Despite shorter-term savings accounts offering lower interest rates than their long-term counterparts, many people still opt for the former due to fears of inflation and expectations of changing interest rates in the future. Additionally, if they need to withdraw their money early, they will have to close the entire account, and the interest earned will be based on a non-term deposit rate. As a result, long-term deposits are less appealing to those who may need sudden access to their funds.

For these reasons, banks often struggle to attract medium and long-term deposits. Consequently, they rely on short-term funds to finance long-term loans, creating a mismatch in their asset-liability management.

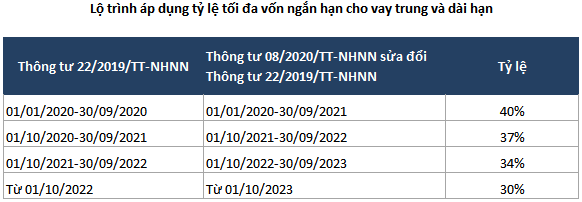

According to Circular No. 08/2020/TT-NHNN, which amends Circular No. 22/2019/TT-NHNN, banks must reduce the maximum ratio of short-term funds used for medium and long-term loans to 34% by October 1, 2022, and further down to 30% by October 1, 2023. This puts pressure on banks with high ratios of short-term funds for long-term lending, as they now have to source longer-term funds, which typically come at a higher cost.

To address this challenge, most banks plan to increase their charter capital to boost medium and long-term funds and reduce the pressure of gradually lowering the ratio of short-term funds for medium and long-term lending in the future.

Banks are also exploring bond issuance as an alternative source of funding. While bonds are essentially loans, they usually have longer maturities than deposits, and the terms of repurchase (if any) are agreed upon upfront, giving banks more control over their capital allocation.

To support banks in their efforts to attract medium and long-term deposits, the State Bank of Vietnam issued Circular No. 04/2022, which took effect in August 2022, ahead of the October 1, 2022, deadline for banks to reduce the ratio of short-term funds used for medium and long-term loans to 34%. This circular regulates the interest rates applicable when customers withdraw their term deposits before maturity at credit institutions.

The State Bank of Vietnam stated that Circular No. 04 was issued to provide favorable conditions for credit institutions to develop diverse capital mobilization products that meet market demands. It is expected to help banks attract medium and long-term deposits, especially as savings accounts remain an attractive investment option for the idle funds of many Vietnamese citizens.

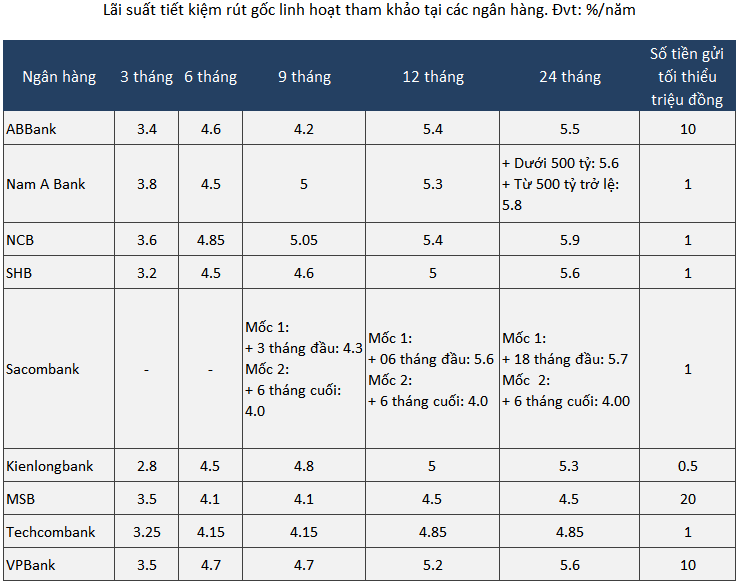

Immediately after the issuance of Circular No. 04/2022, many banks promptly launched a new product called “flexible principal withdrawal savings” to attract deposits.

