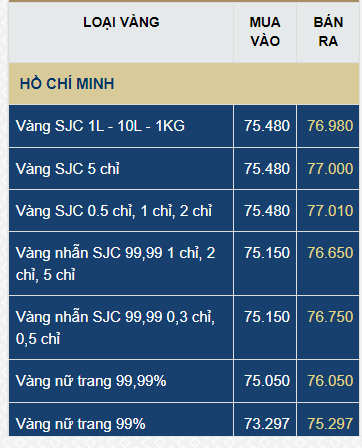

SJC Company is currently listing gold ring prices at 75.15-76.75 million VND per tael. Bao Tin Minh Chau applies the rate of 75.68-76.98 million VND per tael, unchanged from the previous week.

DOJI increased the buying rate by 100 thousand VND per tael and kept the selling rate unchanged. The plain gold ring price is currently listed at 75.9-77.15 million VND per tael.

At Phu Nhuan Jewelry, the price of 24k gold rings remains at 75.15-76.6 million VND per tael, the same as last week.

The SJC gold price in the domestic market today stands at 77 million VND per tael for selling. For buying, DOJI listed at 75 million VND per tael, while SJC and PNJ applied 75.5 million VND per tael, and Bao Tin Minh Chau listed at 75.9 million VND per tael.

In the international market, the spot gold price is currently at $2,409 per ounce. Converted to VND based on the exchange rate at Vietcombank, the international gold price is equivalent to about 74 million VND per tael, excluding taxes and fees.

The latest Kitco News gold survey shows that industry experts are almost unanimous in their bullish outlook for gold this week, while retail investors remain optimistic.

Marc Chandler, CEO of Bannockburn Global Forex, commented that the upward trend for the precious metal continues. He stated, “Gold has risen for the third straight week, supported by a weaker dollar. The yellow metal surged to nearly $2,425 per ounce after the US released a slightly lower CPI, raising expectations that the Fed may cut rates more than twice this year. It’s also worth noting that while the PBOC may not have bought gold last month, other central banks in Asia and Europe have, and a UBS survey of 40 central banks showed that geopolitical tensions are their top concern.”

In the Kitco News Wall Street survey, 13 participants shared their views, and all but one agreed that gold prices would move higher in the coming week. Twelve analysts, or 92%, predicted a rise in gold prices, while only one analyst, or 8%, anticipated a decline. None were neutral on gold in the near term.

Meanwhile, 178 votes were cast in the Main Street online survey, with retail investors maintaining their optimistic stance from the previous week. Specifically, 119 respondents, or 67%, forecast higher gold prices in the week ahead. Thirty-two others, or 18%, predicted that gold would trade lower, while the remaining 27 voters, or 15%, expected prices to move sideways.

Deadline for Reporting Gold Market Management and Operations Results to SBV Today, January 31

As per the directive of Prime Minister Pham Minh Chinh, today (January 31, 2024) is the deadline for the State Bank of Vietnam (SBV) to submit a report on the summary of Decree 24, which includes proposals for amending and supplementing certain regulations for managing the gold market.

Gold prices surge to nearly 79 million dong per tael ahead of Tet, investors make huge profits.

After dropping sharply from 80.5 million VND per tael to 74 million VND per tael at the beginning of the year, SJC gold price has been showing signs of recovery recently. On February 2nd, the price of gold continued to rise significantly and reached nearly 79 million VND per tael.