Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching more than 546 million shares, equivalent to a value of more than 13.7 trillion VND; HNX-Index reached more than 51.2 million shares, equivalent to a value of more than 1 trillion VND.

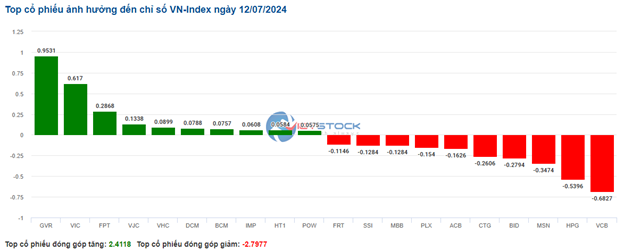

VN-Index opened the afternoon session with a prolonged stalemate around the reference level, and selling pressure continued to outweigh buying, causing the index to weaken until the end of the session. In terms of impact, VCB, HPG, MSN, and BID were the codes with the most negative impact, taking away more than 1.8 points from the index. On the other hand, GVR, VIC, FPT, and VJC were the codes with the most positive impact on the VN-Index, with an increase of more than 1.9 points.

In the livestock sector, DBC shares fell 1.6%, marking the third consecutive session of decline. In a related development, Dabaco has recently been subjected to a decision by the Bac Ninh City Tax Department to enforce administrative decisions on tax management by forcibly collecting money from accounts due to overdue tax payment for 90 days. However, the total amount of tax enforced was quite low, at only 22 million VND. On the company’s side, Chairman Nguyen Nhu So attributed the main reason to an oversight during the review process.

Source: Vietstock Finance

|

HNX-Index also followed a similar trajectory, with negative influences from codes such as DTK (-3.45%), CEO (-2.22%), PVS (-0.7%), and IDC (-0.65%), among others.

Source: Vietstock Finance

|

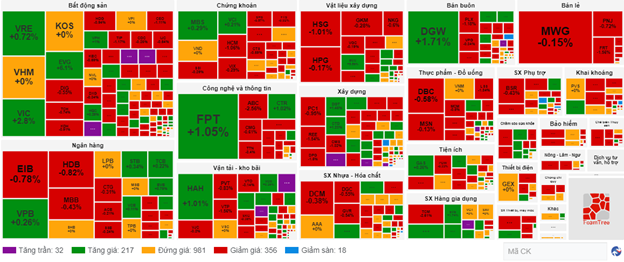

At the end of the trading session, the market decreased by 0.24%. The rubber products sector witnessed the sharpest decline in the market, falling by -1.54%, mainly due to the performance of DRC (-0.56%), CSM (-5.06%), and BRC (-1.05%). This was followed by the securities and construction materials sectors, which decreased by 0.81% and 0.75%, respectively. Conversely, the consulting services sector witnessed the strongest recovery, with a growth of 3.79%, mainly driven by codes such as TV2 (+6.03%).

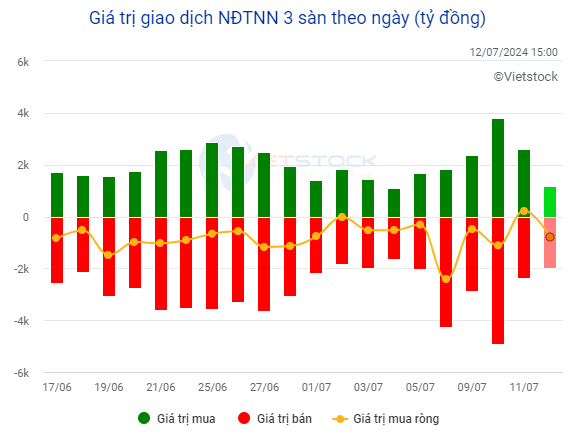

In terms of foreign investors’ activities, they net sold more than 779 billion VND on the HOSE exchange, focusing on codes such as VHM (304.3 billion), MWG (124.21 billion), MSN (79.63 billion), and FPT (48.34 billion). On the HNX exchange, foreign investors net bought slightly over 0.6 billion VND, focusing on PVS (5.98 billion), LAS (4.54 billion), TIG (2.31 billion), and IDC (2.15 billion).

Source: Vietstock Finance

|

12h Weak capital flow, VN-Index falls back

VN-Index fell back after a stalemate around the reference level throughout the first half of the morning session. At the end of the morning session, the VN-Index decreased by 0.33 points, equivalent to 0.03%. HNX decreased by 0.71 points, equivalent to 0.29%.

The reason why the VN-Index, as well as the majority of stocks, could not maintain their early morning highs was due to weak buying demand. The positive momentum observed at the beginning of the morning session failed to attract more capital inflows, and liquidity weakened while selling pressure increased.

The trading volume of the VN-Index recorded in the morning session reached only 215 million units, with a value of just 5.3 trillion VND. The HNX-Index recorded a trading volume of over 20 million units, with a trading value of over 400 billion VND.

