Joint Stock Company for Investment Development ST8 (HOSE: ST8) took only 2 trading sessions to acquire 10% of the capital of Dong Nai Rubber Construction Joint Stock Company (UPCoM: CDR). Specifically, on June 27, 2024, ST8 purchased 149,100 CDR shares, thereby becoming a major shareholder of CDR with a 6.99% stake. Prior to this, ST8 did not own any shares in CDR. On July 3, ST8 continued to buy 64,300 CDR shares, increasing its ownership to 10%, equivalent to 213,400 shares.

During the time ST8 conducted the transaction, there were no matching trades at CDR. Therefore, ST8‘s transaction was entirely through order matching. Based on the closing price, it is estimated that the total amount of money ST8 spent to own 10% of CDR‘s capital was VND 1.8 billion.

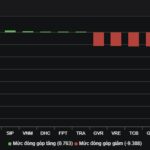

Since ST8 became a major shareholder, CDR stock has had 5 ceiling sessions out of a total of 12 recent sessions. By the session on July 15, the price of this stock continued to “jump” to the ceiling right after the opening.

| Price movement of CDR shares from June 27 to the present |

Becoming a major shareholder of a construction company like CDR takes place in the context that at the recent Annual General Meeting of Shareholders, ST8 Chairman Nguyen Van Hoang (Hans Nguyen) assessed that the Vietnamese economy has bottomed out, the market is showing signs of recovery but will be gradual, still at a low level, and it will take 1-2 more quarters for the recovery signals to become clearer. At that time, ST8 will implement projects within the plan. Although there are no results at the moment, the picture in the next 3-5 years will be very promising.

Mr. Hans Nguyen

|

In addition, ST8‘s investment move is also noteworthy as ST8‘s Chairman, Mr. Hans Nguyen, is known to be a senior manager at Dragon Capital Vietnam, serving as the fund’s Senior Advisor for Asset Management Solutions. He is also the founder of the WAM Institute for Finance and Investment Training.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.