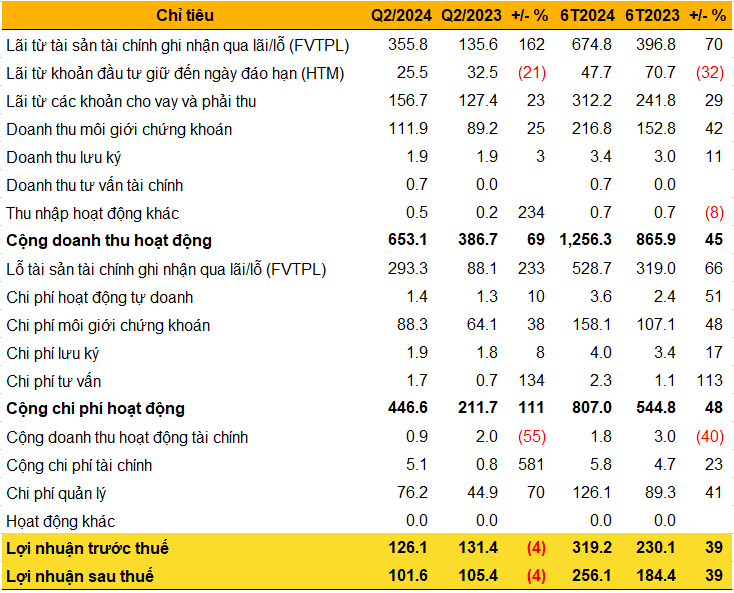

KIS Vietnam reported impressive operating revenue of over VND 653 billion in Q2 2024, marking a 69% increase compared to the same period last year. With the exception of a decrease in profit from held-to-maturity (HTM) investments, all other segments contributed to this revenue growth.

The company’s key segments exhibited positive growth. Notably, profit from financial assets at fair value through profit or loss (FVTPL) surged by 2.6 times year-over-year to nearly VND 356 billion. Lending and receivables income increased by 23%, reaching almost VND 157 billion, while securities brokerage revenue rose by 25% to nearly VND 112 billion.

Total operating expenses for Q2 amounted to nearly VND 447 billion, a 2.1-fold increase compared to the previous year. This significant rise was driven by an increase in all expense categories, predominantly the loss on FVTPL assets, which tripled from the same period last year to exceed VND 293 billion.

Additionally, another expense category that witnessed a notable surge was administrative expenses, which climbed by 71% to over VND 76 billion.

Despite the impressive revenue growth in Q2, the substantial increase in expenses caused a slight dip in KIS’s net profit, which decreased by 4% year-over-year to approximately VND 102 billion.

For the first half of 2024, the company’s cumulative net profit reached VND 256 billion, reflecting a robust 39% increase compared to the same period in 2023.

|

KIS’s Q2 2024 business results and cumulative results for the first half of 2024

Unit: Billion VND

Source: KIS, compiled by the author

|

As of the end of Q2 2024, KIS Vietnam’s total assets stood at nearly VND 12,230 billion, representing a 24% increase from the beginning of the year.

The largest portion of this was the value of loan receivables, which grew by 18% to nearly VND 7,856 billion, almost entirely comprised of principal margin lending.

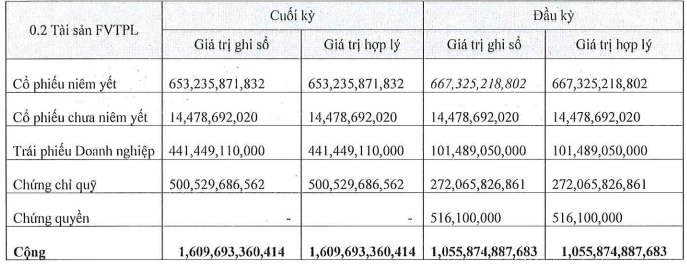

Financial assets at FVTPL were recorded at nearly VND 1,610 billion, a 52% increase. This portfolio included listed stocks (over VND 653 billion), fund certificates worth more than VND 500 billion, corporate bonds exceeding VND 441 billion, and a small amount of unlisted stocks at over VND 14 billion.

|

Changes in KIS Vietnam’s FVTPL assets in the first half of 2024

Unit: VND

Source: KIS Vietnam’s Q2 2024 Financial Statements

|

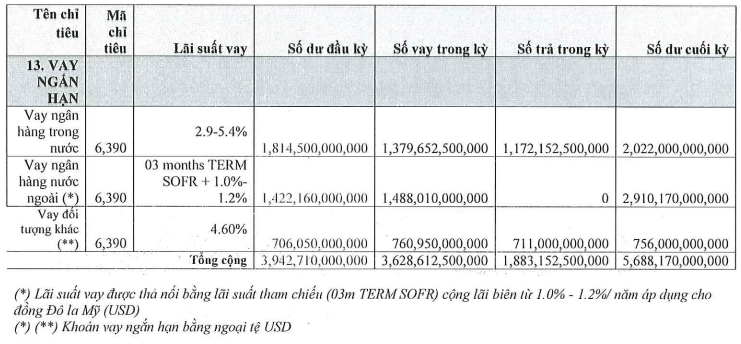

On the liabilities side, KIS Vietnam’s short-term borrowings accounted for 85% of its total liabilities, amounting to over VND 5,688 billion, a 48% increase from the beginning of the year. This rise was primarily due to additional borrowings of more than VND 1,488 billion from foreign banks, with floating interest rates based on the reference rate plus a margin of 1.0-1.2%/year applied to USD.

|

Changes in short-term borrowings in Q2 2024

Unit: VND

Source: KIS Vietnam’s Q2 2024 Financial Statements

|

Huy Khai

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.