On the morning of July 19, the Securities Journalists Club held its annual forum, July Dialogue, with the theme “Upgrading, Fundraising, and Developing Institutional Investors.”

In his opening remarks, Deputy Minister of Finance Nguyen Duc Chi emphasized the practicality and far-reaching impact of the topic chosen by the Securities Journalists Club for this annual event, stating that it plays a crucial role in enhancing the quality of Vietnam’s securities market development.

The Deputy Minister continued, “I propose that all experts, regulators, associations, investors, and businesses in the market focus their discussions on attracting institutional investors. Through these efforts, we aim to achieve an upgrade to emerging market status in the shortest possible time.”

“No one can single-handedly drive the securities market forward,” he added. “We must join hands and work together to propel the market towards a new phase of qualitative development, and the state management agency will take the lead in this process.”

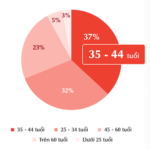

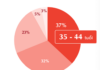

According to Deputy Minister Chi, for Vietnam’s securities market to achieve high quality and sustainable development, institutional investors must constitute a significant proportion of the investor base. Currently, the market boasts a large capitalization, with nearly 8 million trading accounts. However, a closer look at the structure reveals a modest number of institutional investors. According to FiinGroup, foreign investors hold 14% of stocks, indicating a potential weakness and vulnerability in the market.

So, how can we change this and promote the growth of institutional investors in the market?

Deputy Minister Chi acknowledged that this task has long been recognized by the state management agency, the Ministry of Finance, and the Securities Commission, and they have reported it to the Prime Minister as a key task for market development in the coming period.

To increase the number of institutional investors in Vietnam’s securities market, several measures need to be implemented. For instance, addressing the mindset and psychology of Vietnamese investors, who often prefer to manage their assets and invest in securities independently. Additionally, enhancing their capacity, knowledge, and understanding while mitigating the influence of herd mentality is crucial.

Changing this mindset will not happen overnight. Alongside education and communication, investors may need to experience the market’s realities firsthand. It is hoped that investors and individuals with capital in Vietnam will recognize the benefits of investing through professional institutional investors.

“Having professional organizations on board doesn’t necessarily mean we need to maintain 8 million securities accounts,” said Mr. Chi. “Even if we have 5-6 million accounts, with half of them belonging to institutional investors, that would be fantastic.”

However, to achieve this, the state management agency needs to implement multiple solutions to facilitate the operations of investment funds and various types of investment funds. For instance, there is a need to establish clear regulations and oversight for voluntary pension funds to promote and expand this type of fund. The Deputy Minister emphasized the significant potential of this initiative, stating that the National Assembly had recently passed the Social Insurance Law, mandating the government to formulate related regulations for voluntary pension funds.

Speaking at the forum, a representative of the Club shared that over the past 20 years, the Securities Journalists Club has built a professional community for its members, comprising journalists and editors specializing in securities and the securities market. This community has served as a valuable bridge connecting state management agencies, market participants, and investors with the media.

As a result, the club has actively contributed to disseminating information and promoting the Party’s guidelines and the State’s policies and laws, as well as the management work of the Ministry of Finance and the State Securities Commission.

Three years ago, on the occasion of the club’s 15th anniversary, a commitment was made to innovate in professional activities. This led to the organization of an annual forum in July, named July Dialogue, aiming to connect leaders, managers, experts, and businesses to discuss and address crucial issues in Vietnam’s capital market.

This year marks the second edition of July Dialogue, and the theme, “Upgrading, Fundraising, and Developing Institutional Investors,” reflects the urgency of the topic, especially with the consistent guidance from the highest leadership level.

However, upgrading is just the beginning. What follows is a process of maintaining and enhancing the quality of Vietnam’s securities market to truly earn the status of an emerging market, particularly concerning the development of professional institutional investors.

This year’s July Dialogue brought together representatives from regulatory agencies overseeing the securities and securities market, including the Ministry of Finance, the State Bank of Vietnam, and the State Securities Commission. Additionally, market participants such as stock exchanges, the National Securities Depository and Clearing Corporation, securities companies, fund management companies, commercial banks, and listed companies were in attendance, along with industry associations.

The organizers expressed their hope that the event would generate effective suggestions and feedback from a management perspective, leading to tangible improvements in the market.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.