BAOVIET Bank’s recently released financial report reveals impressive growth as of June 30, 2024. The bank’s total assets reached VND 97,062 billion, a significant increase of 14.67% compared to the beginning of the year.

As of the end of June, BAOVIET Bank’s customer deposits stood at VND 58,888 billion, reflecting a 7.71% growth rate year-to-date. This contributes to maintaining a safe loan-to-deposit ratio as per the State Bank of Vietnam’s (SBV) regulations.

The credit scale reached VND 49,728 billion, representing a 4.24% year-over-year increase. This is a positive outcome considering the low credit growth rate of the entire banking sector in the first six months. It also positions BAOVIET Bank to achieve the SBV’s assigned growth rate for the remaining six months of the year.

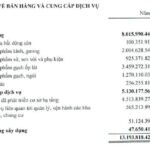

Net interest income increased by 19.6% compared to the previous year. Service activities recorded a significant six-month growth, attributed to revenue streams from the Bao Viet Holdings customer base. Foreign exchange trading income also showed promising results, reaching VND 64.11 billion, a 117% increase.

BAOVIET Bank’s Total Assets and Customer Deposits Show Significant Growth

The bank’s total operating income for the first six months was VND 1,034 billion. Operating expenses increased by 22% year-over-year due to continued investments in information technology projects to accelerate digital transformation. Additionally, enhancing employee salaries and benefits contributed to higher operating expenses during this period.

Provision expenses for the second quarter decreased significantly to just over VND 209 billion, a reduction of more than 35% compared to the same period last year. This improvement reflects a considerable enhancement in the bank’s credit quality.

For the first six months, BAOVIET Bank recorded a pre-tax profit of VND 25.79 billion, a 4.42% increase year-over-year. The second quarter alone contributed VND 17.5 billion to this profit.

In line with its strategic direction for 2024, BAOVIET Bank focused on developing business collaborations with member units of Bao Viet Holdings, fully leveraging the customer base within the Bao Viet ecosystem. During the first six months, this strategy resulted in acquiring 3,600 new customers, mobilizing nearly VND 650 billion in deposits, and achieving individual credit balances of over VND 210 billion.

As a committed member of the credit institution system, BAOVIET Bank actively implements the Government and Prime Minister’s directives, under the guidance of the SBV. The bank has been dedicated to carrying out numerous solutions, emphasizing cost-cutting measures to reduce lending rates. This approach facilitates easier access to capital for individuals and businesses, ultimately fostering production and business activities.

BAOVIET Bank Offers Diverse Financial Solutions

To achieve these goals, BAOVIET Bank designs diverse financial product packages tailored to different customer segments, market conditions, and the production and business needs of its clients.

Recently, the bank introduced a preferential credit package for small and micro-enterprises, offering loans at an interest rate as low as 6.5% per year to supplement working capital for business operations.

For individual customers, BAOVIET Bank offers loans suited to their specific purposes, providing flexibility in choice. Those in need of short-term capital for consumption or production and business investment can borrow at interest rates as low as 3% per year. Meanwhile, customers requiring medium and long-term loans for construction, home purchases, or vehicle purchases can enjoy interest rates as low as 7.5% per year for the first 12 months.

According to BAOVIET Bank’s representative, in the second half of 2024, the bank will continue to focus on leveraging the Bao Viet ecosystem’s customer base to increase personal loan balances through specialized products with attractive interest rates and fees.

In celebration of the 60th anniversary of Bao Viet, BAOVIET Bank is collaborating on exclusive promotional programs for Bao Viet customers across its banking (savings, loans, cards, and payments), insurance, securities, and investment services.

In addition to its business expansion, the bank remains committed to digitizing its banking processes and developing products to enhance customer experiences and increase service fee revenue within its income structure.

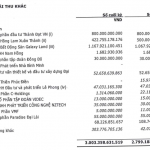

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.