What is flexible principal withdrawal savings?

Flexible principal withdrawal savings is a term deposit product that allows customers to withdraw a portion or all of their deposited funds before the maturity date while still earning interest on the withdrawn amount based on the non-term deposit rate corresponding to the actual duration of the deposit. The remaining principal, if any, will continue to earn interest at the initial rate until the maturity date.

Banks typically require a minimum deposit of 500,000 VND to open this type of account. The term can range from 3 to 24 months, depending on the bank. Interest is calculated based on the account balance at the end of the term, and if withdrawn early, the portion of the deposit that has not yet reached the end of its term will only earn interest at a non-term rate of 0.1-0.5%/year.

Due to the flexibility offered to customers, the interest rates for flexible principal withdrawal savings are usually lower than those for traditional term deposits.

Source: Author’s compilation

|

Among the banks offering this product, NCB currently provides the most attractive interest rate for a 24-month term at 5.9%/year, only slightly lower than the 6%/year rate offered by traditional savings accounts for the same term.

The following examples illustrate how interest is calculated for both traditional savings accounts and flexible principal withdrawal savings.

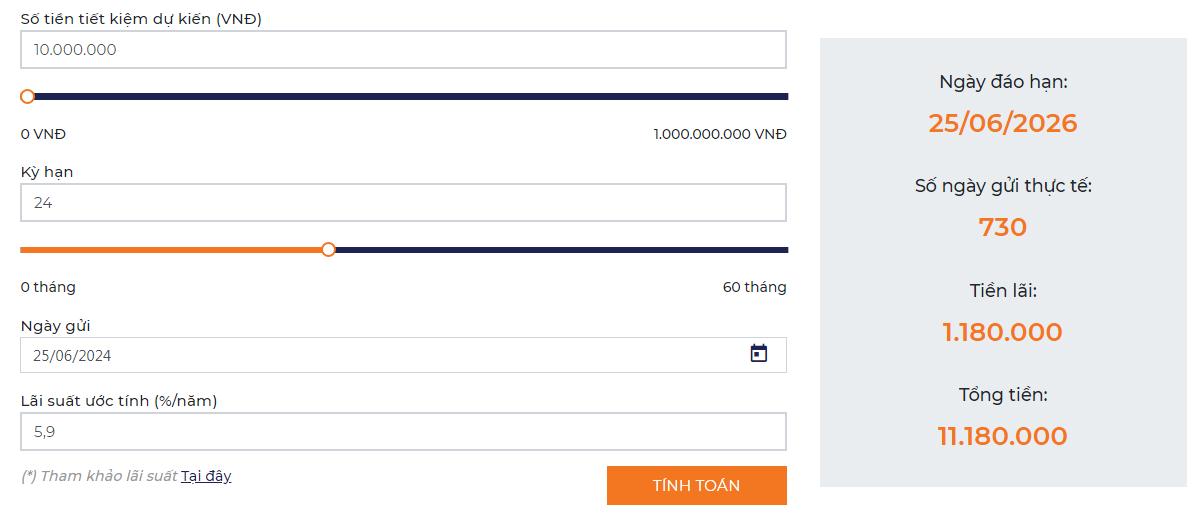

Example 1: A customer deposits 10 million VND for a 24-month term at an interest rate of 5.9%/year. The maturity date is June 25, 2026. The interest earned at the end of the term is:

