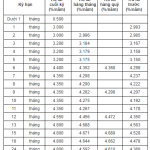

According to the latest survey, HDBank (Ho Chi Minh City Development Joint Stock Commercial Bank) has maintained the same interest rates on demand deposits for individual customers as of last month. Currently, interest rates at HDBank range from 2.75% to 8.1% per annum for terms ranging from 1 to 36 months, with interest paid at maturity.

Specifically, interest rates for terms of 1 to 5 months are listed at 2.75% per annum, while the rate for a 6-month term is 4.8% and 7-11 month term is 4.6% per annum.

For a 12-month term, the interest rate for deposits of 500 billion VND or more is 7.7% per annum, while the rate for deposits below 500 billion VND is 5.4% per annum. Similarly, for a 13-month term, the interest rate for deposits of 500 billion VND or more remains at 8.1% per annum, and for deposits below 500 billion VND, it is 5.6% per annum.

Interest rates for 15 and 18-month terms are listed at 5.9% and 6.0% per annum, respectively. Terms of 24 to 36 months have an interest rate of 5.4% per annum.

HDBank continues to offer low-interest rates of 0.5% per annum for short-term savings accounts with terms of 1 to 3 weeks.

In addition to interest paid at maturity, HDBank offers various other interest payment options with the following interest rates: Interest paid in advance: 2.65% – 5.4% per annum; Monthly interest: 2.65% – 5.7% per annum; Quarterly interest: 4.5% – 5.7% per annum; Semi-annual interest: 5.1% – 5.8% per annum; Annual interest: 5.2% – 5.3% per annum.

HDBank’s Deposit Interest Rates for Over-the-Counter Customers for July 2024

Source: HDBank

HDBank’s Online Savings Interest Rates for July 2024

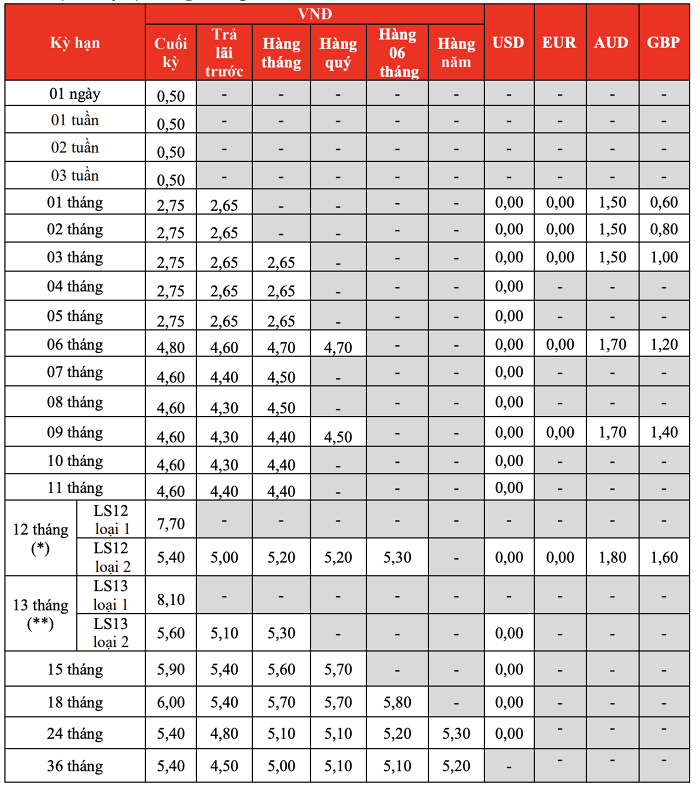

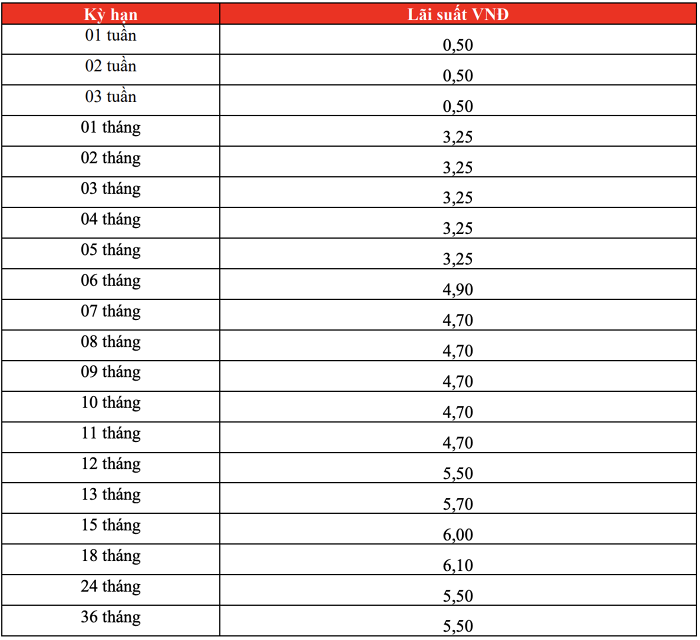

In July, interest rates for HDBank’s online savings accounts remain unchanged from June, ranging from 0.5% to 6.1% per annum.

Specifically, terms of less than 1 month have the lowest interest rate of 0.5% per annum; the interest rate for terms of 1 to 5 months is 3.25% per annum; 6-month term is 4.9% per annum; 7 to 11-month term is 4.7% per annum; 12-month term is 5.5% per annum; 13-month term is 5.7% per annum; 15-month term is 6.0% per annum; 18-month term is 6.1% per annum; and both 24 and 36-month terms have an interest rate of 5.5% per annum.

With a maximum interest rate of up to 6.1% per annum, HDBank is one of the banks with the highest deposit interest rates in the system today.

HDBank’s Online Deposit Interest Rates for July 2024

Source: HDBank

Latest HDBank Savings Interest Rates April 2024: Best Interest Rates for 18-Month Term

In April, HDBank’s highest saving interest rate for regular deposits is 5.9%/year, applied for online deposits with a term of 18 months.