By the end of the morning session, most sectors were in negative territory, including the utilities sector, despite its strong growth earlier. Large-cap sectors, such as securities, construction, and retail, also recorded negative performances.

The information technology sector contributed to the growth of the index at the beginning of the morning session, with stocks like FPT (+0.98%), CTR (+0.89%), and ITD (+1.14%), among others.

In contrast, the construction sector opened on a negative note, with large-cap stocks in the industry drowning in red, including REE, which fell by 1.26%, HUT by 0.56%, and VCG by 1.04%.

10:30 am: Investor caution prevails

Investor caution resulted in a decline in trading volume, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index increased by 1.18 points, trading around 1,284 points. The HNX-Index decreased slightly by 0.4 points, trading around 244 points.

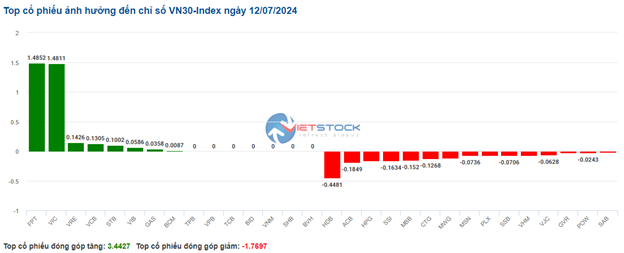

The breadth of the VN30 stock universe was slightly negative, with notable performances from FPT, VIC, VRE, and VCB, which contributed 1.49 points, 1.48 points, 0.14 points, and 0.13 points to the index, respectively. On the other hand, HDB, ACB, HPG, and SSI remained in negative territory, but the decline was not significant, as they took away nearly 1 point from the VN30-Index.

Source: VietstockFinance

|

The information technology sector led the recovery with a 1.23% gain. Within this sector, the giant FPT (+1.35%) continued to be the driving force, with a trading value of more than 190 billion VND as of 10:30 am, accounting for over 75% of the sector’s trading value. Additionally, buying interest was also observed in stocks like CTR (+1.23%), EBS (+0.91%), and EID (+0.74%)…

The real estate sector also witnessed a decent recovery, although the breadth remained negative, with more declining stocks than advancing ones. Specifically, stocks like VHM (+0.13%), VIC (+2.92%), BCM (+0.46%), and VRE (+0.72%) were the main supporters of the sector index. In contrast, residential real estate stocks such as KDH, NVL, PDR, and DXG experienced strong divergence, with a mix of declines and references.

Additionally, CCL stood out with a sharp rise to the ceiling price right at the opening, forming a Rising Window candlestick pattern accompanied by volume exceeding the 20-session average, indicating active trading among investors. Currently, the stock price has rebounded after retesting the old high breached in March 2024 (corresponding to the 9,488-9,888 region) while the Stochastic Oscillator has signaled a buy and moved out of the oversold zone, suggesting a relatively optimistic outlook in the near term.

Source: https://stockchart.vietstock.vn/

|

The agriculture, forestry, and fisheries sector is currently the group with the most negative performance, with a decline of 0.83%. This decrease was mainly due to the performance of HAG (-0.41%), VIF (-2.06%), and HNG (-1.13%)… Meanwhile, CTP (+1.39%), HKT (+3.33%), and NSC (+1.32%) maintained their positive momentum.

Compared to the opening, the market continued to fluctuate and witness strong divergence, with more than 980 reference codes and a slight dominance of sellers. There were 356 declining codes and 217 advancing codes.

Source: VietstockFinance

|

9:40 am: Real estate continues its growth momentum

At the beginning of the July 12 session, as of 9:40 am, the VN-Index increased by more than 4 points, reaching 1,287.98 points. The HNX-Index also witnessed a slight increase, reaching 245.58 points.

According to the latest report released, in June 2024, the CPI in the US decreased by 0.1% from the previous month, marking the first decline since May 2020. On a year-over-year basis, the CPI in the US increased by 3%, the lowest level in more than three years and a decrease from the 3.3% recorded in May.

Excluding energy and food, the core CPI rose 0.1% from the previous month, weaker than the expected increase of 0.2% forecasted by experts. Year-over-year, the core CPI rose 3.3%, the weakest increase since April 2021 and also lower than the expected increase of 3.4%.

With positive data in June 2024, “the Fed has moved one step closer to cutting interest rates in September,” said Chris Larkin, managing director of trading and investment at E-Trade, part of Morgan Stanley.

As of 9:40 am, the real estate sector was leading the market with a growth of 1.33% in the morning session. Notably, stocks in this sector, such as VIC, VRE, VHM, BCM, NLG, and DXG, recorded increases of 3.65%, 1.93%, 0.78%, 0.77%, 1.16%, and 0.68%, respectively.

Additionally, the mining sector also recorded a positive performance, contributing positively to the overall market index. Specifically, stocks such as PVD, PVS, KSB, and CLM increased by 0.67%, 0.7%, 0.24%, and 4.79%, respectively…