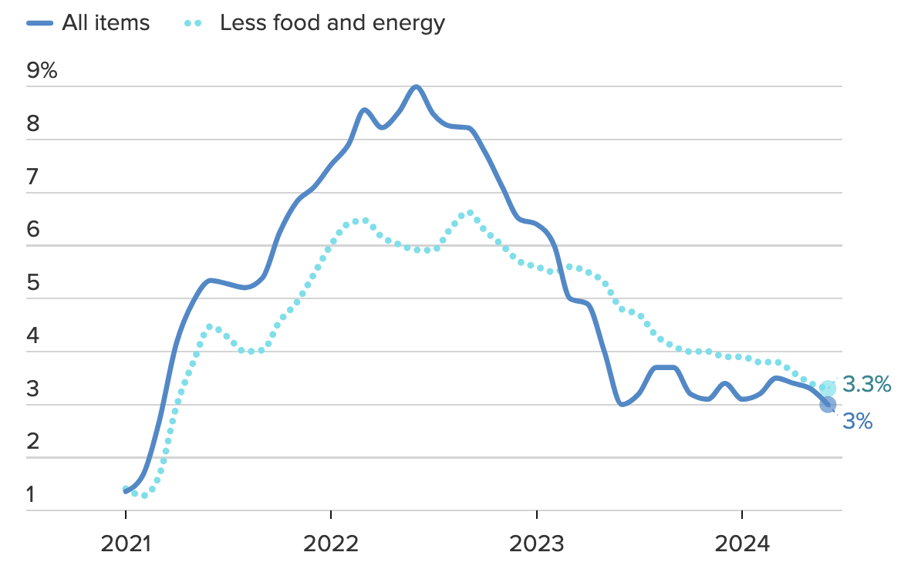

Compared to the same period last year, the CPI rose by 3%, the lowest increase in more than three years. In May, the CPI remained unchanged from April and rose 3.3% year-over-year.

The core CPI, which excludes the two volatile categories of food and energy, increased by 0.1% from the previous month and 3.3% from the previous year. These increases were lower than the respective 0.2% and 3.4% rises forecasted by economic experts before the report’s release. The year-on-year increase in core CPI was the lowest since April 2021.

A key factor in the CPI slowdown was a 3.8% drop in US retail gasoline prices year-over-year, offsetting a 0.2% increase in food and housing prices. Thus far, persistent inflation in the housing group—which accounts for about a third of the basket of goods and services used to calculate the US CPI—has been a major contributor to the country’s slow inflation decline. Hence, the slowdown in price increases in this sector is another positive sign for US inflation.

In an interview with CNBC, E-Trade’s Chris Larkin stated that the June inflation report meant the Fed was “one step closer” to cutting rates in September. “Between now and the Fed’s September 18 meeting, a lot could happen, but unless economic data turns red-hot again, the Fed will have no reason not to cut rates,” Mr. Larkin said.

In addition to the decline in energy prices and modest increases in housing prices, a 1.5% drop in used car prices in June, and a 10.1% drop compared to the same period last year, was another significant factor in the decline in inflation. Surging used car prices had been a primary driver of inflation since 2021.

The easing of inflation means that real average hourly earnings of US workers increased by 0.4% in June from the previous month, despite only rising by 0.8% from the previous year, according to another report by the US Department of Labor.

Although US inflation has not yet reached the Fed’s 2% target, the June CPI report provides further evidence that price trends in the country are moving in the right direction.

The year-on-year increase in the US CPI peaked at over 9% in June 2022, prompting the Fed to raise interest rates 11 times in a row between March 2022 and July 2023. After the final increase, the Fed kept interest rates at 5.25-5.5% even as inflation slowed.

Following the release of the June CPI report, traders in the futures market bet on a more than 93% chance of the Fed cutting interest rates in September, up from 70% the previous day, according to data from the CME’s FedWatch Tool.

“The latest inflation data convinces us that the Fed will cut rates in September. The smallest increase in core CPI since 2021 certainly gives the Fed confidence that the hot CPI numbers in the first quarter of this year were only temporary, and the Fed will have the motivation to cut rates more than once this year,” said Seema Shah, chief strategist at Principle Asset Management.

During the June meeting, the Fed predicted only one rate cut for 2024, but the market now believes that after the first cut in September, the Fed will cut rates at least one more time before the end of the year. According to FedWatch Tool, there is a 40% chance of a rate cut in December.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Propose adding a bad scenario script to “shock” the economy

In addition to the positive economic growth scenarios for 2024, Vietnam needs to prepare for negative scenarios to enhance its ability to cope with unexpected shocks.