The State Bank of Vietnam has released statistical data regarding Total Means of Payment and Customer Deposits at credit institutions (CIs) for April 2024.

Total means of payment reached over 16 trillion VND by the end of April 2024, a 0.13% increase from the beginning of the year. Customer deposits in the CI system exceeded 13.4 trillion VND, with an additional increase of 120 thousand billion VND in April.

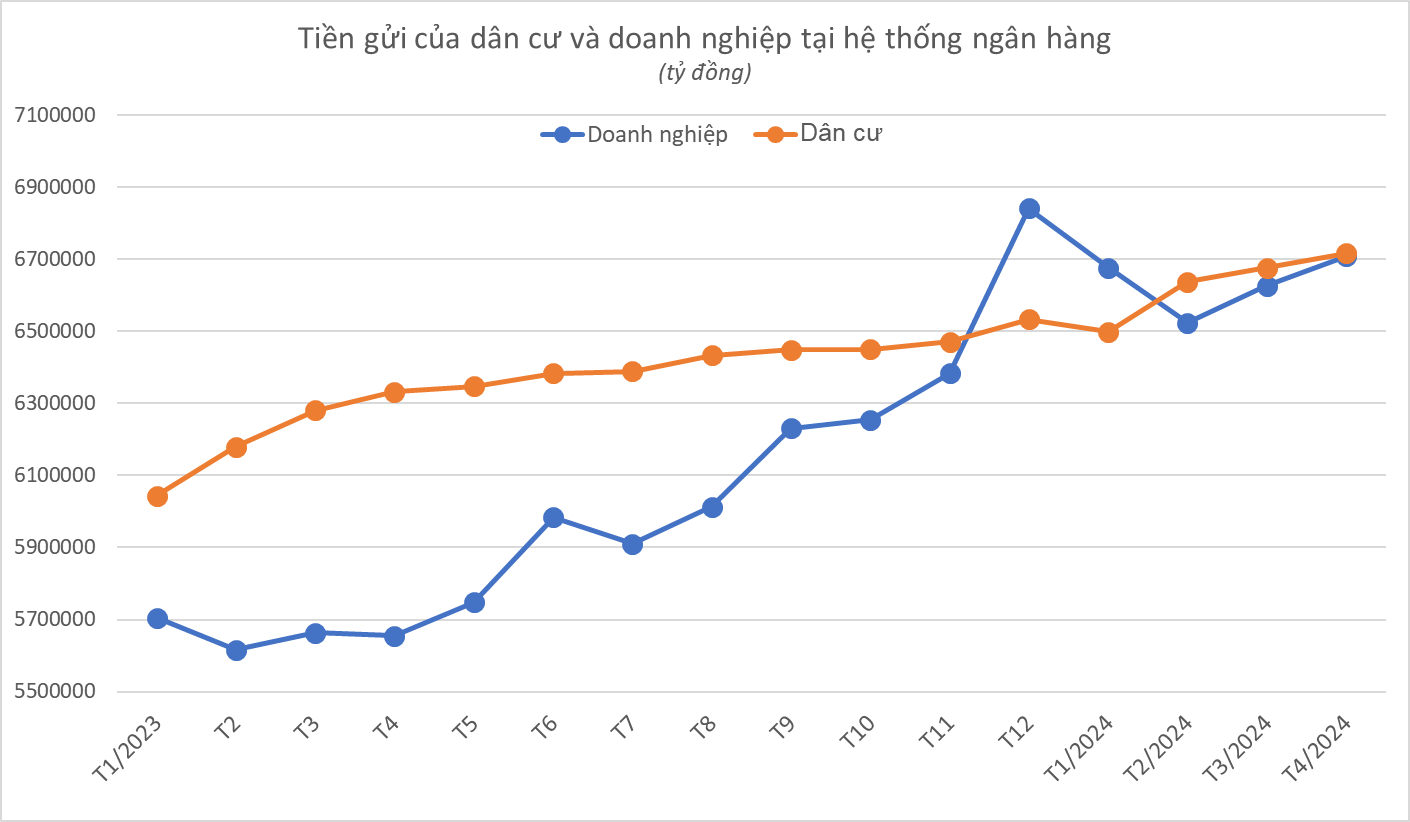

Both organizational and household deposits showed positive growth in April. Specifically, organizational deposits increased by more than 81 thousand billion VND in April, reaching over 6.7 trillion VND. However, due to significant declines in January and February, organizational deposits still witnessed a decrease of over 133 thousand billion VND (equivalent to a 1.95% drop) during the first four months.

Household deposits also increased by 39.7 thousand billion VND in April, reaching a new record high of over 6.7 trillion VND. Cumulatively, household deposits have grown by more than 183 thousand billion VND (equivalent to a 2.8% increase) since the beginning of the year.

Despite record low-interest rates at the beginning of the year, deposits in the banking system continued to grow, although at a slower pace compared to credit. Specifically, customer deposits in the system increased by 0.91% in the first four months, while credit growth was 2.01%.

On the other hand, according to data from the General Statistics Office, as of June 24, 2024, capital mobilization by credit institutions increased by 1.50% compared to the end of 2023; while credit growth for the economy reached 4.45%.

To attract depositors, banks have been consistently raising deposit interest rates in recent months. The macroeconomic update report for July 2024 by MB Securities Company (MBS) revealed that in June, commercial banks simultaneously adjusted deposit interest rates, with increases ranging from 0.1% to 0.5%. This move by commercial banks to increase deposit rates comes as the State Bank of Vietnam reported a significant rise in credit growth of 4.45% as of June 24, up from 2.4% at the end of May. The banks are raising savings rates to attract more deposits to meet the improving demand for capital in the coming months.

Conversely, the group of state-owned joint-stock commercial banks maintained an average interest rate of 4.7% for 12-month terms. Notably, VietinBank was the only bank in the group to adjust its deposit interest rates in June, resulting in more competitive rates compared to its peers. Specifically, interest rates were slightly increased by 0.2% per year for terms ranging from 1 to 11 months and 24 to 36 months.

MBS anticipates a mild increase of 50 basis points in deposit rates during the second half of 2024 due to the expected rise in credit demand as production and investment accelerate in the latter half. MBS forecasts that the 12-month deposit rate of large joint-stock commercial banks may inch up by another 50 basis points, returning to the range of 5.2%-5.5% in the latter half of 2024. However, lending rates are expected to remain unchanged as regulatory authorities and banks strive to support businesses’ access to capital.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.