10,000,000 x (5.9%/365) x 730 = 1,180,000 VND

Source: Kienlongbank

|

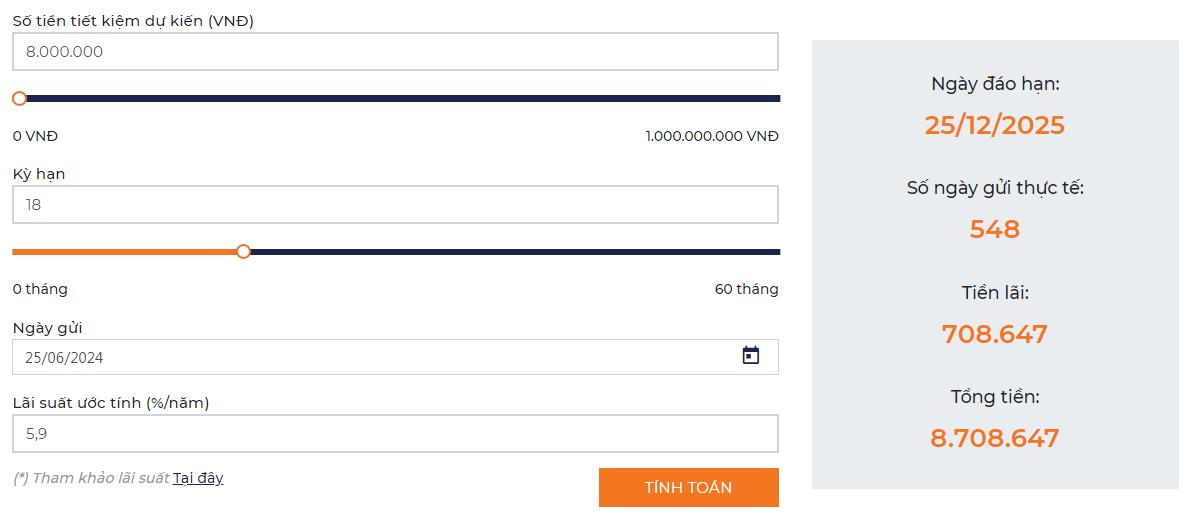

Example 2: A customer deposits 10 million VND for a 24-month term at an interest rate of 5.9%/year, with a maturity date of June 25, 2026. However, the customer withdraws 2 million VND on December 25, 2024. The interest earned on the early withdrawal is calculated at the lowest non-term rate of 0.1%/year: 2,000,000 x (0.1%/365) x 183 = 1,003 VND.

For the remaining 8 million VND, the interest earned at the end of the term is:

(10,000,000 – 2,000,000) x 5.9%/365 x 548 = 708,647 VND

Source: Kienlongbank

|

As demonstrated, flexible principal withdrawal savings meet customers’ needs for both higher interest rates through longer-term deposits and flexibility in accessing their funds. With this option, customers can confidently choose longer-term deposits, knowing they can withdraw a portion of their funds if needed without having to close the entire account. This, in turn, helps banks attract more medium and long-term deposits.

|

Article 5 of Circular No. 04/2022/TT-NHNN stipulates: “In case the customer withdraws the entire deposit before maturity, the credit institution shall apply a maximum interest rate equal to the lowest non-term deposit interest rate offered by that credit institution for the respective customer segment and/or currency at the time of early withdrawal. In case the customer withdraws a portion of the deposit before maturity, the credit institution shall apply a maximum interest rate equal to the lowest non-term deposit interest rate offered by that credit institution for the respective customer segment and/or currency at the time of early withdrawal for the withdrawn portion. The remaining portion of the deposit shall continue to earn interest at the rate applicable to the deposit from which the partial withdrawal was made.” |

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

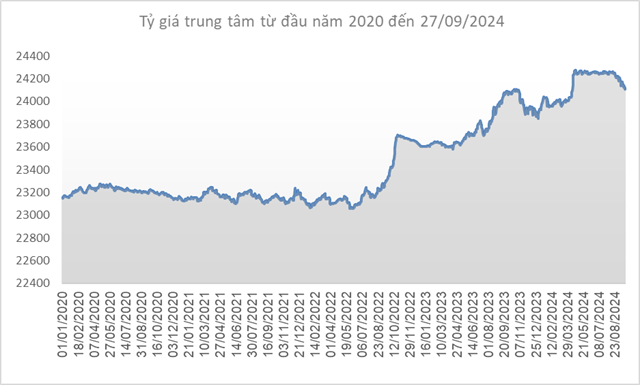

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.